RBA minutes boost AUDCNH, but downtrend signals potential turn

The Australian dollar has enjoyed a boost today, following on from the RBA meeting minutes released overnight. While the last meeting had seen new Governor tout a remarkably similar line to her predecessor, these minutes highlighted a willingness to act again if necessary. That data dependency should bring greater sensitivity to future data out of Australia. Nonetheless, it is worthwhile noting that while the RBA remains open to further action if necessary, that is essentially the case for any central bank given the risk posed by energy prices. Another sharp surge in crude and gas would drive prices higher and push the onus onto central banks to take more stringent measures.

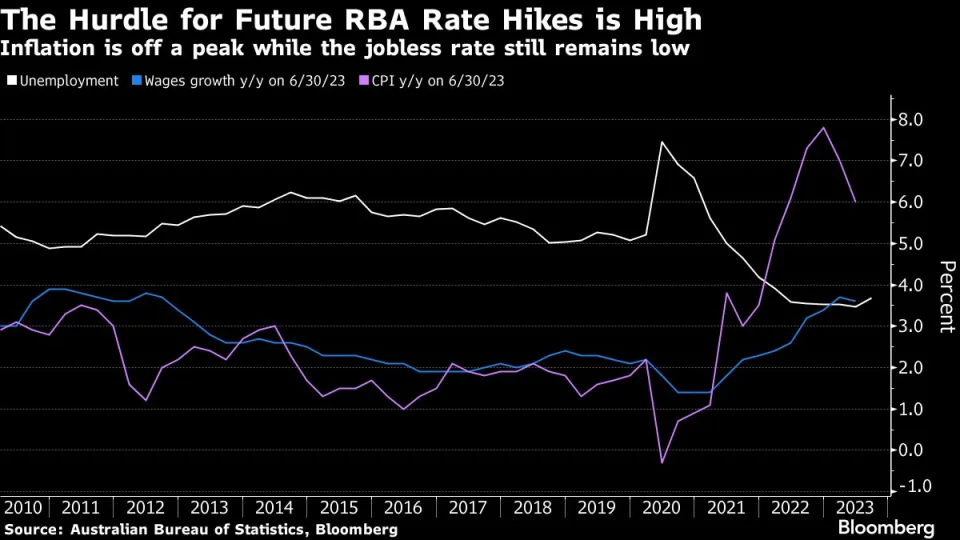

From an economic standpoint, the recent decline in inflation does bring hope that the current policy mix is sufficient for now. However, it is worthwhile noting that the low unemployment rate, and elevated wage growth figure do highlight a potential for further action if necessary. That being said, the current trajectory for rates do highlight the potential for a patient approach at the RBA.

Looking at the AUDCNH chart, we can see that today’s rally provides a potential selling opportunity given the wider downtrend in play. The consistent pattern of lower highs does signal the possibility of another move lower before long. With that in mind, watch for a potential bearish continuation turn if this downtrend is to continue. To the upside, a break through the 4.7 swing-high would be required to negate this bearish trend and signal a possible rebound from here. Watch out for the deep Fibonacci resistance levels at 4.65 (61.8%) and 4.67 (76.4%) as near-term resistance levels that could turn the tide on today’s bullish trajectory.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.