Black Friday sales bring retail stocks into focus amid tentative signs of weakness

With Black Friday impending, traders will be watching closely for signs of consumption as we enter arguably the most important period for retailers. While Black Friday and Cyber Monday have typically been a US phenomenon, we have seen companies in the UK and other Western nations similarly utilize this opportunity to raise sales ahead of the festive period. Notably, this year we see the event emerge at a time of concern for retail sales, with a number of key retailers utilizing their third-quarter earnings event to predict a tough year-end after a slow September. With the impact of elevated interest rates increasingly feeding through to the economy, traders are increasingly questioning whether consumers will continue to spend more to receive less.

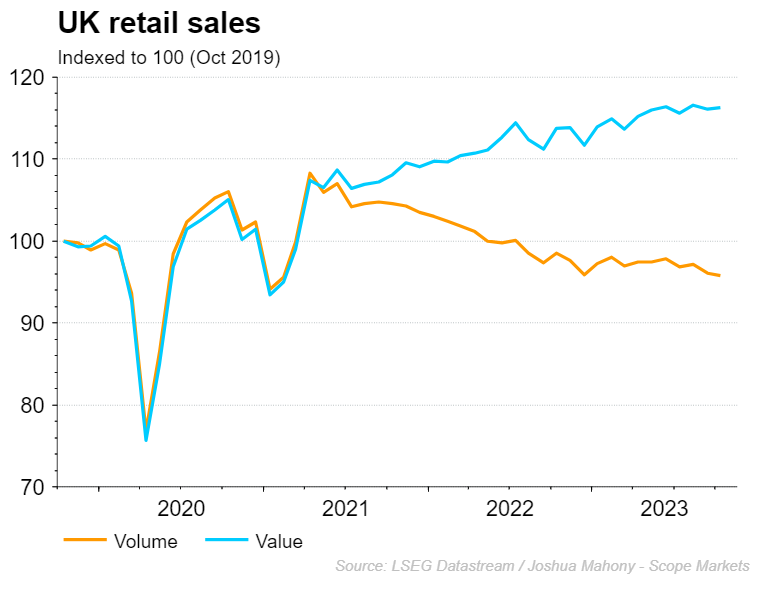

The chart below highlights that exact phenomenon, with UK retail sales seeing an incredible divergence between the volume and value of sales. With consumers apparently willing to pay more in the face of rising inflation, the question here is whether that trend of ever higher expenditure will persists. The fact that we have seen strong wage growth alongside inflation does help signal potential longevity in this trend.

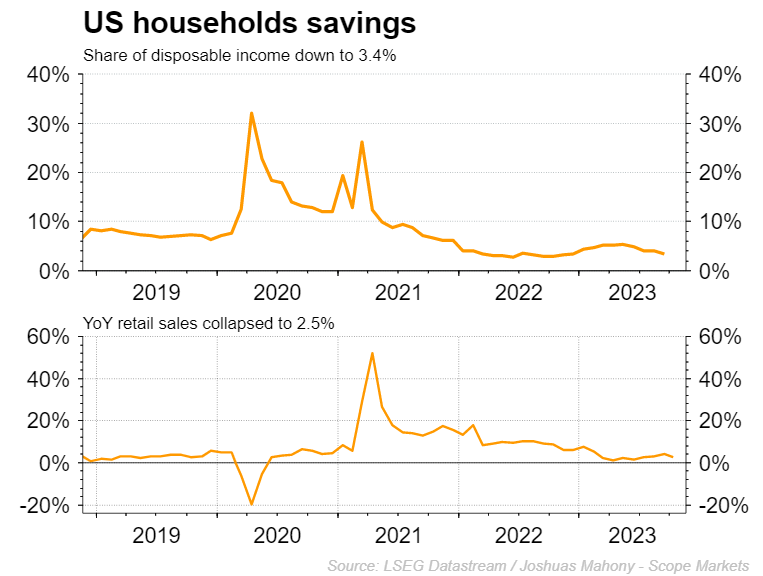

Looking at the UK in particular, we can see the decline in the annual rate of retail sales has come as household savings deteriorate. The huge build-up in savings over the course of Covid did provide a backstop for consumers, with strong spending patterns coming as people dip into their bank accounts. As a result of this, savings have been depleted heavily as costs increase. With the US personal savings as a percent of their disposable income down to just 3.4%, there is likely to be greater pressure for households to cut back on spending this year.

With these factors in mind, traders will be watching out for any early signs of strength or weakness over the long weekend. After-all, markets will be treating Black Friday and Cyber Monday sales as a guide on spending habits over the course of the festive period. With that in mind, expect plenty of volatility for big high-street and online names. We often see early snippets of information from payment and data providers such as Barclaycard, Nationwide, and Adobe analytics. While it is worthwhile noting spending habits around this key weekend can be used as a gauge of consumer demand, it does not rule out a strong December period which often sees higher margin sales compared with those sales driven deals sought out in November.

Below we have a list of the top US retailers according to 2022 sales, with traders likely to look for early signs of consumer behaviour in a bid to drive sentiment in these stocks.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.