FX Week Ahead 5-9 July 2021 / AUDJPY in Focus

Table of Content

Key points

- The economic calendar is very light in the week ahead

- The focus will be on the Australia data, FOMC and the end of the week Canada jobs report

- AUDJPY technical outlook

Monday

The markets are quiet on Monday, with the market set to focus on the early Australia retail sales data, and the investors expect the data not to set a much-needed tone for an Aussie rebound.

The Australia retail sales data on Monday will start the week. The market expects the data for June to show a slight improvement despite the recent lockdown in some parts of Australia due to the spread of a new strain of coronavirus. The data is not gonna cover the data for the last few days of lockdown.

Tuesday

The markets are set to be busy on Tuesday, with the economic calendar full of events that could set the tone for the markets.

The markets will again start the day with the economic events from Australia.

The Australian interest rate will be the key focus, followed by the rate statement. The market is already pricing in an unchanged interest rate. The new outbreak, slower than expected vaccination process and lockdowns could weigh on the shining economy of Australia. With the prices of commodities up, the housing prices boom and unemployment at 5.1% in May, investors expect the RBA to announce its plan to move out of low monetary policy, which could push the Aussie for a bullish reaction. Early in the morning, the RBA governor will give a speech and is expected to give what is mostly like a hawkish decision.

The Euro will be eyeing the release of Eurozone retail sales data, and traders expecting better than expected figures as the economy re-opens in most parts of Europe despite the growing concern of the delta variant. The market is projecting 7.9% in June from 23.9% in May.

The US Dollar traders will keep their eyes open to the ISM manufacturing PMI release. The ISM Service Index may be the leading number, and it should indicate that due to the reopening, the industry has grown very strongly, and business opportunities have increased. However, like the manufacturing survey, it will emphasize the lack of suitable workers to hire.

Wednesday

The markets will be busy on the US side, but the economic calendar is highly light.

In the United States, the ISM service survey will begin rolling on Tuesday, and all eyes will turn to the minutes of the last FOMC meeting on Wednesday. The ISM index is expected to cool down but still at a high level, indicating that the strong growth momentum in the United States continues.

As for the meeting minutes, this is a meeting where the Fed shocked the market by suggesting that it might reduce asset purchases, so investors will look for clues. Before taking the next step, what kind of progress does the committee hope to see?

Thursday

The markets will be fairly quiet, and the economic calendar is light.

The Aussie will focus on the RBA governor speech, and investors will be monitoring any hawkish decision.

Friday

In Canada, we have an employment report for June. After re-implementation in April, some Covid containment measures are being relaxed. Still, considering the timing of data collection, we don’t expect the employment report this time to be too strong. However, the vaccine launched in July will show great improvement, with Canada topping the list in terms of the proportion of the population that receives the first dose of the vaccine.

Technical outlook

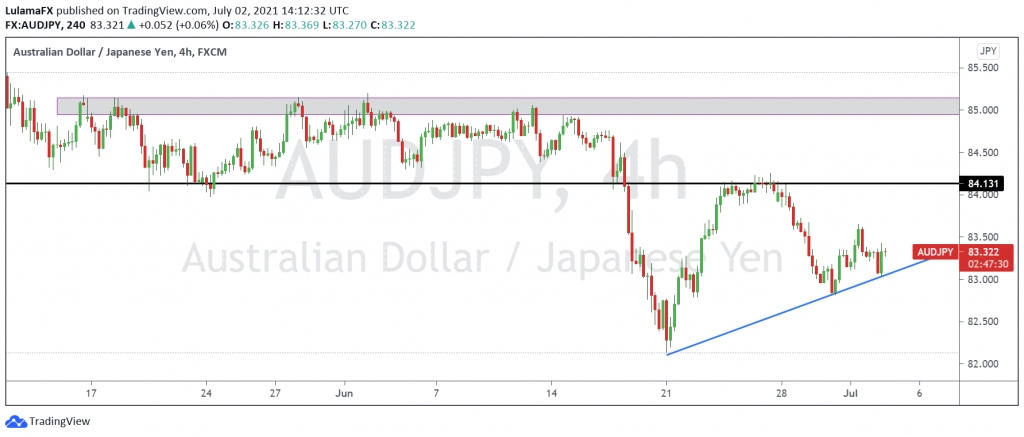

AUDJPY outlook

With strong economic events for the Aussie in the week ahead, the market will be looking to pull back. Traders will be eying the RBA decision, which is expected to set a bullish reaction for the AUD.

The AUDJPY recently respected the support to pull back from the end of July losses to set a bullish tone. Bouncing at the trendline is a confirmation of what could be the start of a bullish move. The Aussie will be eying support in the week ahead, which could see the pair set up gains targeting 84.131, and a move past the resistance level could set more buying pressure in the market.

However, a bearish scenario could occur should the market trade below the resistance level and set a breakout.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.