Strong GDP and retail sales data fails to lift market sentiment

- Markets weaken despite stronger US and China data

- Energy on the rise as Middle East tensions rise

- UK CPI flatlines, as BoE face battle to drive down inflation

European markets are following their Asian counterparts lower in early trade today, with Middle East concerns overshadowing a raft of strong data out of the US and China. At a time when markets are increasingly focused on corporate earnings, yesterday’s buoyant retail sales release helped lift the outlook for both main street and wall street alike. From an Asian perspective, a better-than-expected GDP figure out of China helped boost sentiment, shifting the tone after recent concerns in the real estate sector. A strong retail sales figure of 5.5% represented the highest reading in four-months, improving the outlook for improved growth borne out of strong domestic consumption.

Energy prices are moving higher as claims of an Israeli attack on a hospital in Gaza brought protests targeting Israeli and US embassies in the Middle East. With tensions high, there is a fear that the conflict will spill into a wider division, with crude oil prices heading into a two-week high as a result. With US crude gaining $6 over the past week, the potential for a fresh bout of upside in energy creates concern that inflation will once again turn higher.

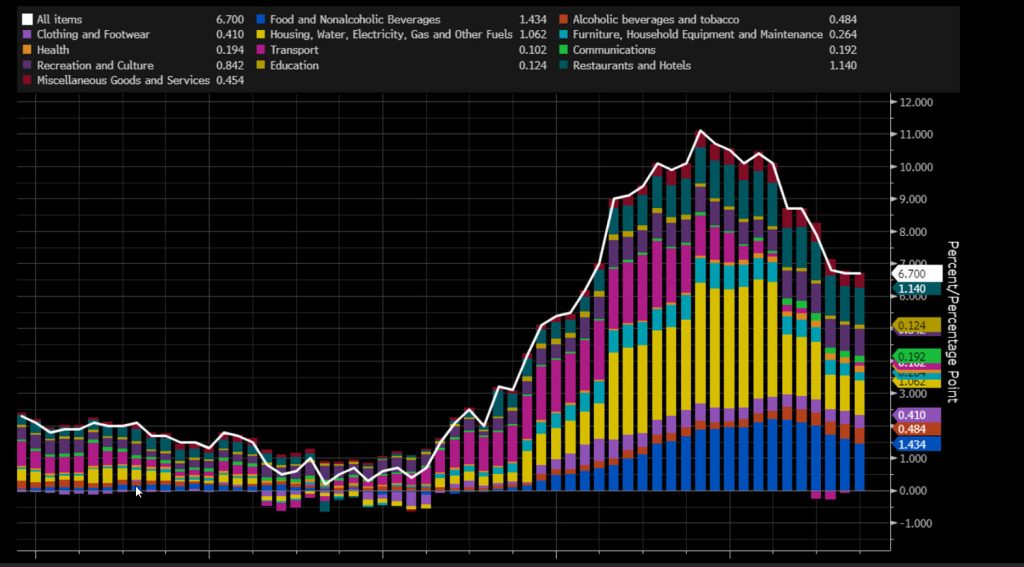

UK stocks have floundered in early trade, as an uptick in energy names fail to overshadow a wider risk-off move in the wake of higher-than-expected inflation data. Today’s UK inflation report made for difficult reading at Threadneedle street, with CPI flatlining at 6.7% on higher transport costs. With the UK suffering the highest inflation rate in the G7, the Bank of England will be concerned that elevated wages and rising energy prices could ultimately see inflation rise rather than fall. With wage growth up to 7.8%, the fear is that UK consumers will happily continue to pay more in a bid to maintain their quality of living.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.