Earnings Preview: Apple, Starbucks & Booking Holdings

Apple Q3 earnings

Thursday 2 November

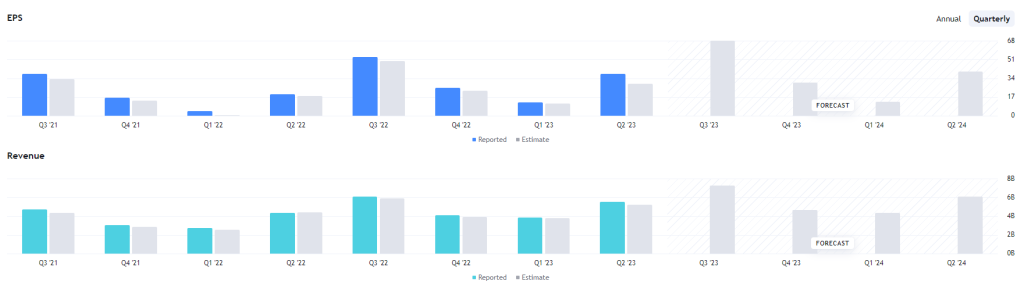

Apple shares have been on the back foot since reaching a fresh high in July, losing over 13% in just over three-months. That may not sound like too much, but for a multi-trillion dollar company, we are talking about serious value destruction in play. While those declines are a reflection of wider concerns in the tech sector and Chinese growth, we have more recently seen doubt emerge over demand for the new iPhone 15 product. It is worthwhile noting both the importance of the iPhone for total revenues, but also the fact that the new product was released towards the end of September. With that in mind, the third quarter looks likely to be the calm before the storm, with the fourth quarter seeing those iPhone 15 sales numbers that also include the crucial Christmas/black Friday period. With that in mind, marginal gains are expected across both revenues and earnings, but perhaps the demand for their new phone will only truly emerge in the final three-months of the year.

Aside from the iPhone, there will be a focus on the Apple services business, with a range of products such as Apple care, Apple pay, Apple TV+, and app store transactions providing a reliable income that has been steadily growing. That need to diversify income away from the iPhone will be difficult given the sheer size of the market, but an ability to leverage each user to sell additional bolt-on products will be key. The services segment accounted for almost 20% of the company’s revenues in 2022, but the strong margins mean that this area can disproportionately benefit the bottom line.

Starbucks Q4 earnings

Thursday 2 November

Starbucks earnings provide a fresh insight into a company that saw a particularly interesting third quarter, with a strong expansion in China helping to overshadow an otherwise disappointing US performance. Coffee prices have been weakening over the course of the June-September period, signalling a potential improvement to the company’s margins going forward. With US consumers remaining strong in the face of rising interest rates, investors will hope for an earnings figure in the same ballpark as that impressive $1 per share figure last time around. However, expectations of higher revenues and falling margins signal the potential for another strong earnings figure on Thursday.

In terms of the key elements to watch out for, the Reinvention Plan laid out in 2022 brought a whole host of areas they plan to improve across the business. Improved margins should be helped by falling coffee prices, but their sensitivity to spot prices are questionable. Meanwhile, the strength of the Chinese business last quarter raises hopes for another strong performance across both total and same store sales. Another area of growth comes from the Starbucks membership reward programme, with the expansion of that loyaly scheme key to driving increased sales. Last quarter saw the number of active members rise 15%, to 31.4 million. Finally, the expansion of their digital offering should provide another key area of note, with continued uptake of their app bringing potential upside for sales as customers can place advance orders and earn rewards.

Booking Holdings Q3 earnings

Thursday 2 November

The world’s largest online travel agency report on Thursday, with the company’s range of businesses spanning not only their namesake but also the likes of KAYAK, Priceline, Agoda, Rentalcars.com, and OpenTable. The third quarter represents the most important of the year, with the success of their summer months often the key driver of annual performance. Speculation over spending habits in the face of rising interest rates does raise concerns for shareholders, but forecasts signal a potential surge that could bring earnings up through their pre-pandemic levels this year. The recovery from Covid has been a protracted one, with those global closures and restrictions proving particularly detrimental for travel focused firms. However, their agency model means that they enjoy the upside of bookings without owning the underlying assets. As such, the company has emerged in a strong position, with rising inflation levels expected to push the average price (and thus commission) per booking higher. With consumer spending remaining strong for the time being, a bumper Q3 has been predicted, although the potential for a economic downturn remains relevant given the deterioration in savings and weakening economic data (in Europe). As such, there will be a keen focus on the outlook as we head towards the year-end. Finally, the recent introduction of their generative AI-enabled travel assistants for both Priceline and Booking.com bring an area of interest as they seek to build out a unique offering.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.