Earnings preview: Walt Disney, Uber tech, and Occidental Petroleum

Walt Disney Q4 and full year earnings

Wednesday 8 November

The Walt Disney Company, a global powerhouse in the entertainment sector, is poised to announce its full-year and fourth-quarter results after market close on Wednesday 8 November. One of the most anticipated topics among investors is Disney’s streaming performance, particularly after the Q3 revelation of a 7.4% subscriber decline for Disney+, largely attributed to Disney+ Hotstar losing broadcast rights to the Indian Premier League. With expectations set for an addition of 3.1 million subscribers and a recent hike in pricing for its ad-free tier, the spotlight will shine on whether these changes can offset past declines. On the brighter side, Disney’s Q3 showed strength in the Parks, Experiences, and Products division, but it remains to be seen if cost-of-living pressures might impact visitor numbers at its marquee locations like Disney World in Florida.

Another area of interest for stakeholders will be the future of streaming service Hulu. Two-thirds owned by Disney and the rest by Comcast, the fate and strategy for Hulu might provide insights into Disney’s broader streaming ambitions, especially in light of growing competition and the push-pull of subscriber numbers on its other platforms. Additionally, the recent decision by Disney to release standalone financials for ESPN has fueled speculation about the network’s sale. Investors will be keen to understand the strategic direction for this specialty sports network, which has been a long-standing pillar of Disney’s media network.

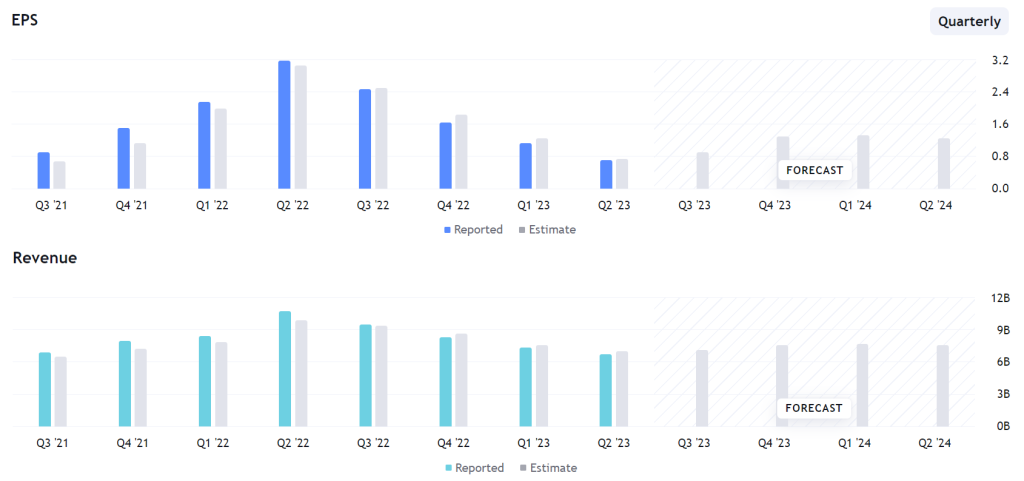

A look at the historical earnings trend below highlights how the fourth quarter typically represents the low point for the year. Nonetheless, a detailed look at the entire year, plus a comparison against Q4 2022 will be key as we attempt to gauge the direction of the business. Overall, there are several key narratives that investors and traders will be closely monitoring. From the fluctuating fortunes of its streaming services to the performance of its physical parks and the potential reshaping of its media assets, this earnings announcement will be key in the face of dramatic losses to their share price.

Uber Q3 earnings

Tuesday 7 November

Uber Technologies are gearing up to reveal their third-quarter earnings report before the US markets open on Tuesday. After a landmark second quarter that saw the ride-sharing giant post its inaugural quarterly GAAP operating profit, market watchers are keen to see if this momentum can be sustained. Analysts expect that the be the case, although their forecast of $0.07 EPS represents a moderation compared with the Q2 figure of $0.18. Nonetheless, it would stand in stark contrast to the $0.61 per share loss for the same quarter last year. A look at the forecasts beyond this quarter, there is a hope that the trajectory of Uber profits should be upwards from here on in.

Coming off the back of a growth focused strategy, we are now seeing the company focus on profitability in the face of testing market environment. Keep a close eye for aspects such as gross bookings, trips, monthly active platform consumers, free cash flow generation, and forward guidance. This report is the final one under the stewardship of CFO Nelson Chai, who has been in the role since 2018.

Occidental Petroleum Q3 earnings

Wednesday 8 November

Occidental Petroleum report their third quarter earnings after the bell on Tuesday, with markets hoping to see the company stem the decline in earnings that has lasted four consecutive months. This report comes off the back of yet another buying spree from Warren Buffett’s Berkshire Hathaway, which pushed its ownership over the 25% threshold after hoovering up shares despite having to pay ever higher prices. This comes at a time of consolidation in the oil and gas industry, with Chevron agreeing to buy Hess ($53bn) and Exxon Mobil striking a deal to purchase Pioneer Natural Resources ($60bn). Could this be a similar fate for Occidental Petroleum, which is currently valued at $54 billion? The company’s move into the carbon capture space could attract those focusing on the green transition, with any updates over their “Direct Air Capture” product likely to attract interest.

The energy sector has been missing the mark thus far this earnings season, with both Chevron and Exxon both falling short of expectations. While the industry looks set to see significant declines compared with last year, this is more a reflection of the bumper 2022 than a weak 2023 showing. With gas prices on the rise once again, the outlook will be key within Wednesday’s earnings report.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.