Santa Rally: Has the Fed geared markets up for another bumper year-end?

Its that time of year again, with traders wrapping up the year and judging whether they can squeeze more from the 2023 lemon. Coming off the back of a particularly strong November, there will be obvious concerns that we could see a reversal of the recent dovish shift with regards to the central bank rate cut pricing. Nonetheless, we are moving into ‘Santa rally’ territory, with traders often looking for that year-end bump for equities. Let’s take a look at the Santa rally phenomenon, and judge whether it could come into play once again in 2024.

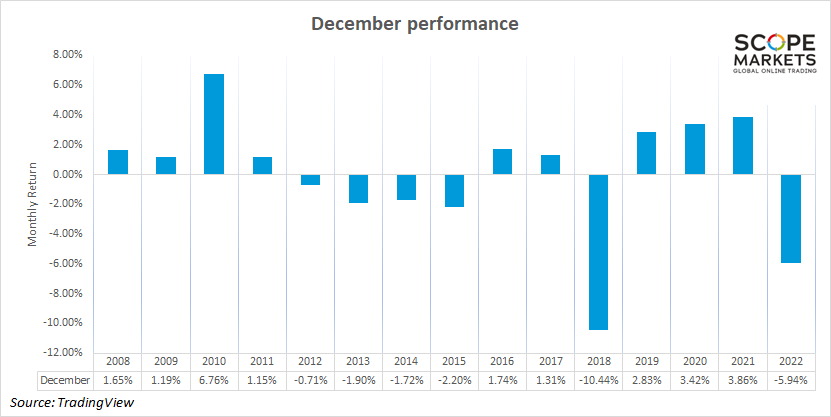

Firstly, there has always been plenty of disagreement over the dates in question, with some taking a wider perspective and other looking at a shorter timeframe. Lets look at the December figures, with the performance seen since 2008 highlighting a mixed bag that saw nine positive months out of the past fifteen. In terms of the size of those moves, 2018 and 2022 weakness dragged down the wider performance covering the entire 2008-2022 period.

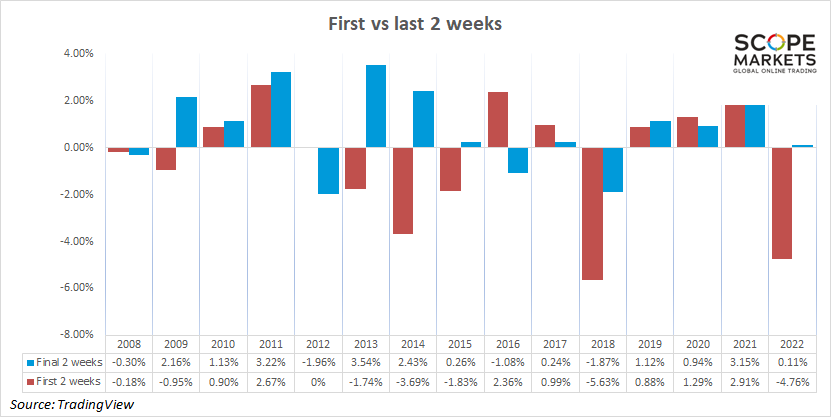

Let’s split out the month of December differentiating between the first two weeks of the month and the final two-weeks. The latter will typically represent a shortened period given the national holidays around Christmas. Nonetheless, the feel-good vibe towards the back-end of the month is evident according to this data, with the weakness often seen in the first two-weeks rarely felt over the 18-31 December period. Out of the past 15 years, just four of them saw the S&P 500 decline in the final two weeks of the year. Some have attributed this to the late December decline in institutional volume, with the more optimistic retail element of the market taking over. It is particularly noticeable that the S&P 500 has typically seen the major losses confined to the first two weeks of the month, with a more upbeat tone dominating the final fortnight.

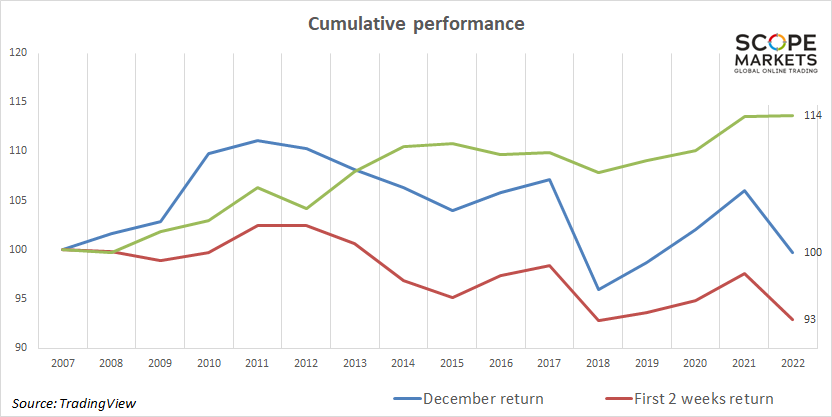

Looking back over the past 15-years, we can tie this together by looking at the performance for someone holding the S&P 500 for the entirety of December each year, compared with the first or final two weeks. What is clear is that the final two-weeks of the month do typically provide a relatively reliable bullish environment for traders. With the Federal Reserve taking on a surprisingly dovish assessment in their final meeting of the year, could we see the final fortnight of 2024 play out in much the same manner as years gone by?

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.