Eurozone CPI release key as EURUSD shows signs of resurgence

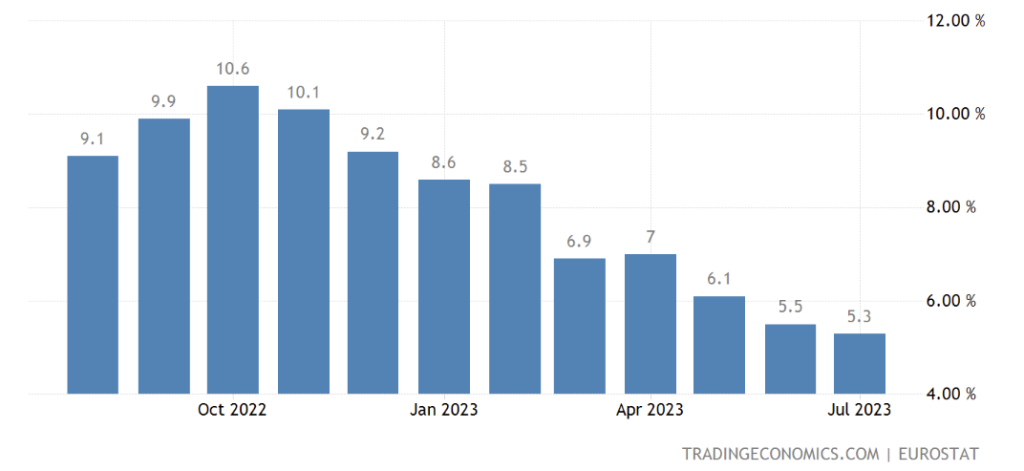

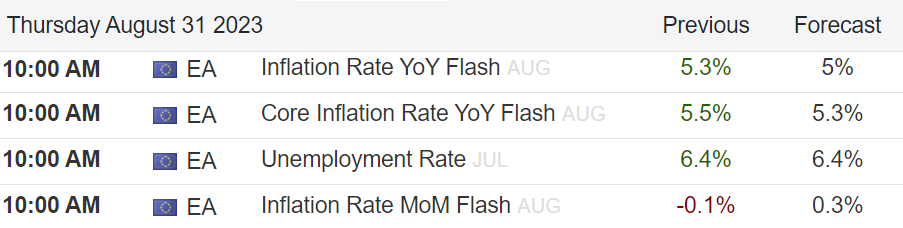

The euro looks primed for a volatile end to the week with eurozone inflation data due for release on Thursday. The obvious association between inflation and ECB policy should mean that any adjustment in CPI will drive market volatility through adjustments in rate expectations. Last month saw eurozone inflation move to 5.3%, from 5.5% in June. This 0.2% drop marked a slowdown in the disinflation pathway for the eurozone, highlighting the increased difficulty of driving down the stickier inflation elements. The role of ‘base effects’ has been key for countries such as the US of late, with CPI moving higher as historical readings drop out of the annual figure. That highlights the importance of tracking monthly CPI, with the -0.1% July figure bringing optimism that may be less evident if only watching the year-on-year figure.

CPI:

Core CPI remains a thorn in side of many central banks, with the latest eurozone figure of 5.5% signalling the ongoing struggles to bring down prices when stripping out volatile elements such as energy and food. The actions taken by the ECB appear to have made little impact on those stickier core inflation elements, with the core rate remaining only marginally below the 5.7% peak established four months earlier. Thus, the ability to shift core inflation lower will be a crucial signal that the ECB can believe their actions are finally having a tangible impact on inflation.

Core CPI:

Looking at the latest inflation data out of Europe, there are worrying signs that traders will undoubtedly take note of. While Spain has long been at the forefront of driving inflation down towards target, they have posted their second consecutive CPI increase after reporting a three-month high of 2.6% in August. This was primarily driven by fuel prices, with the core figure easing back to 6.1%. However, on the flip side we have seen German CPI tick lower, falling to 6.1% from 6.2%.

What to expect

Looking ahead to the Thursday release, market forecasts signal a potential decline across both headline and core inflation. An ongoing story of disinflation that carries across through the core reading would likely come to the benefit of stocks, dampening expectations for another ECB rate hike. However, that would likely come to the detriment of the euro. Conversely, a higher-than-expected inflation report would signal to the ECB that further action is likely needed, bringing potential strength for the euro.

EURUSD technical analysis

The euro has started to turn higher against the dollar this week, with price rebounding from an ascending trendline that dates back to March. With an uptrend in place over the course of 2023 thus far, we could therefore be due another period of strength if risk attitudes improve and eurozone inflation remains elevated. With trendline and Fibonacci support both coming into play here, bulls look to be coming back into prominence. A break back below the 1.0635 swing-low would ultimately be required to bring an end to this bullish trend. Meanwhile, with the intraday chart having seen the pair break up through resistance, we are starting to see a positive picture reemerge for EURUSD after a month of declines. All eyes will be firmly focused on the eurozone inflation report and US jobs data as key drivers of sentiment going forward.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.