Bank of England preview: Will the MPC look beyond short-term inflation levels?

Table of Content

What and when?

The bank of England looks set to announce their latest monetary policy decision on Thursday 2 November, with markets keenly anticipating the outlook from a central bank that appears to be struggling with both a weak economy and particularly elevated inflation.

The UK economy

The UK economy had been expected to underperform its Western peers this year, with the country expected to fill into recession. That has not come to fruition with the UK economy faring better than many had anticipated. That isn’t to say that the Bank of England enjoys a booming economy against which further tightening is possible. The latest PMI surveys remain below the key 50 threshold, signalling an economy in contraction. Notably fears around a sharp decline in the services sector have eased of late, with the latest services PMI reading of 49.2 being overshadowed by a huge upward revision in the September figure (49.3 from 47.2).

UK PMI IMAGE

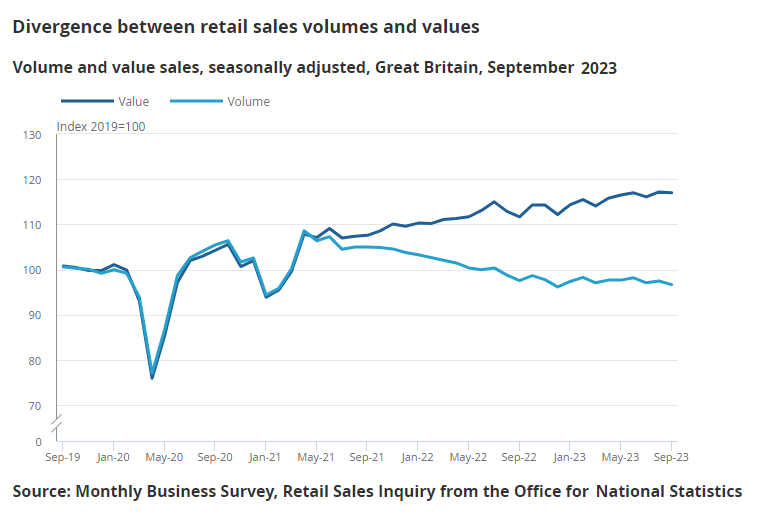

The latest retail sales figure similarly makes for uncomfortable reading, with the -0.9% decline in September raising questions over economic activity. Meanwhile the annual retail sales figure came in at -1%, as it gradually closes in on the 0% threshold. However, it’s important to understand the context of this data, with UK consumers actually spending 4.7% more over the course of the year to September. Unfortunately, they consumed 1% less despite spending a higher amount. That pattern of spending more for less could be tested as the value of retail sales appears to have flatlined in recent months. Could UK consumers be unwilling to spend more after a two-year period of rampant inflation? The Bank of England will hope so, as the apparent willingness to continue spending in the face of higher prices has seen wage demands surge which in turn pushes prices higher once again.

From an employment perspective, the average earnings figure remains a key concern given its role as a proxy for underlying inflation pressures. While the latest figure heralded a welcome decline from 8.5% to 8.1%, the fact that wages are well above inflation signal the potential for strong consumption going forward. We also saw a sharp uptick in the UK claimant count, which rose to 20.4k. However, this is simply a case of bringing the figure back in line with recent trends after a particularly low figure the month prior. We also saw the three-month employment change figure for August outperform forecasts at -82K (-198K expected). One welcome development came from the latest unemployment rate figure which fell from 4.3 to 4.2%. Whether this is simply a pause or the end of an upwards trend that has dominated recent months remains to be seen. It is also worth noting that the unemployment rate is the most lagging part of the UK jobs report, with the latest figure looking way back to August.

We are certainly seeing signs of weakness within the UK economy, but for the time being they are relatively modest and potentially the kind of soft landing that the Bank of England might deem necessary to bring down inflation. The delayed nature of the unemployment rate does highlight the relative importance of the employment and claimant count change figures. They have shown weakness but are yet to truly flash red in a meaningful manner.

What about inflation?

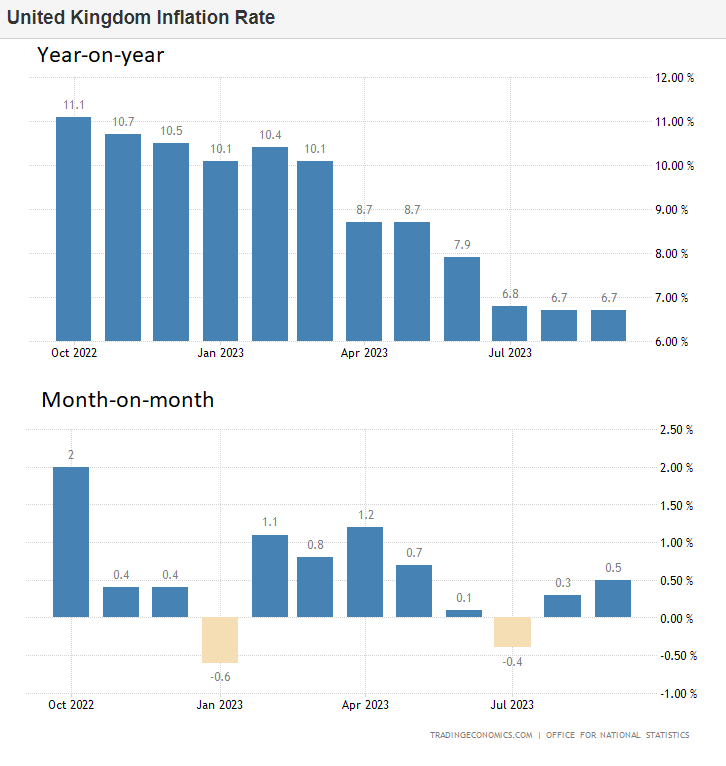

The UK inflation issue remains a puzzle the Bank of England are yet to solve, with the September figure of 6.7% standing well above their peers. Unfortunately, we are seeing little headway made over recent months, with almost no downside seen since the welcome decline from 7.9% to 6.8% back in July. However, that lull may be about to change, with the base effects element seeing the forthcoming October figure strip out that shocking 2% monthly gain last year. This looks likely to take headline CPI back down from 6.7% towards the 5% mark when it is reported mid-November.

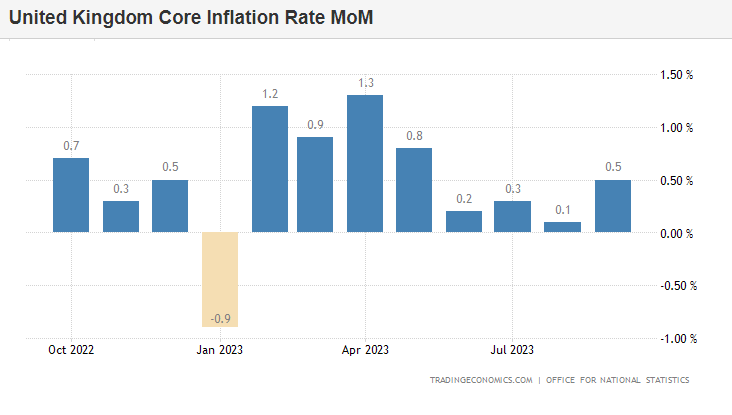

The other side of the inflation story comes in the form of core CPI, which stands at 6.1% for September. Unfortunately, we are not expecting to see those same base effects take hold this month, with this underlying metric expected to take a slow disinflationary path for now. Instead, we are likely to see this reading make headway in the first half of 2024 as the elevated February to May figures seen below are stripped out of the annual figure. Taking a look at the recent monthly figures, the Bank of England will be encouraged by the trajectory from June onwards. A continuation of the trajectory seen over the past four-months would bring expectations that we are currently on track to bring core CPI down to 3.3% by the end of H1 2024.

In summary, while the UK inflation figure points towards an economy that continues to struggle in its bid to drive down price pressures, that should hopefully resolve by the end of H1 2024. Whether that comes to fruition or not is likely to come down to movements in the energy markets and wage pressures. Energy is the biggest problem faced by Western central banks, with their efforts counting for little in the event of another surge in gas and crude prices. The trajectory of European gas prices in early October has brought concern, but the bank is unlikely to act until we see proof that this has pushed prices higher. UK gas reserves appear to be well stocked, but the gains seen over recent months do raise questions over how this winter might shape up for European energy prices in the absence of Russian (and potentially Egyptian) imports.

What to expect

The last Bank of England meeting saw a narrow vote to end the tightening phase, with just five out of nine members opting to leave the interest rates unchanged at 5.25%. That highlights a less than convincing environment with which to enter this latest meeting. Markets are looking for a wider majority this time around, where a second consecutive hold and majority would help hammer home the notion that this tightening phase is over. Middle East instability does provide a curveball for the Bank of England, with any surge in energy prices potentially setting the UK on a higher inflationary path once again. With that in mind, the bank is likely to remain data dependent and open to further action if necessary. The UK economy remains moderately weak, and inflation looks set to normalise over the next eight months. For the Bank of England, it’s the case of holding the policy steady and hope we do not see a dramatic economic collapse or any notable surge in energy prices.

EURGBP Technical analysis

The pound has been losing ground against the euro of late, with the pair pushing higher to take back much of the downside seen in the first half of the year. With the recent trend of higher highs and higher lows, there is a good chance we will see further strength in the event of another rate hold and wider majority within the vote. The 0.874 level remains key here, with a break-through that level taking the pair into another bullish leg higher. Conversely, a decision to raise rates would likely drive sterling strength, with a decline through 0.87 required to signal a wider bearish picture coming into play.

EURGBP IMAGE

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.