Monthly FX lookahead – December 2023

Table of Content

US Dollar (USD)

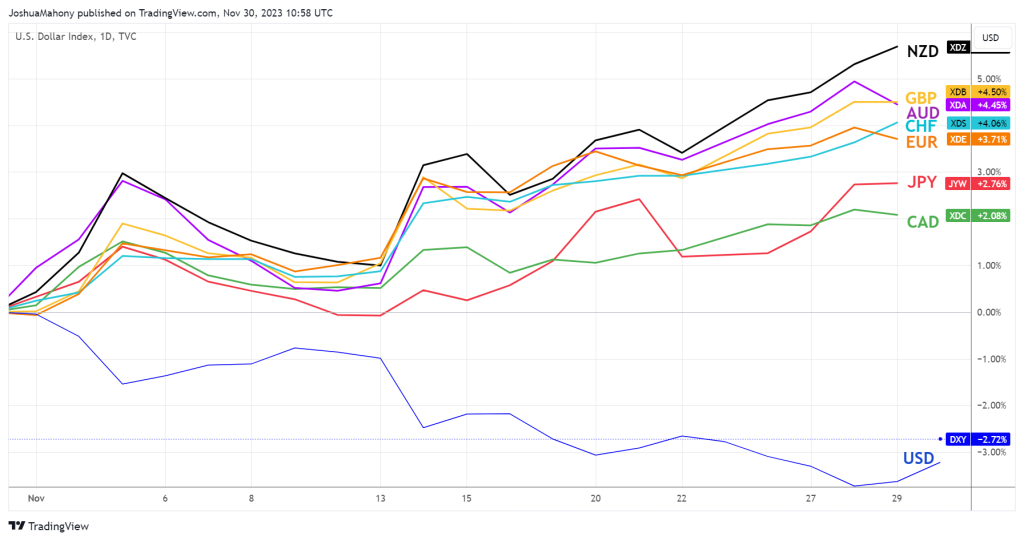

The greenback closed out the month of November at the bottom, with traders reversing their bullish dollar bets on the growing optimism that we can finally shift our focus away from monetary tightening and towards the timing of a 2024 rate cut. While the risk-on sentiment seen throughout global equity markets has helped drive haven currencies, like the USD, lower, the strength of the dollar throughout prior months did provide the basis for a significant bearish turn for the USD in particular.

In terms of the main drivers, concerns around the US economy did emerge in early November thanks to the lowest non-farm payrolls figure since early 2021 (150k). This weakening theme developed over the course of the month, with earnings season seeing a number of key retailers warn of deteriorating demand towards the back end of the third quarter. This could be an early sign of an impending collapse in consumption, as interest rates finally have a tangible impact on spending habits. The November 1st FOMC meeting saw the Fed keep rates steady as expected, although their continued data-dependent approach fell off given the ongoing concerns around the economy and falling inflation. US CPI remains the key issue here, and the lower-than-expected October figure of 3.2% helped further enhance calls for an initial rate cut in early 2024. While the events of October saw pricing around the timing of the rate cuts shift, market expectations have closed out the month with a 62% chance of a May rate cut.

With Black Friday sales reaching record levels, we will be watching for further signs of consumer strength going forward. Early jobs data comes on December 8th, with payrolls and average earnings key given the depressed unemployment rate. As things stand, we are yet to see any notable jump in distress signals out of the US. However, any notable downturn could bring forward rate cut expectations. The inflation gauge on 12 December remains key, with the FOMC following on the 13th. Notably that meeting includes their latest projections, with inflation forecasts guiding market expectations over when the committee plans to begin easing.

Canadian Dollar (CAD)

The Canadian dollar saw plenty of selling pressure over the course of November, as a slump in energy prices led to widespread weakness for this key commodity currency. The reliance of Canada on oil and gas exports brings a strong correlation between CAD and WTI, highlighting why the currency saw particular weakness in the first two weeks of November as US crude shed 11%. Fortunately, it wasn’t all doom and gloom for the CAD, with the strength seen in equity markets helping to drive dollar weakness that saw USDCAD decline into a two-month low.

Energy prices served as a key driver of sentiment over the course of November, with questions emerging over the ability of OPEC to follow through with their planned production cuts. We also saw selling in the energy markets emerge as a result of demand considerations, with affordability a key issue that could weaken fuel sales in the fourth quarter. From an economic perspective, a weak Canadian jobs report saw the employment change figure slump to 17.5k, while unemployment took an unwelcome jump to 5.7%; the highest reading since February 2022. From an inflation perspective, a sharp decline back down from 3.8% to 3.1% helped raise calls for a swift dovish turn from the Bank of Canada (BoC) next year. Markets currently price in a first cut as early as April 2024, which would make it one of the earliest banks to begin the process of reversing the tightening enacted over the past two-years.

Looking ahead, December kicks off with the latest Canadian jobs report (1 December), with markets keeping a close eye out for any further uptick in unemployment. Additional weakness in the jobs market could put pressure on the BoC to plan for an earlier normalization of monetary policy next year. For now, the BoC looks likely to maintain rates at 5%, although markets are pricing a 12% chance that they will cut rates on December 6. That is relatively high given the fact that no one expects to see any of the major central banks cut before 2024. With this in mind, the inflation data due out on December 19 may be key given the elevated nature of market expectations of an early rate cut from the BoC. Similarly, there will be greater sensitivity to any commentary from key BoC members as we seek to gauge whether they seek to drive down or enhance those current calls for a relatively early rate cut.

Euro (EUR)

The euro enjoyed a largely positive November, with gains made against haven assets helping to push this key European currency higher. That risk-on play helped push EURUSD into a fresh three-month high, reversing much of the weakness seen throughout August and September. Aside from that consistent EURUSD rally, the likes of EURGBP, EURAUD, and EURNZD struggled to maintain the bullish momentum in the second half of the month.

From an economic perspective, November ended with a blockbuster decline for eurozone inflation, falling to a mere 2.4%. While core CPI remains at a lofty 3.6%, the move back down to target now starts to look like it’s a question of when not if. In fact, markets are likely to shift their focus towards the question of below-target before too long, with markets likely to bring forward their expectations for the timing of the first ECB rate hike. From an economic perspective, November saw signs of tentative strength. The sharp improvements to ZEW economic sentiment surveys saw the German figure reach an eight-month high (9.8), while and eurozone figure rose to a nine-month high of 13.8. This represented a marked shift from the negative readings seen throughout much of this year. On the jobs front, the employment change figure also beat expectations, rising to 0.3% in the third quarter. However, it was the PMI surveys which truly hammered home the potential for a less downbeat economic outlook, with both German and eurozone composite readings rising to 47.1.

Looking into December, the value of the euro could be heavily reliant on the economic direction of the eurozone and the impact on European Central Bank (ECB) considerations. With the ECB rate decision due on December 14th, we will be keeping a close eye out for signs that they could be gearing up for an early 2024 rate cut. Markets are currently looking for an April rate cut, although the need to act so swiftly will be heavily influenced by the ability of the economy to withstand further suffering in a bid to drive down inflation. Keep a close eye out for the latest PMI (22nd) and inflation (28th) data due out at the back end of December.

Great British Pound

The pound saw plenty of upside throughout November, with the UK economy looking relatively healthy despite widespread forecasts of a 2024 recession from the likes of the IMF. The weakness of the US dollar helped drive GBPUSD into a three-month high, with risk-on sentiment driving equities higher and havens lower. Meanwhile, energy price weakness helped lift GBPCAD to levels not seen since September. However, the pound struggled against the Oceanic currencies, with relatively elevated inflation and greater risk sensitivity helped to drive NZD and AUD to outperform.

November kicked off with a Bank of England (BoE) meeting that saw the rate pause majority grow, with six of the nine members voting to keep the bank rate at 5.25%. That marked the beginning of a phase that brought improved economic data and weaker inflation. Outperformance for UK GDP saw a September monthly growth figure of 0.2%, while the preliminary third-quarter reading rose from -0.1% to 0%. In terms of inflation, a decline in average earnings (7.9%) helped ease underlying pressures. It was the CPI figure which really grabbed the headlines after tumbling from 6.7% to 4.6%. This helped quell calls for another rate hike from the BoE, although markets do still price in a 13% chance of a final hike in the coming months.

Looking to December, there is a desire to see further progress on the inflation front to reverse the calls for a prolonged period of elevated rates at the Fed. With markets looking for a first rate cut in August, the trajectory of inflation will be key in determining which way those expectations shift. With the UK economy looking better thanks to a rise of 50 on the composite PMI, further signs of strength could help the pound given the potential for a prolonged period of tightening from the BoE. The latest monetary policy decision on December 14 will be notable given that it provides the MPC with a chance to react to the recent slump in CPI inflation. Watch out for fresh CPI (20th) and PMI (22nd) data due late in December, with markets looking towards that week as a key determinant of sentiment heading into the new year.

Australian Dollar (AUD)

The Australian dollar saw plenty of upside over the course of November, with risk-on sentiment seen throughout markets bringing this pro-cyclical currency to the forefront. The ongoing tightening from the RBA has helped ensure continued strength for the AUD, while easing fears around China helped lift associated currencies.

The RBA rate hike on November 7, formed the basis for a strong month. However, much of the upside appeared to kick in as market sentiment pushed risk assets higher. The elevated nature of Australian inflation means that the prospect of further tightening likely remains, with markets pricing a 47% chance that we see a final hike in March. It is worthwhile noting that this is partially driven by the fact that the RBA are well behind their peers, with the current cash rate of 4.35% leaving room for maneuver compared with the US Fed Funds rate of 5.50%. With the Australian jobs market remaining strong according to the impressive unemployment (3.7%) and employment change (55k) figures, AUD looks like it may be well supported on the prospect for additional tightening.

Looking to December, there is little expected in terms of a monetary policy shift at the RBA meeting on December 5. However, expectations of a potential hike in the coming months do provide plenty of interest around the wording from RBA Governor Bullock. With the latest GDP (6 Dec) and jobs data (14 Dec) likely to highlight a relatively strong economic picture, markets will be keeping a close eye out for any signals that emerge from both the RBA meeting and meeting minutes on December 18th.

New Zealand Dollar (NZD)

The New Zealand dollar enjoyed plenty of upside in November, as money flowed out of havens such as the USD in favour of procyclical currencies. The declines seen in AUDNZD highlighted the outperformance within the Oceania region, with New Zealand’s reliance on agricultural exports likely to fare better than Australian commodities that rest more heavily on Chinese economic expansion. The USD weakness seen over November saw NZDUSD surge into levels not seen since the beginning of August, reversing three months’ worth of losses.

The strength of the New Zealand dollar was heavily driven by optimism around Chinese demand, with the surge in retail sales (7.6%) signaling a high likeliness that we could see NZ exports increase. An improved GDT figure (0%) came because of improved demand, with the value of dairy exports in good shape according to recent strength. The RBNZ decision to keep rates steady was widely expected, but things will become increasingly interesting as the economy strengthens and fresh inflation data highlights the data faced by the RBNZ.

Looking in the month ahead, the quarterly nature of New Zealand inflation means that we only see relatively infrequent updates in terms of pricing pressures. We will have to wait until January for the fourth quarter CPI figure. Until then, NZD valuations will be heavily impacted by the RBNZ outlook, market risk sentiment, and developments in relation to the Chinese economy.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.