Earnings week preview: Microsoft, Meta and Exxon Mobil bring big tech and energy focus

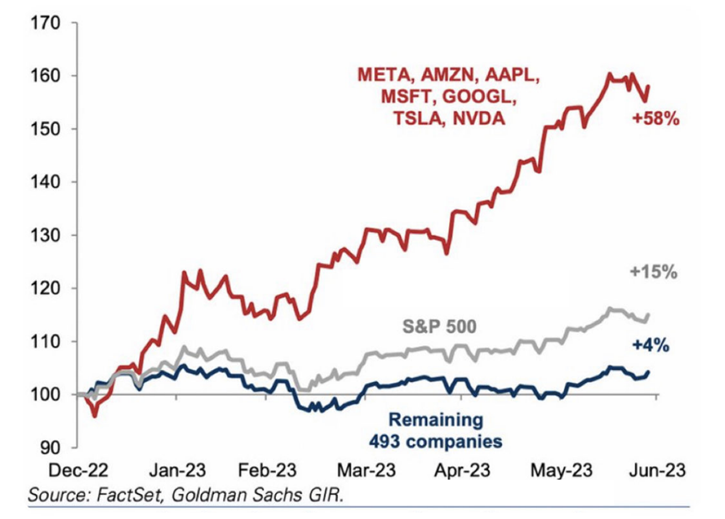

With earnings season in full flow, the all-important tech sector comes into view this week. The dominance of big tech in driving markets higher does mean that the outlook for the sector will be a critical factor to consider when calculating whether the third quarter will bring another bout of stock-market gains. The top 7 stocks have managed to post a 58% return thus far this year, which played a huge role in driving the S&P 500 higher, given the fact that the remaining 493 companies managed to gain just 4% over that period. The fact that we see Meta, Amazon, and Microsoft all report within this one-week span means that by Friday, traders should have a much greater idea of whether this ‘top 7’ led rally is likely to continue in the months ahead.

Microsoft earnings to see AI and cloud revenues dominate

Microsoft report their Q4 2023 earnings on Tuesday, with the tech giant finding itself front and center of the push towards generating AI revenues thanks to their ChatGPT investment. As with any growth stock, investors are always looking for the next major revenue source, and that brings particular attention to Microsoft as markets attempt to understand the potential breadth of value AI could bring. The integration of AI into Microsoft’s Office suite highlights their leadership in the field, with a monthly fee of $30 surprising the market when it was recently announced.

Taking a look at established elements of the Microsoft revenue stream, the cloud services provided under their Azure product look to provide a major area of note, as they seek to grab market share off the likes of Amazon Web Service (AWS). Last quarter saw Azure and their other cloud services grow by 27%, falling short of the lofty 31% seen in the prior quarter. Traders should keep an eye out for whether we see that rate of growth pick up once again for Q4. While cloud services provide the most notable area of growth over recent years, the company revenues are split relatively evenly between Cloud, productivity/business processes, and personal computing.

This year has seen Microsoft shares drive sharply higher, thanks in part to market-beating earnings, and AI speculation. The first three-quarters of the year saw the company top market estimates for earnings. Can they continue that trend despite the lofty expectations this time around?

Expected earnings per share (EPS): $2.55 per share. Comparatives: $2.45 (Q3 2023) and $2.23 (Q4 2022)

Expected revenues: $55.47bn. Comparatives: $52.86bn (Q3 2023) and $51.87bn (Q4 2022)

Meta hopes new AI and Threads can drive continued optimism

Meta Platforms release their hotly anticipated second-quarter earnings data on Wednesday 27 July and market expectations are high for the social media giant. Meta’s shares have been soaring on Wall Street, gaining over 150% year-to-date, making it one of the top performers. The company’s strategic cost-saving measures, including canceling certain data center projects and implementing a 25% staff layoff, are expected to help provide a shot-in-the-arm in the arm for earnings. That move to cut costs and raise revenues has clearly provided plenty of optimism for shareholders. Given last month’s return to positive revenue growth, things appear to be moving in the right direction.

One noteworthy development for Meta is the rapid adoption of its Twitter-like app, Threads, which attracted an impressive 100 million users within its first week of launch. Traders will be watching closely for any additional updates on the product. Given the fact that Elon Musk paid $44 billion for Twitter, there is plenty of ground for optimism if Threads does indeed take-off. Another interesting project at Meta is their LLaMa 2 artificial intelligence system, which is open source, unlike Google’s Bard and ChatGPT. Their decision to team up with Microsoft highlights the potential strength of this offering. Quite how the company will grow and monetise this product remains to be seen, with widespread uptake likely to be the first goal. While the company hopes to build a strong growth trajectory based on virtual reality, artificial intelligence, and ad-supported products, investors will be watching closely to see how these projects add to the cost base.

Expected earnings per share (EPS): $2.90 per share. Comparatives: $2.20 (Q1 2023) and $2.46 (Q2 2022)

Expected revenues: $31.07bn. Comparatives: $28.46bn (Q1 2023) and $28.82bn (Q2 2022)

Falling inflation likely to benefit Exxon in the long run

Exxon are expected to post somewhat lackluster numbers on Friday, with the energy sector as a whole likely to see revenues contract sharply once again. The huge boost provided by soaring energy prices in 2022 has petered out, with natural gas in particular having reversed much of the upside seen in the wake of the Russia-Ukraine conflict. While the war wages on, the initial clamour for LNG to replace Russian imports has calmed down considerably. With supply chains now in a more healthy and orderly position, energy prices have similarly stabilised. For the likes of Exxon, this means and end to the oversized profits achieved in 2022.

Unfortunately, they also must contend with an underwhelming Chinese economic recovery and any economic fallout that comes from central bank efforts to drive down inflation (via consumption). Declining real incomes do ultimately dampen demand, and thus energy stocks are faced with an environment of questionable demand and commodity prices that make for unfavourable year-on-year comparisons. Nonetheless, the pessimistic outlook for the sector could provide the basis for outperformance should market expectations prove too low. Investors will also be able to look beyond current economic question marks to recognise that central banks will have little reason to dampen economic activity more than absolutely necessary. Thus, while earnings have normalised after a bumper 2022, Exxon Mobil remains a highly cash-generative business that will likely benefit from any monetary policy loosening that comes once inflation is tamed.

The question is whether markets focus on the here-and-now, or remain constructive over the potential impact of falling inflation.

Expected earnings per share (EPS): $2.06 per share. Comparatives: $2.83 (Q1 2023) and $4.14 (Q2 2022)

Expected revenues: $85.61bn. Comparatives: $86.56bn (Q1 2023) and $115.68bn (Q2 2022)

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.