Will the Bank of Japan move to adjust YCC policy?

The Bank of Japan announce their July monetary policy decision on Friday 27 July, with traders keeping a close eye out for signs of any shift from Ueda and the committee. Coming off the back of Federal Reserve and ECB meetings that saw markets attempt to gauge where the tightening would end, traders of the Yen want to know if the BoJ will ever get started.

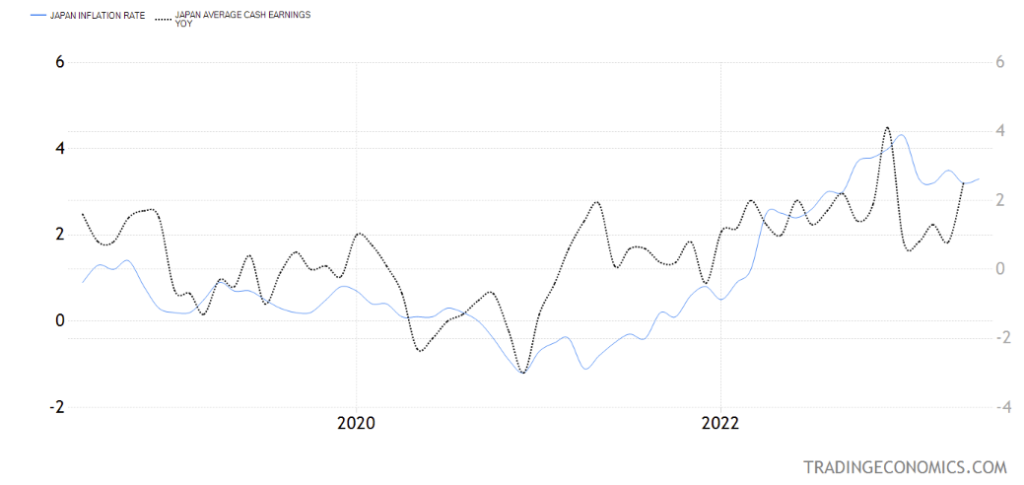

Japan has long found inflation a difficult thing to come by, with decades of below-target CPI that have also seen years of negative price growth. With that context in mind, it should come as no surprise to have seen a somewhat patient approach from the Bank of Japan, with a period of above-target price growth simply making up for years of lost price growth. In fact, BoJ Governor Ueda sees this period of above-target inflation as an opportunity to raise expectations and ultimately drive wage growth higher. Last month’s Japanese wage growth figure of 2.5% came as a surprise that pointed towards a potential shift from the bank. The top financial diplomat in Japan did speculate that the BOJ may see these “signs of change” in corporate behaviour as a reason to tweak their policy. However, former BOJ board member Takahide Kiuchi stated that he thinks it is unlikely they will move this meeting, despite expectations that adjustments are likely to come soon.

With that in mind, Friday’s meeting will see traders looking to understand whether Ueda remains happy to retain their highly accommodative monetary policy stance, or tighten in some way. A rate hike would be unlikely as a first move, with markets looking towards the BoJ’s yield curve control policy as the most likely adjustment we could see. A widening of the band back in December came as a result of the constant spending needed to maintain the bond yield cap. That pressure is not currently a problem. Nonetheless, the desire to keep that current yield band in place will come into question once again this week, with any widening of the band raising borrowing costs. Traders would likely see such a move as a reason to buy the yen, as it may also lead to a position where rates could be raised down the line.

Recent yen gains have been a reflection of falling inflation elsewhere, with monetary tightening elsewhere slowing to a halt. The outlook for monetary policy at the BoJ looks unlikely to significantly weaken the yen given their longstanding accommodative approach. However, a move to tighten in any way could help lift the yen after a prolonged period of weakness. That being said, overnight Tokyo CPI should be watched for signs that inflation is falling to the point where tightening may never be necessary. Markets currently expect to see this leading inflation gauge fall from 3.1% to 2.8%.

EURJPY technical analysis

The yen has been gaining ground against the euro in the wake of the ECB meeting, with EURJPY threatening to form a big double top formation if we see 153.3 eventually break. This looks like an interesting pair to target if the BoJ opts to tighten monetary policy, with a rise up through 156.24 required to signal a more bullish outlook coming back into play.

It is notable that’s Japanese flat inflation has also lacked significantly against their western peers. While the UK was struggling to contain double-digit inflation in Q4 2022, Japanese CPI was moving up to the 4% region. However, just as we saw price growth peak elsewhere at the beginning of the year, Japanese inflation has also be drifting lower

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.