NFP Preview: Data dependant Fed to keep close eye on jobs data

The US jobs report will be the major highlight of this week after the Federal Reserve noted at its July conference that it will rely solely on data before it decides on future rate hikes with the next policy meeting set for September. That data dependant approach from Powell & co should help increase market sensitivity to major economic reports going forward.

Leading into the current week, the US dollar was boosted by the quarterly GDP report which indicated that the economy was growing at a strong clip, casting aside fears of a rate fuelled recession. The central bank had earlier raised interest rates by 25-basis points as expected, signalling that it will be increasingly data driven in future meetings. The two primary areas of note markets will observe in a bid to gauge forthcoming Fed action are inflation and jobs. With that in mind, this Friday’s jobs report will provide plenty of ammunition for markets as a key barometer of forthcoming monetary policy.

Raft of data released throughout the week

Before Friday’s event, the market will pay attention to a slew of economic data from the US which could induce price movement. On Wednesday, the ADP Non- farm employment change is forecast to decline from 497k to 191k. On Thursday, the unemployment claims report is expected to import, with a figure of 226k (from 221k). Traders will also be keeping a close eye out for the impending ISM services PMI survey, which has been forecast to drop from 53.9 to 53.2.

What to expect:

The non-farm employment change figure always takes centre stage, and this month is expected to see another decline after 4 months of robust hiring in the public sector. The forecasts signal a NFP figure around 203k, following last month’s 209k reading. However, the wage growth figure is likely to similarly provide the potential for a significant market move, with traders seeing it as a key underlying inflation metric. Forecasts of a decline to 0.3% (from 0.4%) could bring a risk-on move given the disinflationary consequences. Finally, the unemployment rate is expected to remain unchanged at 3.6%.

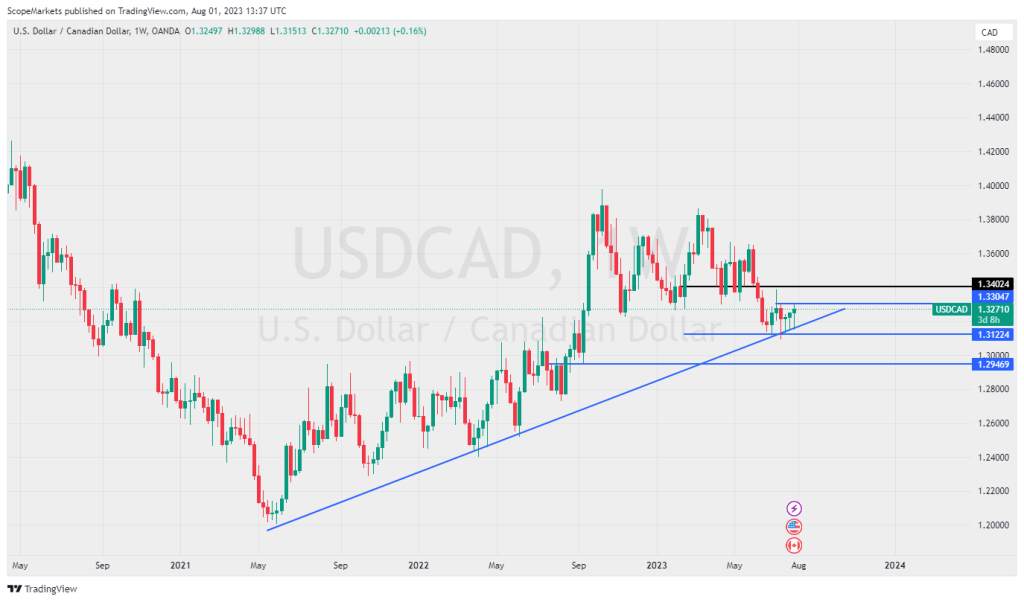

USDCAD technical analysis

USDCAD could experience extreme market volatility on Friday due to the Jobs report emanating from the US and Canada at the same time. The trendline support has enticed bullish interest every time the price encountered it. Stronger-than-expected jobs reporting could boost the US dollar fuelling further price appreciation towards 1.3300 and 1.3400. Meanwhile, a decline through trendline support and 1.3122 could signal a potential period of weakness coming to the fore.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.