FOMC preview: rate hike expected, but will we see another by year-end

The Federal Reserve reconvenes this week for a meeting that has been speculated to potentially bring the final rate hike of this cycle. Talk of terminal rates and dovish turns have been abound over the past six months but sticky inflation has proven a worthy adversary for many of the major central banks. The two-day meeting concludes on Wednesday 26 July, with markets well aware of the potential implications for volatility. The rate decision will be announced at 7pm UK time, with the press conference starting 30 minutes later.

One and done?

The Federal Reserve’s desire to drive down inflation has seen the Funds Rate pushed up from 0.25% to 5.25% over the course of 10 rate hikes. The desire to combat inflation has been clear, with Powell well aware of the risk that an inflation spiral could take shape if drastic action is not taken. However, the latest inflation reading of 3% brought an awareness that the Fed has done much of the groundwork in a bid to dampen both current inflation and future expectations. The ability to drive down prices to this level should ensure that wages follow.

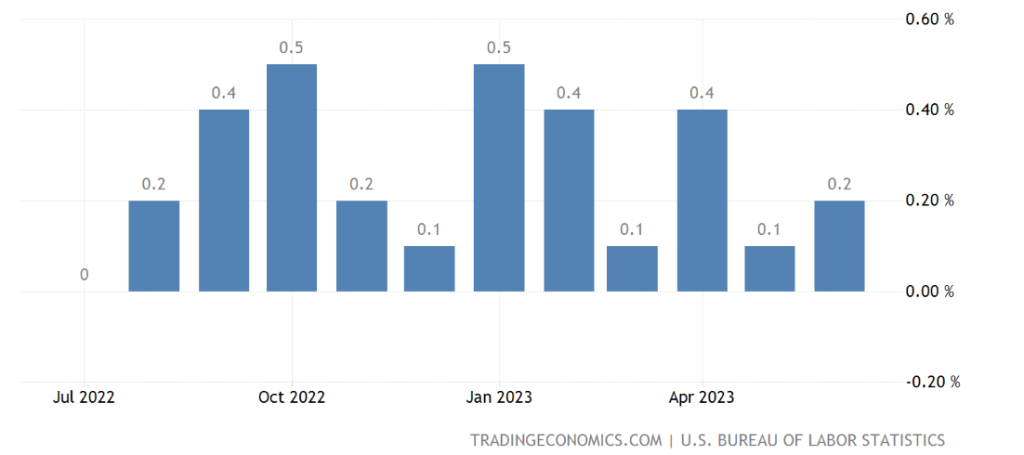

Base effect benefits are essentially over, and there is certainly a need to be aware of the likely tick higher in headline CPI over the coming months. After all, the next two CPI figures will replace the 0% (August) and 0.1% (September) figures from the year prior. While that makes it obvious that there is a high likeliness of inflation increasing over the coming months, it is more important for the Fed to see monthly inflation around 0.1-0.2% as that annualises to provide a CPI rate close to target.

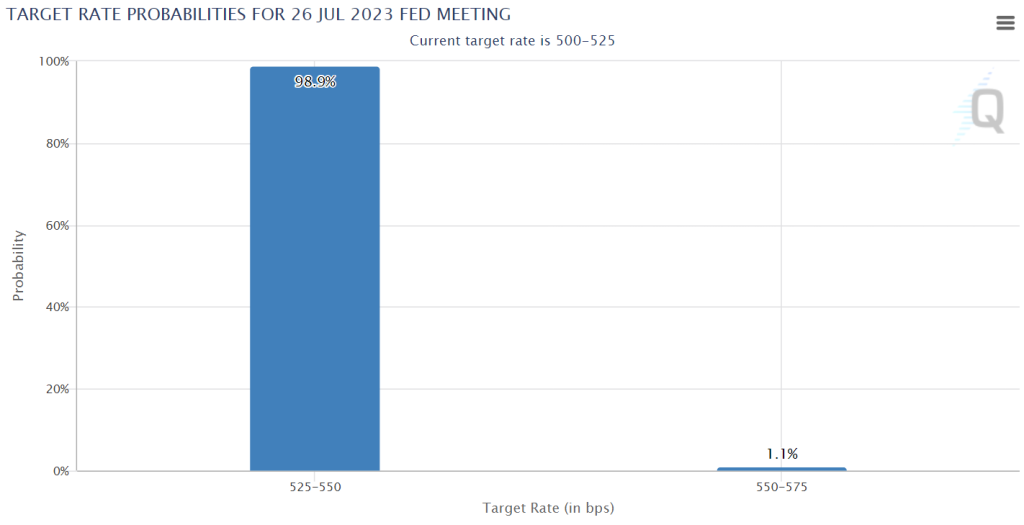

Despite the notable decline in year-on-year inflation seen this month, markets do still expect to see another 25-basis point hike this time around. The CME FedWatch tool outlines a 99% expectation that we will see a 25-basis point hike at this meeting, with such overwhelming market pricing usually highly indicative of the ultimate outcome. After-all, the Fed will utilize commentary and meetings such as this to gradually steer market expectations ahead of each rate decision.

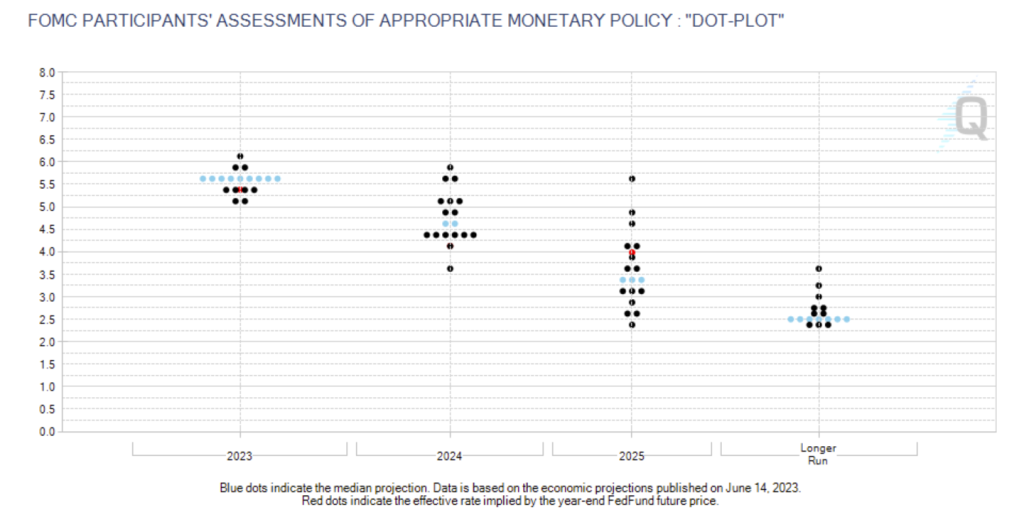

The June dot plot signalled an expectation that rates would lie around 5.5-5.75% by year-end, highlighting the potential for another hike beyond this week. That brings questions over when such a move might take place. Certainly, there is a growing feeling that the decline in US CPI may help negate the need for that additional hike. As such, traders will be keeping a close eye out for any commentary over whether this is indeed the final hike before rates enter a period of stability. Or will Powell leave the door open for additional action, bringing expectations of another hike before year-end. With markets currently pricing in a 32% chance of an additional 25-basis point hike by the December meeting, market volatility for this meeting will likely emerge from any pricing adjustments around future rates.

S&P 500 Technical Analysis

The S&P 500 has been on the front foot over the course of July thus far, with the bulls taking the index within 6% of record highs. The 4-hour chart highlights the reliable uptrend in play, with any signal that this could be the final hike from the Fed likely to bring further upside for the index. A push through the recent peak of 4579 would bring about a fresh bullish signal for the index. To the downside, a pullback would look to be a short-term bullish retracement unless we see the index decline through the recent swing-low of 4378.

EURUSD Technical Analysis

Looking at the dollar, EURUSD has been heading lower of late. The pullback highlights both strength of the dollar and the euro weakness that has emerged off the back of eurozone disinflation. However, the trend remains bullish for now, highlighting the potential for another bout of dollar weakness should Powell take a less hawkish tone than the dot plot would insinuate. A break below the 1.08333 low would be required to end the bullish trend that has dominated much of the past year.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.