Third quarter earnings season wrap: Q4 fear limits benefits of recent gains

The US third-quarter earnings season is drawing to its completion, with 96% of the S&P 500 having reported thus far. While the coming weeks will see a sprinkling of additional announcements from mid-tier companies, traders are now able to look back at the past two months in a bid to understand where the US economy is positioned heading into the new year.

How have companies performed?

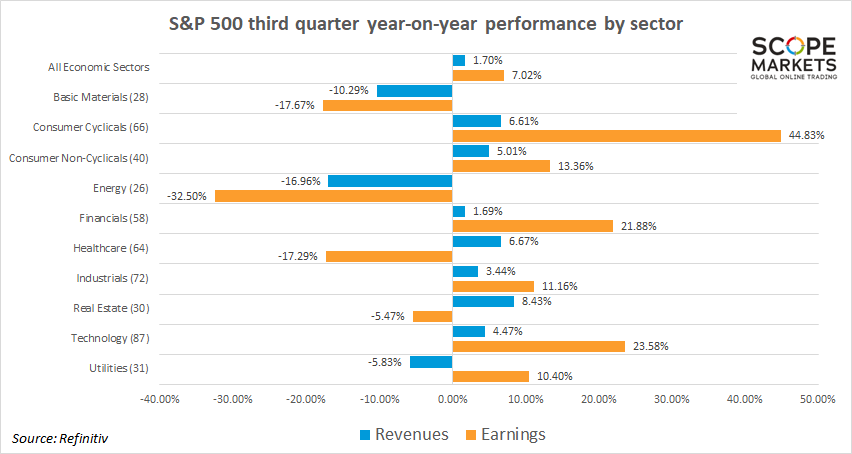

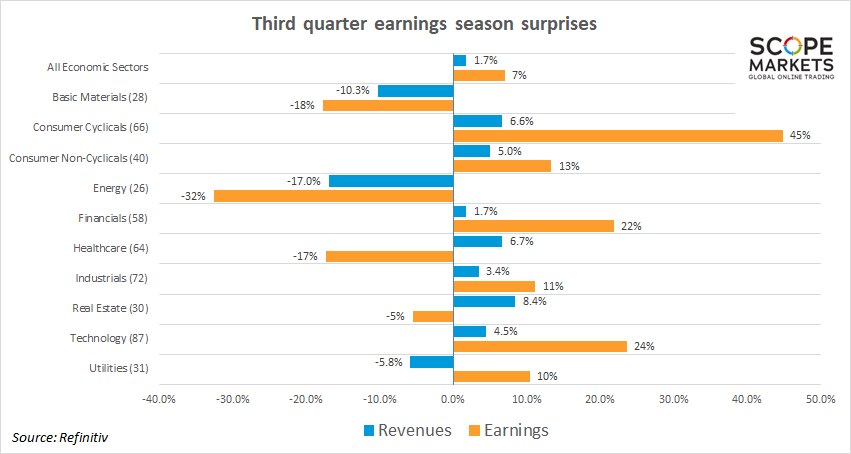

Overall, we have seen the S&P 500 outperform expectations, with widespread expectations of a decline in third-quarter earnings failing to emerge. Instead, we have seen the index post positive year-on-year growth for both revenues (1.7%) and earnings (7%). Meanwhile, beneath this big picture outlook lies a raft of detail. From a sector specific perspective, energy names suffered particularly sharp declines as expected. This was largely a response to the collapse in crude oil prices since last year’s highs. We similarly saw basic material stocks exhibit weakness across both earnings and revenues, although these commodity focused moves are more often a reflection of underlying price moves than indications of any significant shifts in business model or performance.

The outstanding performers came in the form of technology (24% earnings growth) and consumer cyclicals (45% earnings growth). As we can see, it is typically easier to obtain elevated growth rates in terms of earnings compared with revenues. Nonetheless, we can see particular strength across both consumer cyclicals and non-cyclicals, highlighting the strength of the US consumer.

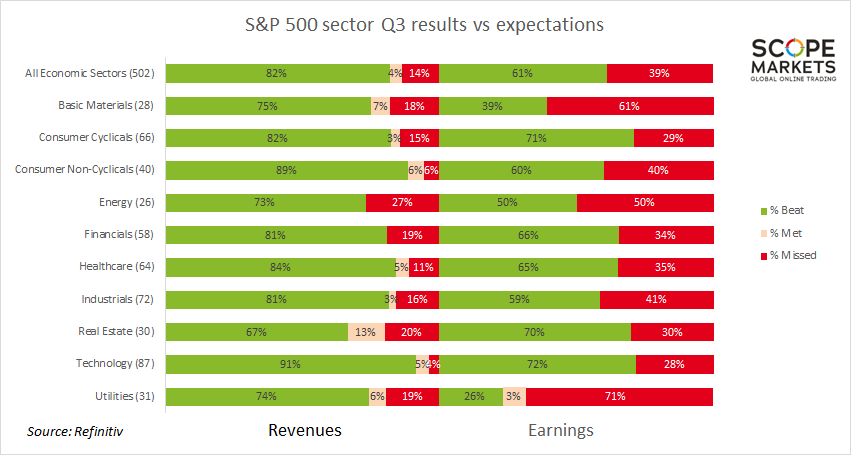

When we look at these sectors in relation to market expectations, it is notable that we have seen continued strength in the IT sector. With the tech sector remaining a key determinant of the wider market, the ability to maintain the upward trend in earnings will be key. Again, we have seen strength across both consumer cyclicals and non-cyclicals, with healthy levels of spending for both essentials and non-essentials. Retailers will hope that trend continues through the key fourth quarter period.

Taken from another angle, we can see that 82% of companies have managed to beat market expectations on revenues while 61% beat earnings estimates. This is obviously good news for market sentiment, although some will question whether this is simply a case of expectations being too low. Nonetheless, the earlier image highlights some very strong year-on-year upside for both earnings and revenues, as elevated inflation levels help push both the value of sales and potential margins higher. The tech sector once again stands out for its strength, with 91% of stocks within that segment outperforming expectations. There is a notable difference between the hefty number of stocks that have managed to outperform on revenue, and the more variable experiences on the earnings front.

Market reaction

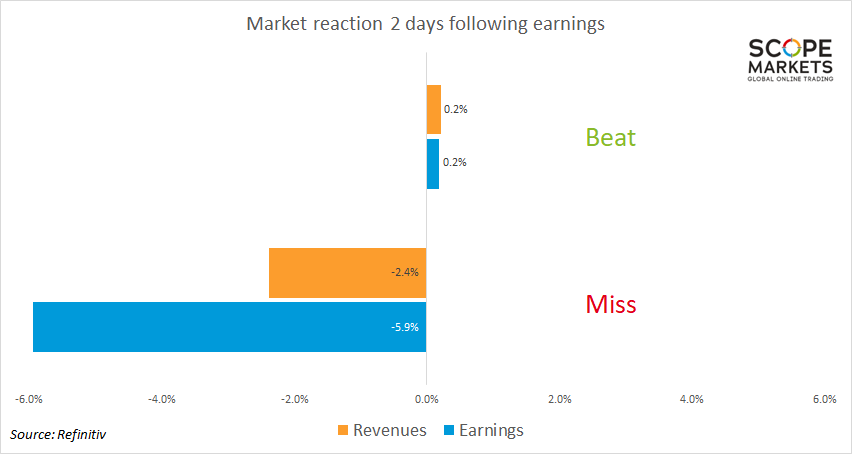

One of the themes from the third quarter earnings season was the relatively unforgiving reaction from markets, with many noting that big tech stocks in particular saw little upside despite impressive outperformance. The failure to celebrate outperformance but overreaction to any weakness does highlight concerns over the outlook for the fourth quarter. It is also worthwhile noting the wider market sentiment, with the recent shift in sentiment around the timing of 2024 rate cuts helping to boost equity markets. However, it is worthwhile noting that the top 7 stocks do continue to drive sentiment as we await a wider recovery in stocks.

Fourth quarter outlook

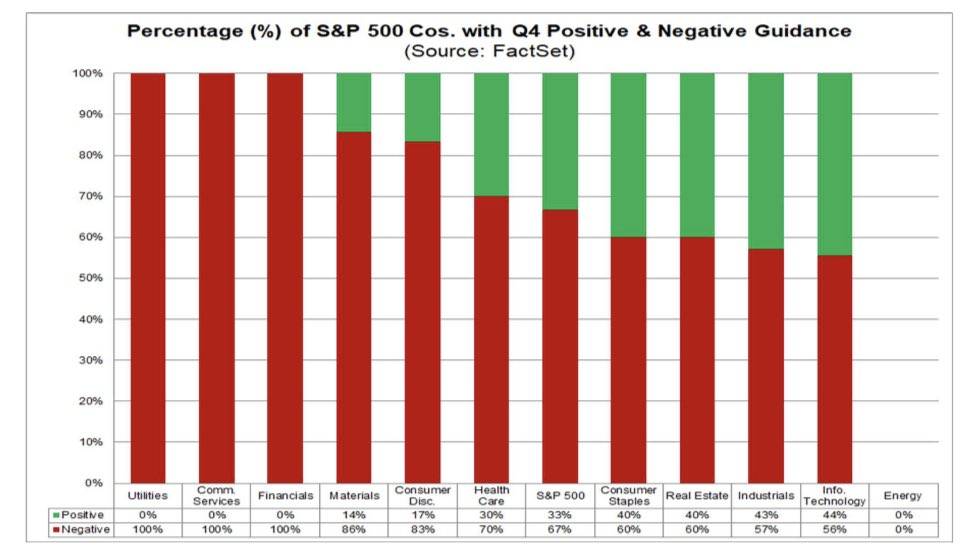

The weakness of stocks in the face of strong data comes as a result of concerns over fourth-quarter earnings, with many companies warning over a difficult end to the year. The likes of Walmart certainly grabbed the headlines when signaling expectations of a weak festive period, but the table below highlights how widespread this phenomenon has been. With businesses expecting to see interest rates dampen demand, investors will have to prepare for a difficult fourth-quarter.

In summary, we can see that the vast majority of stocks within the S&P 500 have enjoyed a strong third-quarter earnings season. Taking the data in both absolute terms and compared with expectations, the quarter provided plenty of grounds for optimism. However, markets appear to have been somewhat skeptical around positive data, with the most notable price action coming for companies reporting lower-than-expected earnings and revenues. This is a nod to the weakening outlook for the fourth quarter, with companies concerned that they could struggle to keep up with expectations over the near-term.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.