ECB Preview: Falling inflation and growth data likely to bring end to tightening phase

Table of Content

Introduction

The European Central Bank (ECB) comes back into play as a key driver of volatility, with the bank announcing their latest monetary policy decision on Thursday 26th October (13:15 UK time). As traders alike await this pivotal announcement, the outlook for the ECB appears to have finally shifted after 10-consecutive of rate hikes. Will we see an end to that trend? Will the ECB continue to tighten as they play catch up with the US and UK? Either way, traders have plenty to consider on Thursday.

Economic Backdrop

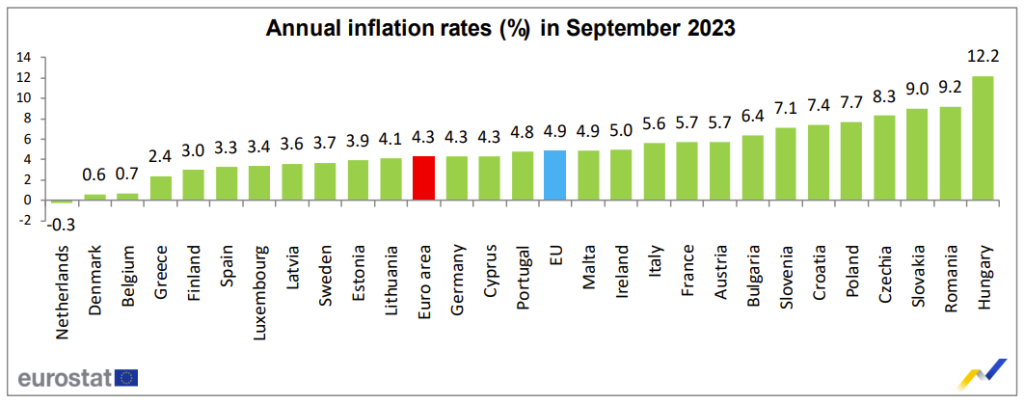

The eurozone inflation picture took a significant step in the right direction last month, with the September CPI reading confirmed at 4.3%. That decline from 5.2% brings confidence that the eurozone inflation picture continues to move in the right direction, with the sharp decline in German CPI playing a notable role (6.1% to 4.5%). The fact that we have seen the Germans play catch up after a period of relatively elevated inflation is hugely significant, with the weakness of their economy meaning that they will be pushing hard for the ECB to halt their rate hike path.

Looking at core inflation, it paints a similar picture, with the euro area figure falling from 5.3% to 4.5%. Once again, German core CPI helped drive that move thanks to a decline from 5.5% to 4.6%. Clearly we have seen the pressure on the ECB ease significantly this time around.

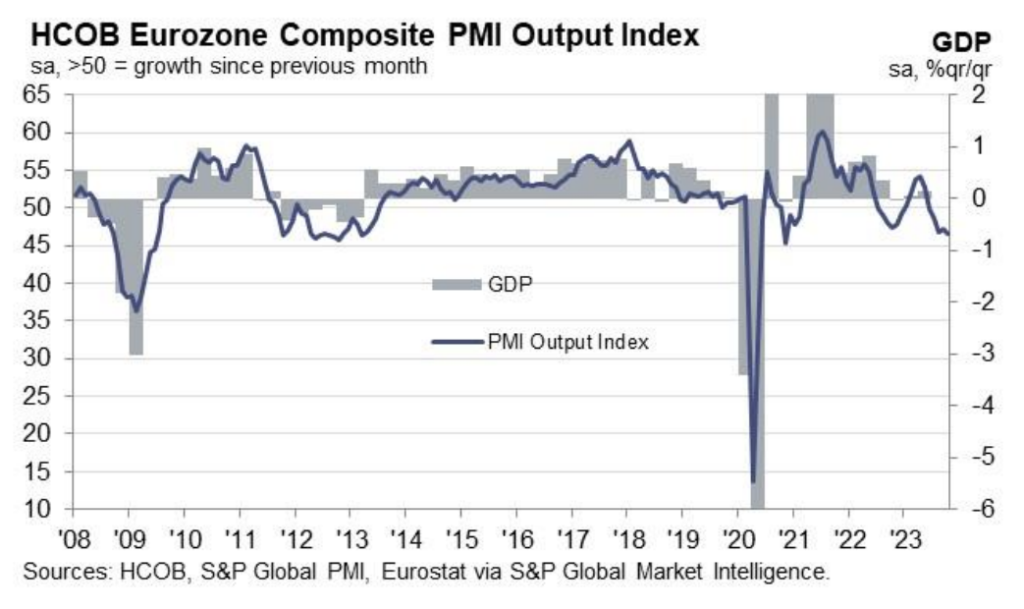

Elsewhere, the risk of an economic contraction grows by the month, with both manufacturing and services sector PMI readings well into in contraction territory. The latest October PMI survey signalled an intensification of this contraction, with a sharp decline in German services output helping to drive the wider reading lower. The fact that the eurozone services sector shrunk in two of the three months of Q3 does raise expectations of a negative GDP figure when it is released next week. The risk here is that we are only now starting to see the negative effects of the ECB’s interest rates kick-in, with the committee likely to hold off in response.

What to Watch Out For

Coming off the back of ten consecutive rate hikes, market pricing signals that a high likeliness of a pause in rates on Thursday. Of course, that means another hike would likely have a significant impact for the euro if it came to fruition. Nonetheless, a rate pause as expected would shift the focus onto Lagarde’s statement, with any forward guidance on future interest rate moves driving euro volatility.

This meeting could also see the ECB consider the potential to enact further tightening through adjustments to their balance sheet. Central to that discussion is the consideration to hasten the end of their reinvestment of proceeds from a €1.7 trillion portfolio, accumulated as a pandemic response measure. This deliberation comes amidst a recent bond market sell-off, propelling government borrowing costs to a decade-high, raising concerns around the size of their balance sheet.

How to Trade It

The euro has been weakening off the back of the weakening PMI surveys, reversing some of the gains seen over the past week. The recent rise into the one-month high came in the face of dollar weakness, with a clear bullish trend in place since the lows seen in early-October. With the ECB likely to halt their tightening process, any hawkish commentary that signals a high likeliness of further rate hikes could help push the euro higher here. Conversely, a dovish tone could drive euro weakness which would be tempered somewhat by the potential risk-on dollar weakness that might also come into play. Ultimately, we are looking at a recent turnaround that looks to bring further strength for the EURUSD pair, with the current pullback looking like another retracement rather than a reversal. With that in mind, a bullish intraday trend remains in place unless price falls below the 1.049 swing-low. Trendline and Fibonacci support around 1.057-1.059 bring a key zone that could see the bulls come back into play.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.