Earnings preview: Nvidia, and Zoom Communications

Table of Content

Nvidia Q3 earnings

Tuesday 21 November

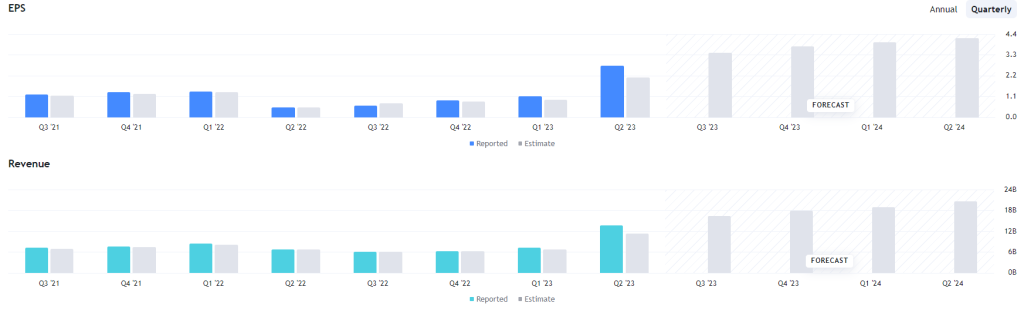

While we’re late into the third quarter earnings season, Thursdays NVIDIA release represents one of the most important of all the stocks in the S&P 500. The reliance on the so-called magnificent seven to drive wider market gains does highlight the importance of this technology giant. The boost provided to big tech through anticipated artificial intelligence revenues does highlight a need to turn expectations into reality. Fortunately, last quarter saw a huge outperformance compared to market estimates, with NVIDIA seeing earnings more than double. Subsequent concerns over the relationship between the US and China let the stock lower in recent months. Efforts to get around the US restrictions on AI technology exports into the Chinese market remains a key issue for investors to follow on Thursday, with Nvidia having attempted to provide alternate products in a bid to serve that massive market.

With Nvidia at the forefront of the AI boom, the expansion in adoption for the technology should help benefit this company in particular. As such, the importance of the company as a provider of both AI hardware and software should mean that their earnings are a key barometer of global tech spending on AI. While many will baulk at the huge valuation the business enjoys, forecasts do point towards expectations of a dramatic ramp-up in both earnings and revenue in the quarters ahead. Quite how big this technology will become remains to be seen, but those seeking exposure to its growth will see Nvidia as perhaps the best route to its expansion without having to try and pick the winner in a likely ever-changing space.

Summary of global analyst recommendations:

- 18 analysts hold ‘strong buy’ recommendation

- 33 analysts hold ‘buy’ recommendation

- 2 analysts hold ‘hold’ recommendation

- 0 analysts hold ‘sell’ recommendation

- 0 analysts hold ‘strong sell’ recommendation

Source: Eikon

Estimates

- Revenues: $16.123 billion

- Earnings: $3.36 per share

Source: Eikon

Zoom Communications Q3 earnings

Tuesday 21 November

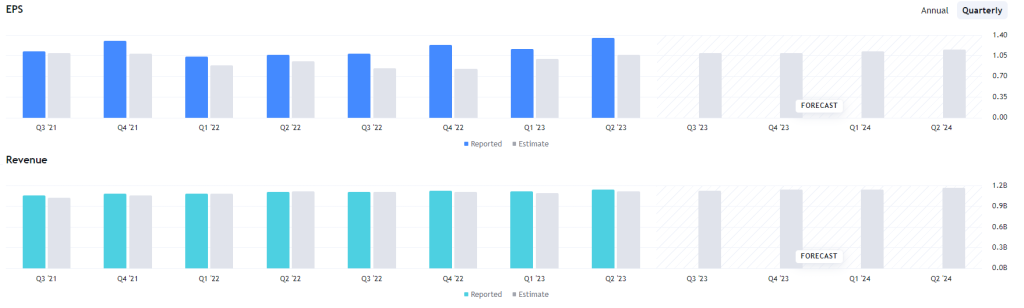

Zoom carried on its downward trajectory over recent months, despite an impressive second quarter that saw the company outperform on the earnings front once again. The ability of zoom to beat estimates should not be overlooked, although the benefit has been questionable given the decline into record lows in late October. The stock has been staging a recovery as we head into the third quarter earnings, with shareholders hoping that this pandemic darling can bring about fresh grounds for optimism. The encouraging outperformance seen in the second quarter did come alongside a somewhat downbeat outlook for the second half of the year, with management tempering expectations around both online and enterprise business. Difficulties stimulating extended sales, international demand and renewal optimization do raise significant questions as we head into the third quarter earnings. Perhaps these questions could feed into the trend of beating relatively weak market expectations, although shareholders will note that those beats have counted for little thus far.

Summary of global analyst recommendations:

- 2 analysts hold ‘strong buy’ recommendation

- 6 analysts hold ‘buy’ recommendation

- 23 analysts hold ‘hold’ recommendation

- 0 analysts hold ‘sell’ recommendation

- 0 analysts hold ‘strong sell’ recommendation

Source: Eikon

Estimates

- Revenues: $1.12 billion

- Earnings: $1.08 per share

Source: Eikon

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.