FX Week Ahead 21 – 25 June 2021 / Federal Reserve Chairman in Focus

Table of Content

Key points

- The markets are fairly busy in the week ahead

- Federal Reserve Chairman testimony will take a stand, and the economic calendar features key events

- Technical outlook

Monday

The markets will be fairly quiet on Monday with no many economic events, but Australian retail sales data and China’s interest rate decision will take the stand.

The People’s Bank of China is expected to keep the interest rate unchanged, but a hawkish comment is potential after the recent US fed rate hikes move. Markets will be awaiting Tuesday’s Federal Reserve Chairman testimony for more direction.

The Aussie attention will focus on the retail sales data to start the week, and we could expect the news to have little influence on the AUDUSD, which has been under pressure as the US dollar continue its strength against the major peers. The Australian employment report did not impress the traders and could be the same for the retail sales data. However, we expect the data to show an uptick as the economy focuses on economic recovery.

Tuesday

The markets will be fairly busy on the US side, with Federal Reserve Chairman expected to give testimony before the committee, which comes after the hawkish Fed decision.

The focus will then change to the BoJ monetary policy minutes. With the economic targets lagging behind, the bank could well be ready to start looking at other measures as the numbers strike back in Japan. However, the news is not gonna have much impact on the Yen should there be no remarks concerning the state of the economy.

Wednesday

The markets will be busy as broad economic events take the center focus in the markets.

The Euro focus will be on the Germany Markit Manufacturing PMI and PMI composite data, aiming to set the tone for the recent struggling Euro currency. A few minutes after, the focus will shift to the PMI composite for the Eurozone, and we expect the data to show positive results from the manufacturing and services.

The market focus will then change to the U.K Services PMI and will be key for the sterling pound. Traders will be expecting higher than expected readings which could set a positive move for the Pound base.

Thursday

The markets will be bustling as Thursday becomes the busiest day of the week, the day features key economic events, and the news will set a volatile tone in the markets.

The European Council Meeting will start the day, and the European markets will be kept busy throughout the whole day.

The BoJ Governor Kuroda will give a speech on the day, and the Yen will be eyeing further details on how the Central Bank is copying with the current outbreak.

The focus will then change to the U.K events, and the London markets will be kept busy. Traders will be on their toes to hear what is next from the Central Bank. We expect the interest rate to be kept unchanged, and we can expect the bank to surprise like the Federal Reserve Chairman did concerning employment, inflation, and interest rate. With the U.K reopening plan extended, the bank will be forced to make adjustments from its plan. We can further expect a hawkish decision which could send the Pound up and can harm the FSTE100.

The attention will later change to the US events and will feature will handful of events. The US durable data, Nondefense Capital Goods, and the Gross Domestic Product. The news will set serious volatility in the market, and the US weekly initial jobless claim will be eyed as last week’s numbers showed an uptick.

Friday

The markets will be quiet to finish the week. However, the European Council meeting and the US Core PCE Price Index will set the tone for the market.

The US Core CPE Price Index will be the key news for the US dollar, and a jump in figures could set the Dollar for more buying pleasure.

Technical analysis

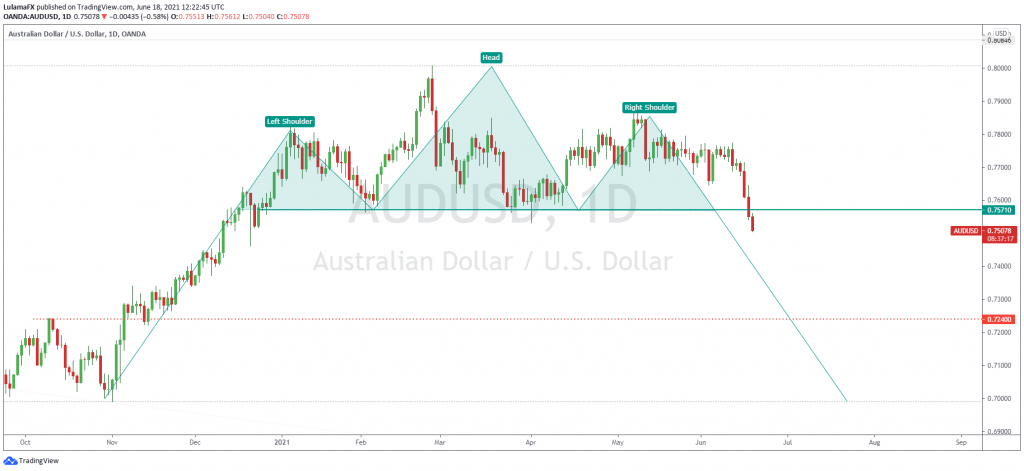

AUDUSD outlook

Due to the slow start to the Asian session on Friday, the AUD / USD held close to 0.7550-55. In doing so, Aussie shorts took a breather near the yearly low and struck the day before after three straight days of southbound trading. Although the market’s adjustment to the Fed’s interest rate hike signal has become the main catalyst to support the US dollar and puts pressure on prices, the lack of new leads may diminish even closer to the low of several days.

Technically, the pair has created a head and shoulders pattern with a break below the neck of the H & S, and a sustained move further down could send the pair to 0.72400.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.