Eurozone inflation declines could hide warning signs from rising energy prices

Euro traders are geared up for a volatile week ahead, with inflation data playing a particularly prominent role on both Thursday and Friday. Coming off the back of a ECB meeting that saw Christine Lagarde provide a dovish hike, markets look to be preparing for a period of stable interest rates. Will this week’s inflation data shake the market’s confidence in that view, or simply double down on the dovish outlook that has been a driver of euro weakness of late?

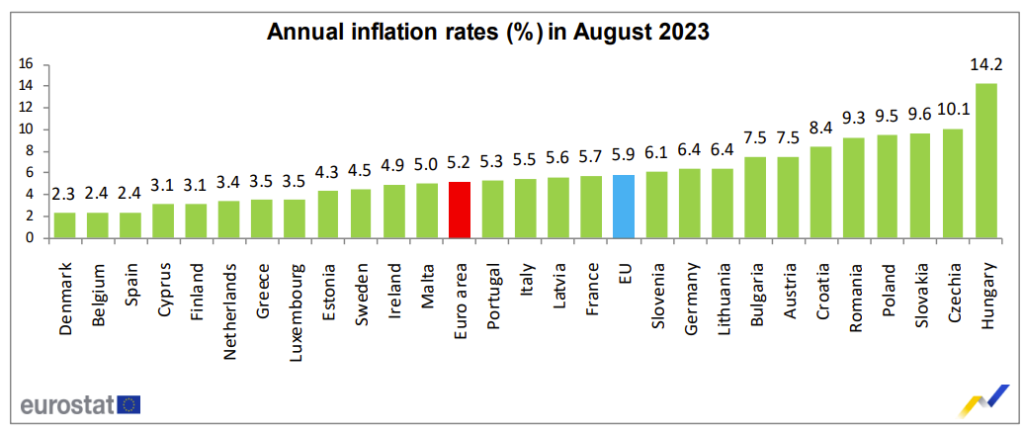

Thursday’s CPI data from Germany and Spain act as the starter to Friday’s main course, as two of the most notable countries come into focus. Germany has been notable within this inflationary period thanks to its difficulty in bringing CPI back down to the levels seen by most of the other major eurozone economies. That has improved markedly in May, when German CPI slumped from 7.2% to 6.1%. However, three-months later and that 6.1% figure remains in play. Given the German influence within the euro area, a notable decline in this figure would ease fears that they will put pressure on the ECB to tighten further.

Spain have found themselves on the other end of the spectrum, with the country leading European efforts to bring prices back down to target. So much so that they managed to bring headline CPI down to 1.9% in June, although this metric has been rising since. Another push higher looks likely as base effects see last September’s -0.7% figure replaced. As such, this is less likely to cause much of a storm for traders.

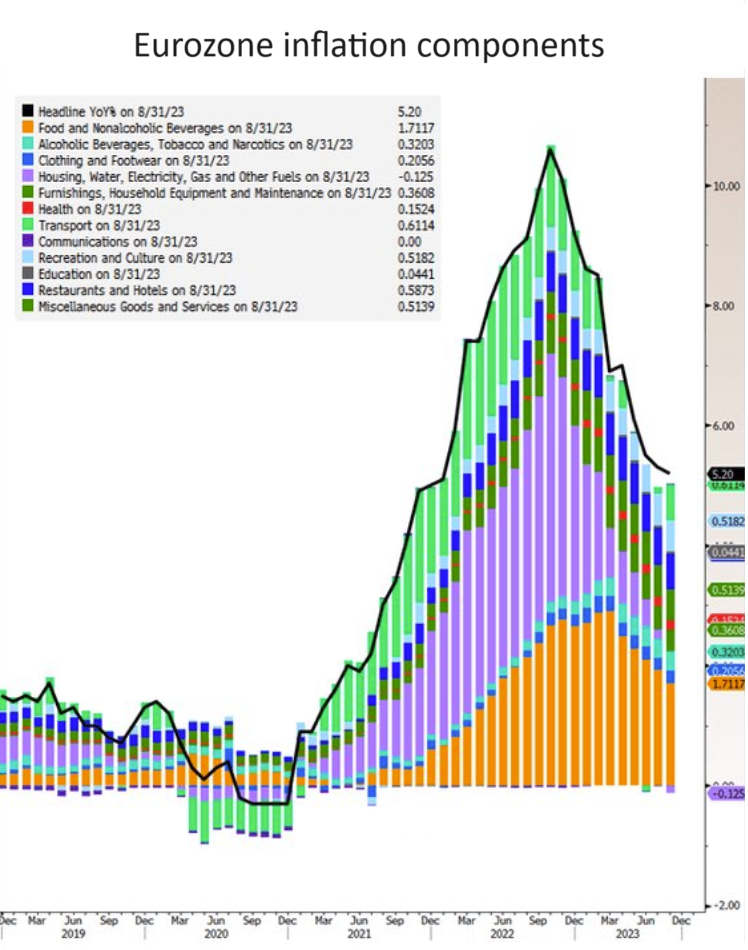

Friday’s eurozone inflation report will grab the headlines for markets, as the ECB decision to end their tightening phase comes into question. A breakdown of the eurozone headline inflation figure highlights how many elements have faded over the course of the year, although food and drink prices remain a continued thorn in the side of the ECB. Housing and energy inflation appears to have disappeared, but the recent rise in oil could see this metric pick up to threaten a second peak.

Headline inflation

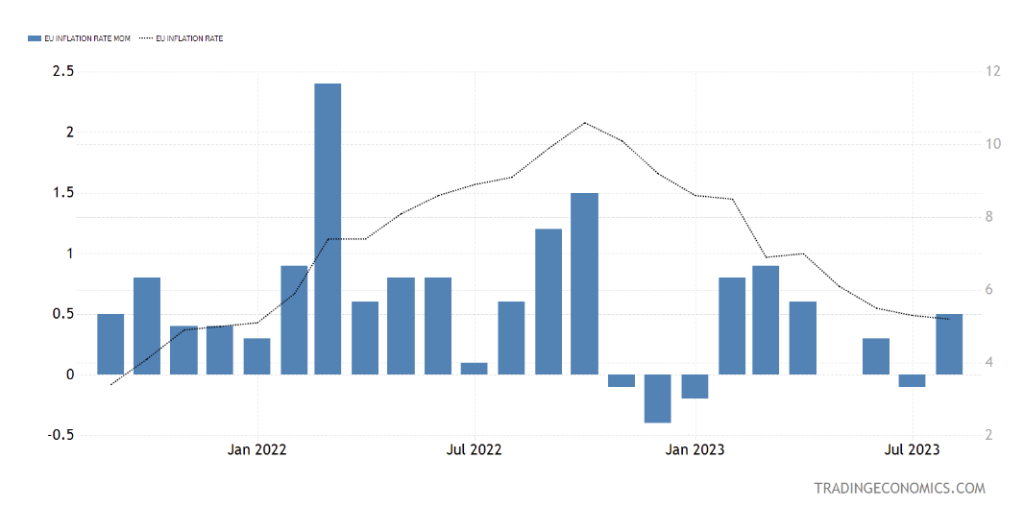

Taking a look at the trajectory of headline inflation, we can see that the ECB have been successful in driving down price growth to a large extent. The past year has seen CPI halved from the October 2022 figure of 10.6%, to the 5.2% announced last month. However, much of that momentum has stalled, with last month’s figure of 5.3% only a notch below the 5.2% seen in July. A look back at the breakdown image above highlights how this coincides with the easing of the housing and energy component disinflation. However, there is hope that we may see another significant leg lower this month, with base effects seeing last September’s 1.2% reading drop out. That would explain why expectations of a higher month-on-month figure of 0.7% are accompanied by calls for a sharp decline in the annual figure.

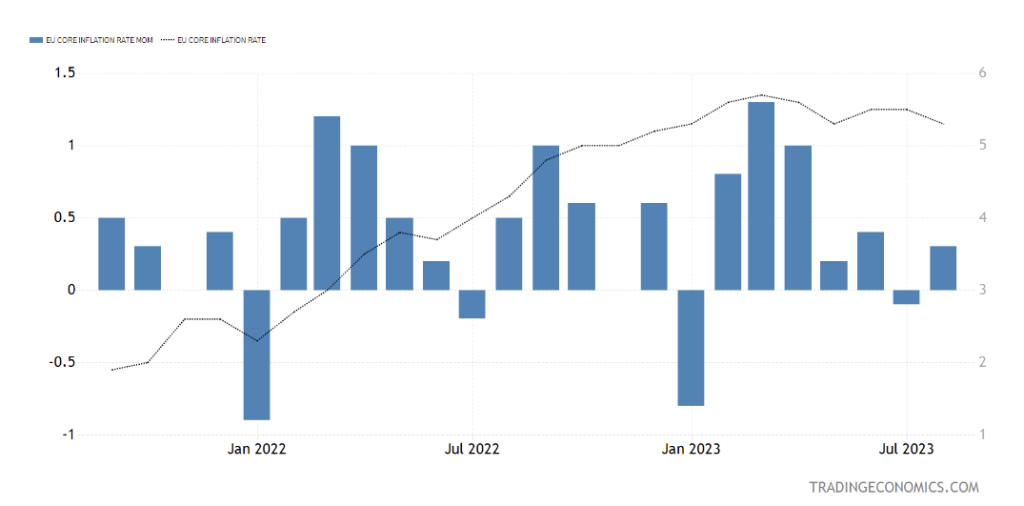

Core inflation

Core inflation similarly looks set to benefit from base effects, with the 1% September 2022 figure being replaced. That should see the annual core figure decline as long as the monthly figure comes in below 1%. Core inflation is clearly a major concern, with the energy-led disinflation seen over the course of this year being stripped out. Hence we have seen little downside for core CPI, which is currently only 0.4% below the 5.7% peak established five-months earlier (March). A significant move lower for the core figure could bring about a euro sell-off, as traders finally see a significant move for this key metric.

Summary

We look likely to see both headline and core inflation benefit from base effects, as elevated monthly readings back in September 2022 drop out of the annual metric. However, energy prices bring heightened risk of a fresh rebound if we see that driving up the headline CPI print. With that in mind, keep a close eye on the monthly reading for any sharp rebound that could be missed if you only follow the annual number. A look into the report itself will be key to note how energy is impacting prices. A sharp decline in headline and core inflation could help drive euro weakness in the immediate aftermath of the event, but that could be short-lived if we start to see signs of another rebound in headline inflation caused by rising oil prices.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.