Friday sees wealth of UK data, bringing GBP into focus

The UK economy comes into focus this Friday with a raft of important data points being released in the wake of last week’s Bank of England rate decision. For FX traders this represents a potential opportunity as we look for increased clarity over the direction of the UK economy and monetary policy.

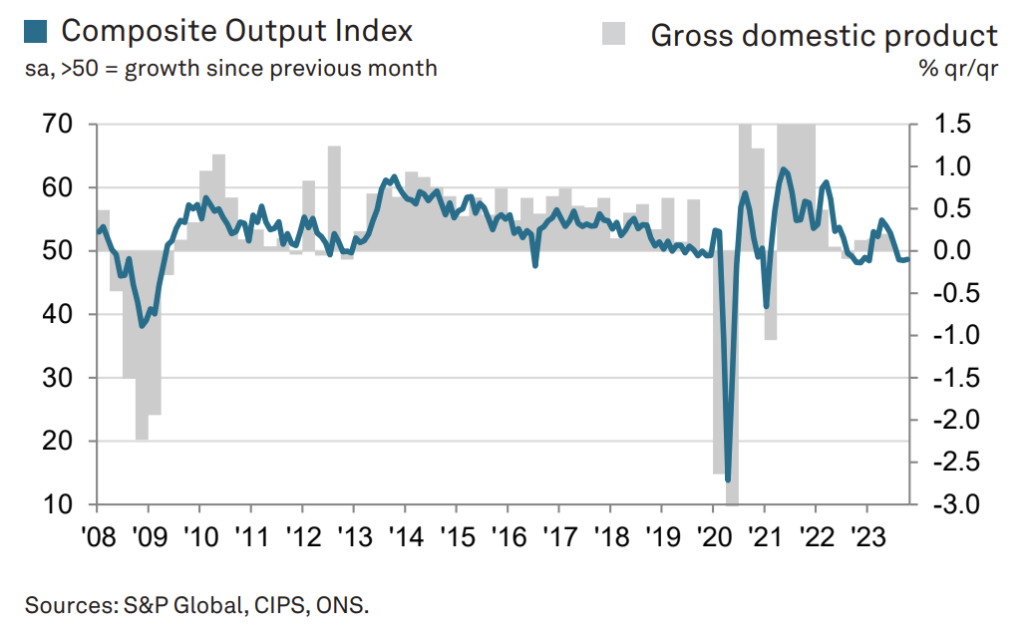

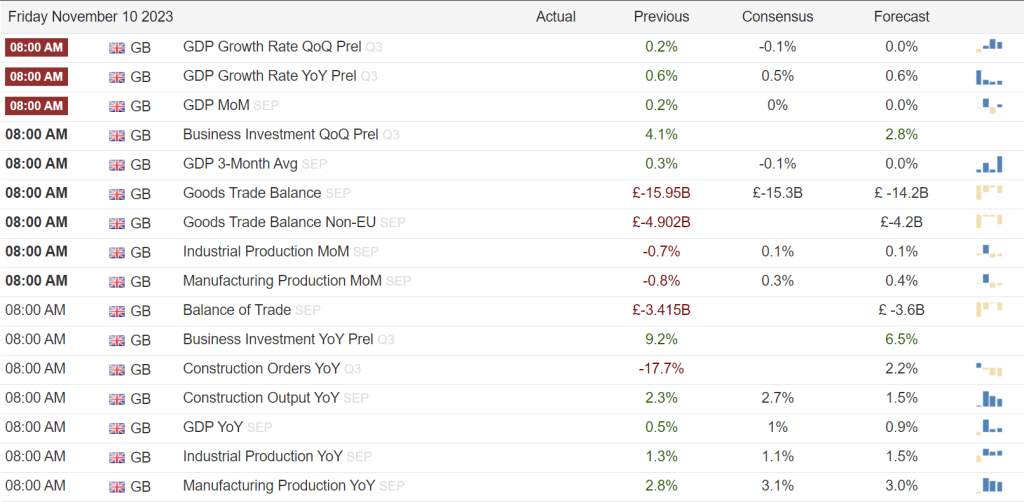

The third quarter growth data will undoubtedly grab the headlines, with markets predicting a -0.1% contraction compared to the second quarter. Coming out of the tales of a similar -0.1% decline in German growth, the soft-landing theme in Europe has been taking shape of late. A contraction in UK growth would not be a surprise for many within the markets, coming at a time when UK PMI surveys trade below 50.

From a sentiment perspective, this batch of economic data will likely be viewed from the perspective of how it influences monetary policy and inflation. The prediction for a -0.1% decline in Q3 growth could heighten expectations that the Bank of England pause represents the end to the tightening process. With last week’s BoE meeting having seen markets increasingly positive that we will see rates cut in the second half of 2024, any additional signs of weakness could bring further calls for disinflation and interest rate normalisation.

Aside from the GDP figure, keep a close eye out for the September industrial and manufacturing production numbers. The latest manufacturing PMI figure of 44.8 highlights the ongoing contraction in the region, with Friday’s data likely to prove key in signalling the direction of that side of the economy. As we can see below, markets are hoping to see the monthly production data improve in September.

EURGBP technical analysis

The pound has been losing ground against the euro over the course of the past two months, with EURGBP pushing higher ahead of this key batch of UK data. The upcoming data will be key in driving sentiment, specifically via a move in relative treasury yields. As we see below, the past month has seen eurozone 10-year yields drift lower compared with the UK. As such, any data that signals a likely move away from hiking and towards a swifter return to rate cuts would likely drive UK yields lower and EURGBP higher. As such, weak data should strengthen EURGBP, while a strong UK data set would be expected to drive EURGBP downside.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.