FOMC preview – Hawkish hold expected as Fed release new dot plot

Table of Content

The Federal Reserve are back in focus this week, with Jerome Powell leading the FOMC into their sixth meeting of the year. Emerging at a time when economic concerns tie up with rising inflation and central banks that appear to have drawn a line under their monetary tightening phase, markets look towards the Fed for guidance once again.

The rate decision will be announced at 7pm UK time, with the press conference starting 30 minutes later.

What is the current state of play?

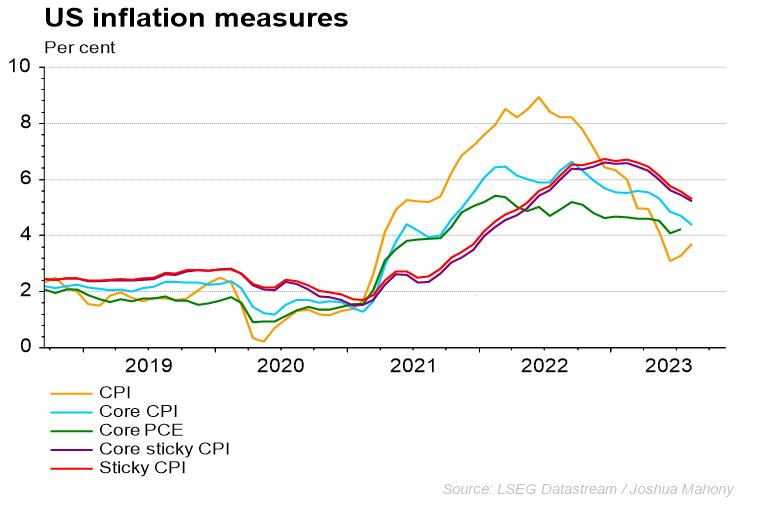

The Federal Reserve has raised rates 11 times out of the last 12 meetings, lifting the Fed Funds rate to the highest level seen since 2001. Thankfully we have seen inflation move lower in response, with the headline CPI rate falling back into 3% in June. Unfortunately, things have taken a turn over recent months, with annual inflation now at 3.7%, and the core figure increasing by 0.3% in August alone.

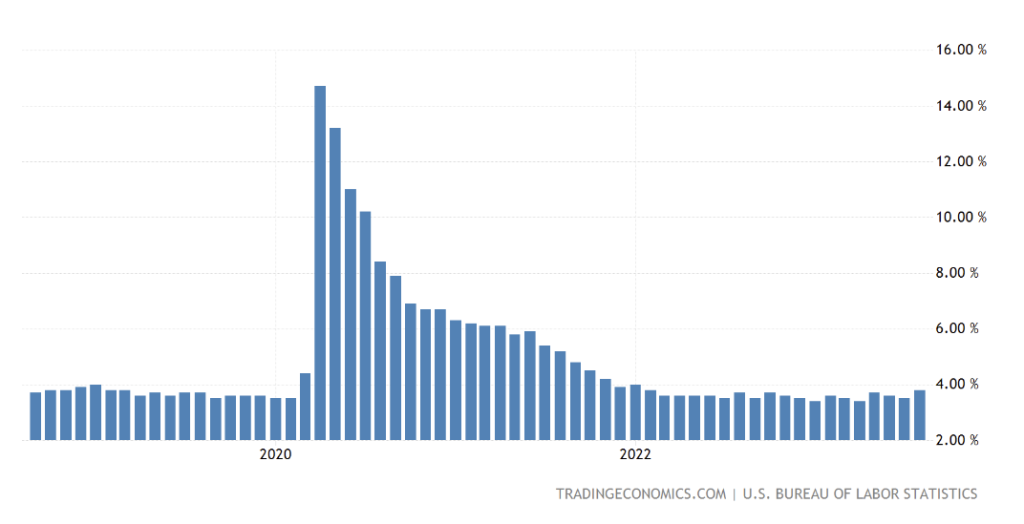

From a jobs perspective, we have started to see warning signs as unemployment heads higher. The latest unemployment rate figure of 3.8% is the highest since February 2022, following a surprise jump from 3.5%. However, we are yet to see a particularly worrying move away from the unemployment range exhibited throughout the past year, with jobless back down at pre-pandemic levels. Meanwhile, the PMI survey provides a concerning growth picture, with the services sector seeing slowing growth that is at risk of stalling or contracting. Meanwhile, the manufacturing sector continues to contract at a worrying clip (47.90).

All in all, tentative signs of weakness are yet to transition into a significant red flag for the Fed, while inflation starts to gain traction. One major concern will be the recent rise in energy prices, but we are yet to see that meaningfully affect inflation expectations quite yet.

What to expect?

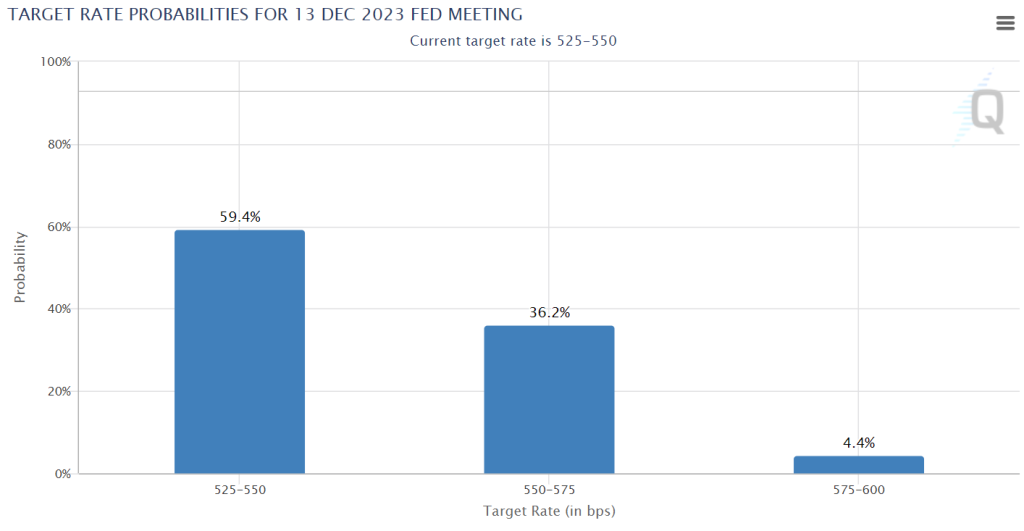

The Fed are highly unlikely to make any adjustments to the Fed Funds rate at this meeting, with the 99% confidence exhibited by the CME Fedwatch serving to highlight the strong market positioning for a pause from the FOMC. However, this simply means that markets look further out for future meetings. Will this be the end of the tightening phase or simply a pause before we resume once again? A look at the final meeting of the year highlights a 40% chance of a hike by year-end.

One of the key elements for traders will be the latest Fed dot plot, with the previous iteration signalling a high confidence that we will see another hike by year-end. With this in mind, any adjustments to this outlook would impact market pricing and cause volatility. This dot plot lays out the rate expectations for each Federal Reserve member. With that in mind, any adjustments highlight shifting perceptions over future interest rate movements from the people that matter the most.

Economic projections

This meeting will also see the Fed provide its quarterly Summary of Economic Projections (SEP), with adjustments to the inflation and growth outlook likely to cause a stir for markets. There is a feeling that we could see a more positive outlook for growth, while adjusting inflation expectations marginally down.

Outlook

There is a strong likeliness that Powell will take a similar tone to that adopted at Jackson Hole, with the Governor expected to remain open to further action if needed in a bid to drive inflation back down to 2%. This tone sets the Fed up for a ‘hawkish hold’, in stark contrast to the ‘dovish hike’ adopted by the ECB.

S&P 500 Technical Analysis

The S&P 500 came under pressure on Friday, sending the index back down to the lows of the month. The ability to break higher from this current period of consolidation will be key, with a decline through 4429 signalling the potential for another leg lower. Watch out for trendline support below as a potential source of upside if this wider uptrend is to come back into play. The bulls have struggled to maintain their gains of late, and we would ultimately need to see a push through 4539 to bring about a more confident bullish continuation signal.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.