Movers and shakers – The best and the worst performing assets of November 2023

Table of Content

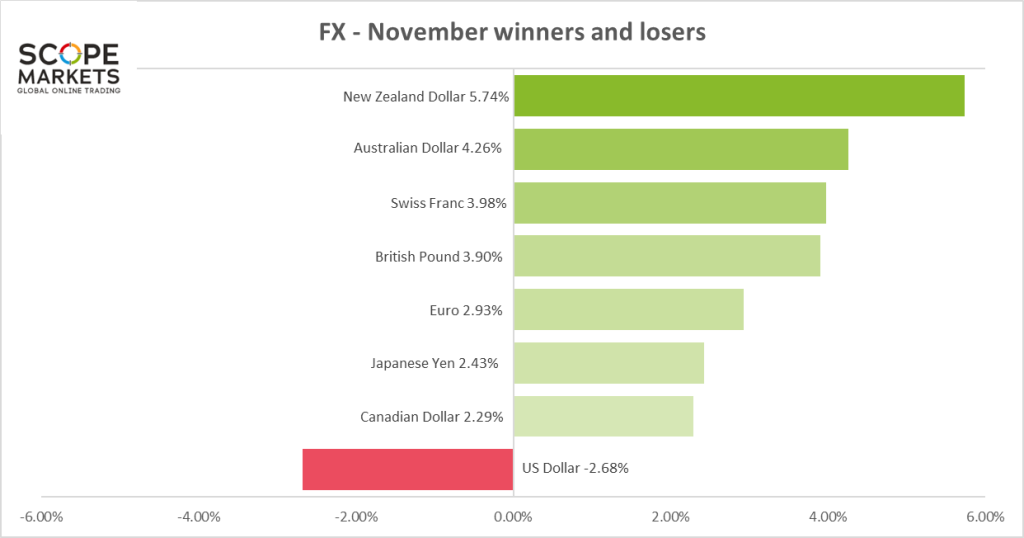

Forex

New Zealand Dollar: +5.74%

The New Zealand dollar enjoyed the top spot for November with the NZD gaining 5.74% against a basket of currencies. This strength was partially driven by a risk on move with saw traders pushing heavily into oversold assets that may have lost traction on the premise of lower growth and a higher for longer approach from central banks. Instead, we are now looking at central banks potentially bringing forward their monetary easing pivot, lifting growth expectations for the year ahead. Notably, the inflation picture for New Zealand remains problematic, although their quarterly CPI release schedule does mean that markets can get somewhat carried away when making comparisons between a third-quarter figure and those recent November CPI numbers emerging from Europe. With New Zealand inflation currently standing at 5.6% according to the latest quarterly figure released in October, we will have to wait until late January to finally see a fresh update for the final three months of 2024. With that in mind, markets are looking for a more delayed easing schedule from the RBNZ, with July pencilled in for the first 25 basis point cut.

US Dollar: -2.68%

The US dollar has been hit hard over the course of November with the dollar index losing 2.68% off the back of a dramatic shift back into risk assets. The US dollar has enjoyed plenty of favour over recent months, as market concerns around inflation, growth, and a higher-for-longer central bank approach helping to drive increased demand for this haven asset. With the Japanese yen hit hard in the face of continued monetary easing, The US dollar enjoyed its role as the haven of choice for many. However, these gains appear to have set up its recent demise, with November on track to be the worst month of 2024. With markets increasingly expecting rate cuts in the first half of next year, continued market optimism could hinder the dollar going forward. There is a risk that we see the economic picture sour under the weight of elevated interest rates, although this could yet provide another boost to markets on the premise that central banks will bring forward the inception of their interest rate normalisation process.

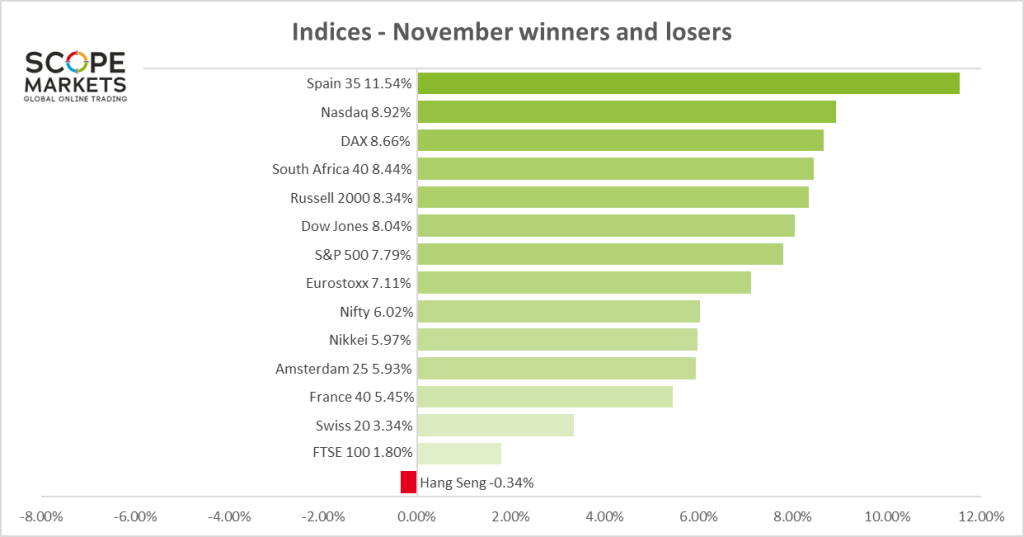

Indices

Spain 35: +11.54%

Spanish stocks have been outperforming as the country prepares to benefit from a likely early pivot from the ECB next year. One of the criticisms of the single currency region is that the ECB has to dictate monetary policy for a number of countries, meaning that some outlier economies will suffer as decisions are formed for the benefit of the many rather than the few. From an economic perspective, the euro zone appears to be in trouble, with weakness evident in recent PMI surveys from France, Italy and Germany pointing towards negative growth for these dominant countries. The latest eurozone composite PMI reading of 47.1 highlights the kind of ongoing contraction that will likely push the ECB to ease as soon as possible. Fortunately for Spain, the economy continues to outperform, with the latest PMI figure of 50 keeping the economy out of contraction territory once again. Unlike the others, Spain is yet to post a single sub-50 composite PMI figure. With that in mind the Spanish economy looks to be moving towards an expansive phase from a position of relative strength. The latest eurozone CPI figure falling to 2.4%, there is a distinct chance that we see the ECB cut rates as early as March – further enhancing the growth prospects of the Spanish economy and stock market.

Hang Seng: -0.34%

November saw the Hang Seng fail to get on board the bull train, with investors and traders remaining concerned over the ongoing slowdown in China despite the wider risk-on sentiment seen throughout global markets. While much of the globe has struggled to deal with above target inflation this year, China has been an outlier. With Chinese inflation currently standing at -0.2%, the economy clearly continues to struggle under the weight of concerns around domestic demand, real estate, and over leveraged credit conditions. The latest PMI readings from China continued to highlight the lack of growth in the region, with manufacturing in contraction territory for the seventh time this year. With Chinese inflation clearly already well below target, the November surge in risk assets elsewhere failed to show up for Chinese stocks. After all, disinflation in the West brings hope of looser monetary policy. Meanwhile, further weakness for Chinese inflation simply would double down concerns over Chinese growth. Long term investors may see potential opportunities within Chinese stocks, but the Western optimism around a potential monetary policy boost in 2024 simply does not exist for China. With that in mind, further underperformance looks likely going forward.

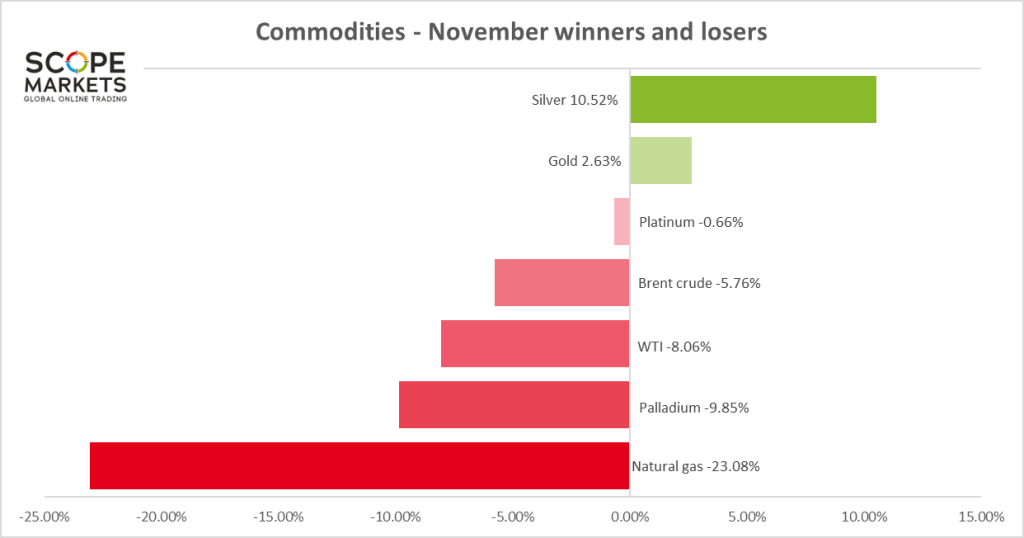

Commodities

Silver: +10.52%

Silver enjoyed a bumper November with this precious metal far outperforming its peers. Precious metals have held up relatively well over the course of this year despite somewhat volatile market conditions. In part this is due to expectations around potential outperformance once we shift back into a period of expensive monetary policy as inflation normalises. November has seen plenty of optimism around that potential shift, with declining inflation helping to bring forward expectations around the timing of the initial rate cut from many of the main central banks. With that in mind, further outperformance for silver looks likely in the months ahead, with this metal typically outperforming gold in periods of strength.

Natural gas: -23.08%

Natural gas prices have slumped over the course of November, helping to ease concerns over any potential spike in European energy prices as we head into the winter. A relatively mild start to the winter helped from a demand perspective, although we are starting to see natural gas storage withdrawals pick up towards the latter part of the month. Nonetheless, the shock caused by last year’s Russia-focused natural gas price crisis in Europe has fast tracked that transition away from this key energy source. According to the OECD, Europe used 15% less gas in 2022. With households and businesses taking measures to reduce their gas use, and European gas stocks elevated, another particularly mild winter could see natural gas losses continue apace. Traders will be keeping a close eye on weather conditions and storage levels as a gauge of whether we see another surge in prices or continued downside.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.