FOMC Preview – Will Powell gear markets up for a December hike?

Table of Content

Where and when?

The Federal Reserve commence their penultimate monetary policy meeting this week with the two-day affair ending on Wednesday 1 November. Set against the backdrop of a remarkably resilient economy, there are calls for a sixth 2023 rate hike. Will we see another rate hike this time around? Will the Fed prepare the ground for a December hike? These questions will be key as we head into this crucial market event.

The US economic picture

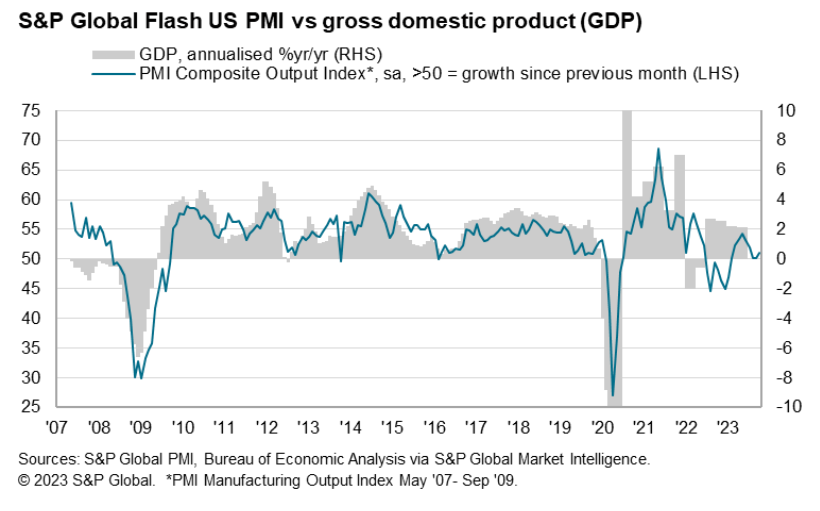

The US economy has been remarkably resilient thus far, with October bringing plenty of encouragement in the face of a historic period of monetary tightening. From a consumption perspective the US retail sales figure released mid-October highlighted continued strong demand with the headline (0.7%) and core (0.6%) figures both well above expectations. The latest PMI readings pointed towards a similar strength with both managing to surprised markets by pushing upwards and out of contraction territory. The Federal Reserve will likely take confidence from the fact that the services PMI pushed markedly higher, rising to 50.9 despite expectations of a sub 50 contraction reading. Last week saw that theme continued with the advanced GDP reading for the third quarter punching up to an impressive 4.9% on an annualised basis. Manufacturers will also be heartened by the better-than-expected core durable goods orders figure, which continued the now five month run of 0.5-0.6% gains.

From an employment perspective, a jump in leisure and hospitality jobs helped drive a big beat on the headline payrolls figure (336k). That represents the best month of jobs creation, although there is some concern that this is being inflated by those taking a second job in the face of rising costs. Unemployment remained at 3.8%, while average hourly earnings remained relatively subdued at 0.2% for the month. That being said, the September wage growth figure of 4.2% is well above CPI inflation, highlighting underlying cost pressures for businesses.

All in all, the US economy remains in a good place despite speculation that we could be on the cusp of an economic breakdown as higher rates finally take their toll on consumption and investment.

What about inflation?

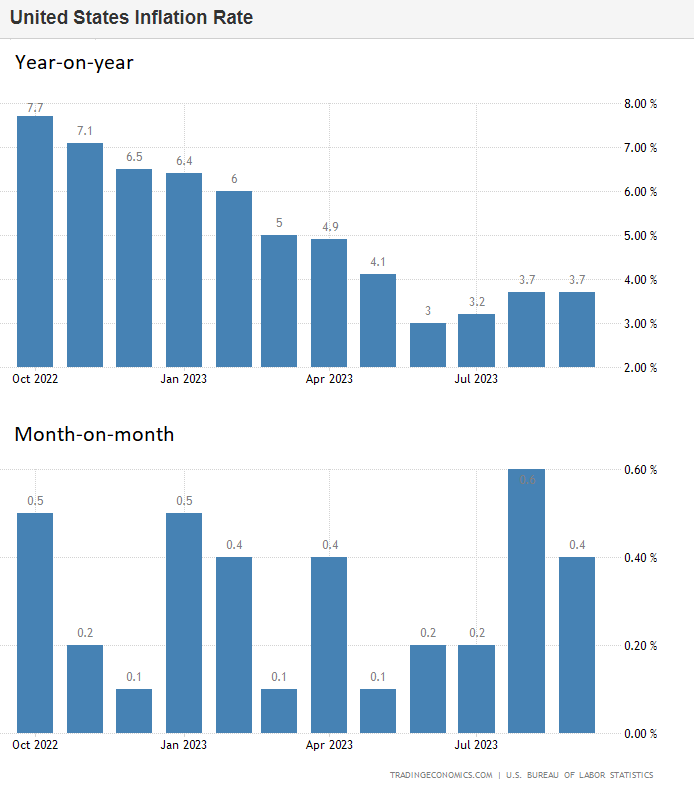

Headline CPI inflation in the US has flatlined at 3.7%, coming off the back of two consecutive gains in July and August. However, it is concerning that the last two monthly readings came in at 0.4% and 0.5%, which would annualise to a YoY figure of 5.4% if it continued going forward. While the coming month should remain favourable as the October 2022 figure of 0.5% drops out, we could see prices rise again if the US monthly CPI reading does not head lower in November (2022=0.2%) and December (2022=0.1%).

In terms of core CPI, the downward trajectory has been maintained with the latest decline seeing a reading of 4.1%. That represents a 0.6% drop from the July figure helping to alleviate some of the fears around underlying inflation pressures. On a monthly basis the past two months data would indicate an annualised figure around 3.6%, highlighting the potential for further disinflation but also a difficulty getting below that 3% mark.

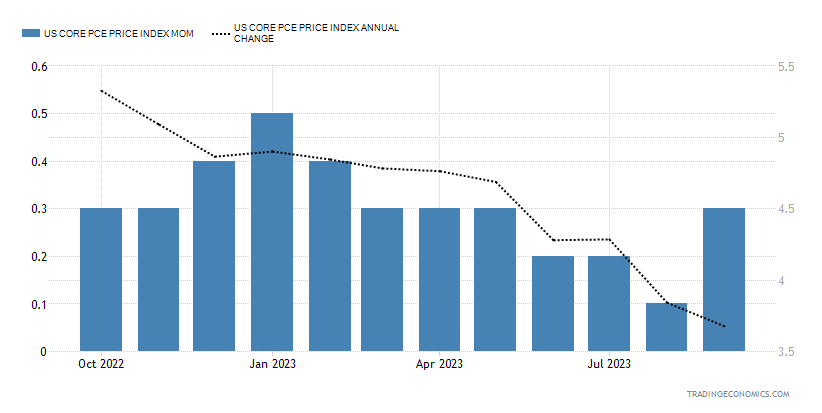

Finally, the Federal Reserves favoured core PCE price index gauge ticked lower for September, moving from 3.8% to 3.7%. Whilst this is a welcome development, prices do remain well off the 2% target. The monthly figure of 0.3% tallies up with much of the past year, with six of the past 12 months now experiencing that monthly growth rate. Much like the core CPI figure this annualizes out to a 3.6% year on year reading. While there is grounds for optimism over the sub 0.3% readings in June to August, October’s return to that 0.3% level is a setback for the Federal Reserve.

While inflation appears to be gradually moving in the right direction, the Federal Reserve might see the undoubtable strength of the US economy as an opportunity to turn the screw once again in a bid to bring prices back down to target. Extended periods of above target inflation can lead to price pressures becoming ingrained and more difficult to deal with. The Federal Reserve will be well aware of this need to drive down price pressures in a swift manner, with a prolonged period of elevated rates causing huge damage to the debt picture at the US treasury.

What to expect

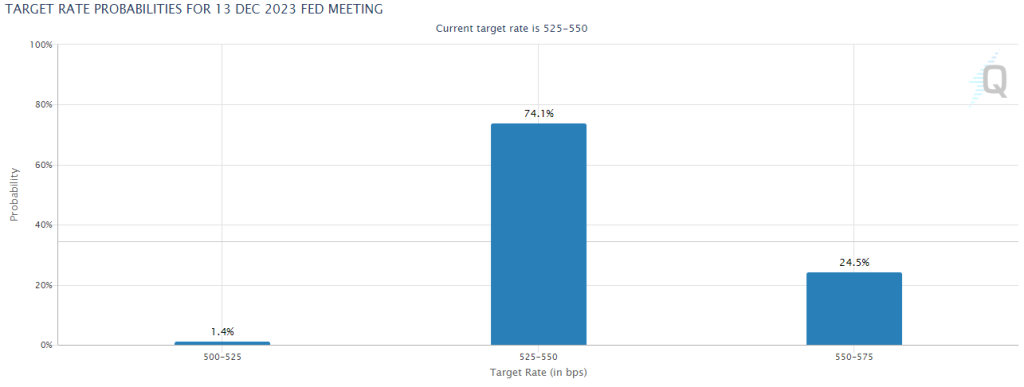

The Fed look unlikely to act this time around, with the CME Fedwatch tool signalling a 98% probability that they will keep rates steady on Wednesday. Things look a little different for the December meeting with a 25% chance of a rate hike currently being priced in. With that in mind, much of the volatility around this meeting is likely to come in response to changing expectations for that December hike. Confidence over the direction of the economy and inflation will be key as markets attempt to gauge whether the committee deem further tightening as being necessary this year. The Federal Reserve’s dot plot does signal the potential for another hike, and this week’s meeting could be the perfect platform to begin shifting expectations in that direction if that is their intention.

EURUSD Technical analysis

The euro has been gaining ground against the US dollar over the course of October thus far, with EURUSD regaining some of the ground lost over the course of August and September. Price appears to be reversing upwards from the 76.4% Fibonacci level once again as we head into this meeting, signalling the potential for further upside over the near term. However, the expectation for a sharp decline in euro zone inflation on Tuesday could hammer home the high likeliness that the ECB have finished hiking for the time being. That could provide a backdrop for EURUSD weakness if we see a hawkish take from the Federal Reserve on Thursday. That being said, a decline below 1.05 would be required to end this current rebound in EURUSD.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.