ECB and BoE rate decision Preview: Will widening rate differential drive EURGBP weakness?

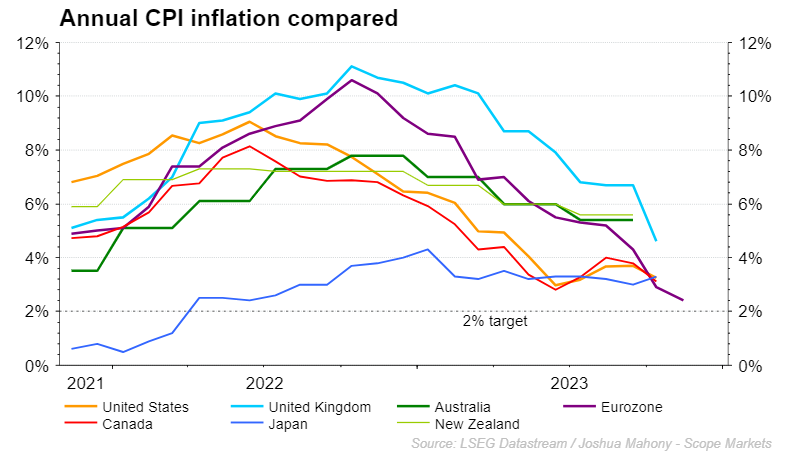

The Bank of England and European Central Bank are set to announce their latest monetary policy decision on Thursday 14 December, with markets looking for fresh clues over the trajectory of interest rates in the year ahead. November saw plenty of optimism from global markets as a slump in eurozone inflation and US payrolls sparked calls for a swift pivot from many of the top central banks in the first quarter of 2024. The UK approaches it from a different perspective, with inflation still well above many of its counterparts. The chart below highlights the current standing of eurozone and UK CPI inflation, highlighting why the wait for a return to easing from the Bank of England is likely to be longer than that of the ECB, Bank of Canada, and Federal Reserve.

What does the economic picture look like?

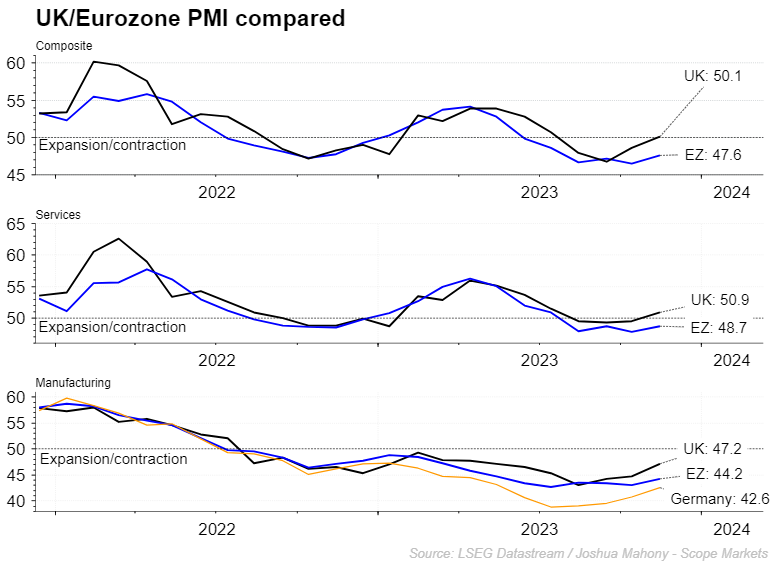

The eurozone economy has been struggling under the weight of a particularly prominent manufacturing sector, with the typically buoyant German economy instead acting as a drag on the wider group of late. A look at the PMI surveys across both countries does highlight the very different outlook as things stand, with the UK composite reading back above the 50 threshold that separated expansion from contraction. With the eurozone still heavily in contraction (47.6), there is a clear disparity compared with the UK that appears to be perfectly within ‘soft-landing territory’.

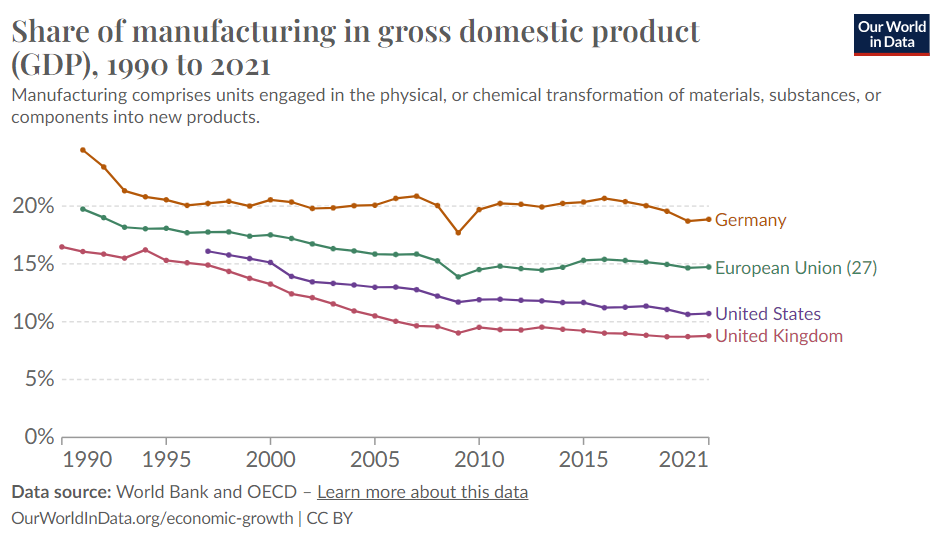

The deep contraction in German manufacturing continues apace, with the manufacturing figure of 42.6 highlighting how industrial activity in the country holds back the wider region. A breakdown on the overall reliance on the manufacturing sector within GDP highlights how the declines seen in this industry have a particularly negative effect on Germany and thus the eurozone.

From an inflation perspective, the latest eurozone figure of 2.4% stands in stark contrast to that seen in the UK, which remains well above target at 4.6%. While that UK figure represents an older gauge from October, the inflation pathway does continue to lag in the UK. This has obvious implications for market expectations over the timing and size of rate cuts from the ECB and Bank of England next year. From a ECB perspective, the weakness of the economy and risk of an undershoot below 2% for inflation does highlight the need for a swift pivot towards loose monetary policy.

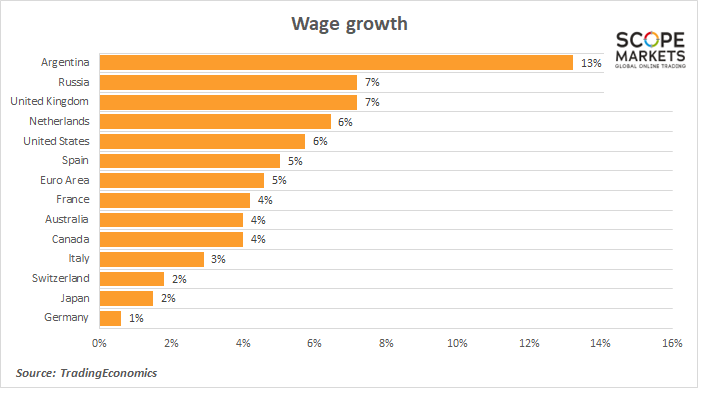

Tuesday’s UK job report did help lift UK equities, as a greater than expected decline in average earnings brought hope that underlying inflation pressures are easing. Nonetheless, the country continues to lag its counterparts, with only Argentina exhibiting a higher wage growth figure of all G20 nations.

2024 interest rate outlook

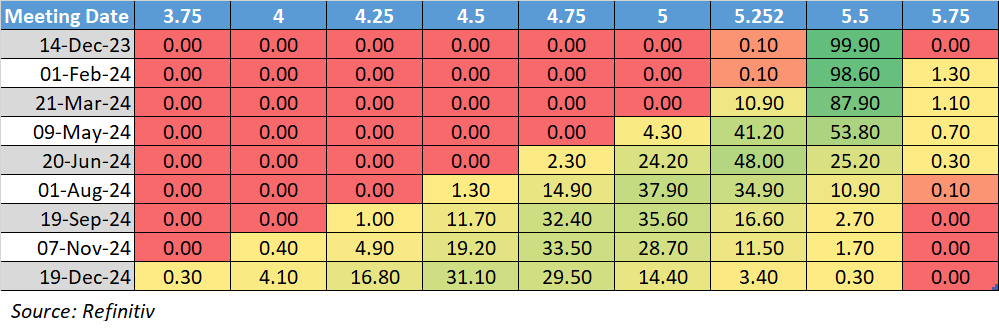

With UK CPI and wages elevated, the relatively stable economy highlights the high likeliness that the Bank of England holds rates at their current level for some time yet. There is less need to limit economic damage, and a need to keep the pressure on to drive down inflation. The chance of a change to the headline interest rate on Thursday remains a major outlier, with Refinitiv pricing a 99.9% chance that we see the BoE end the year at 5.50%. Looking ahead, markets currently price in a 74% chance that the first rate cut occurs in June. In terms of the total amount of easing over the course of the year, they point towards a base case scenario of 100-basis points worth of cuts. This signals a potential four cuts over the final five meetings of 2024. Any adjustments to these expectations will provide volatility for the pound, with Andrew Bailey’s commentary around future inflation and rates likely to provide main takeaway from the meeting.

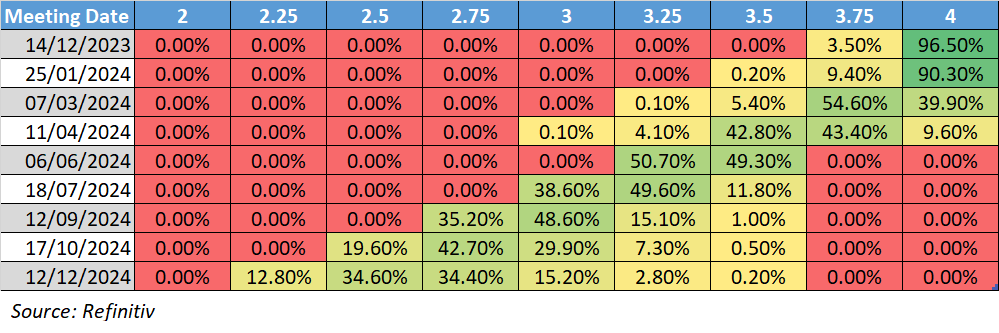

Things are somewhat different for the ECB, with the ECB expected to act swiftly given the weak economic picture and 2.4% inflation rate. That proximity to the 2% level does bring a heightened chance that they undershoot and end up closer to deflation than their target. Despite this, markets expect the bank to hold off for the time being, with the first cut predicted to occur in March (60% chance). In terms of the big-picture view for 2024, markets are pricing a very close call between five and six 25bp rate cuts next year.

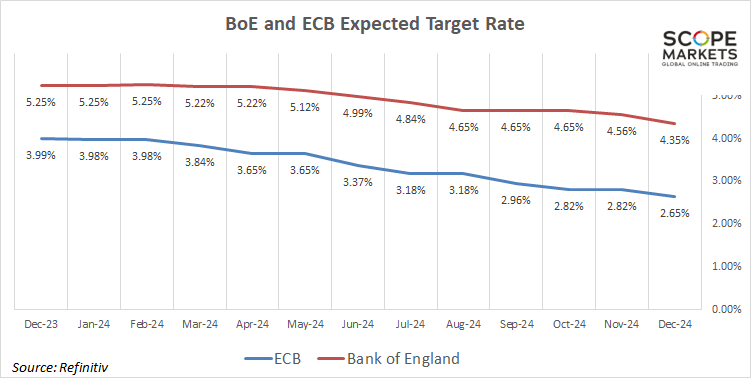

Taking a wider look, we can see that UK rates are expected to remain above the current ECB rate by year-end, with the ECB rates already substantially lower and the Bank of England unlikely to cut as heavily next year. The widening gap between the two highlights the potential for sterling strength if the Bank of England warns of a more cautious approach to deal with the continued problem posed by above-target inflation.

EURGBP technical analysis

EURGBP saw plenty of downside in the latter part of November, with expectations for a more dovish ECB and hesitant BoE sparking weakness for the pair. With price back into the confluence of trendline and 76.4% Fibonacci support, we are now seeing price push upwards as we head into Thursday’s main events. The push through 0.85882 resistance does bring heightened expectations of a rebound for the pair, highlighting the notion that we could see either a dovish BoE or hawkish ECB shift. Alternately, we would need to see a break back below the recent lows of 0.855 to signal a bearish continuation as markets prepare for a swift return to easing from the ECB.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.