UK GDP heads lower, as markets await FOMC announcement

- UK GDP contracts in October, putting pressure on the BoE

- Powell outlook key after yesterday’s Yellen optimism

- Dot plot and projections key, with markets and Fed currently misaligned

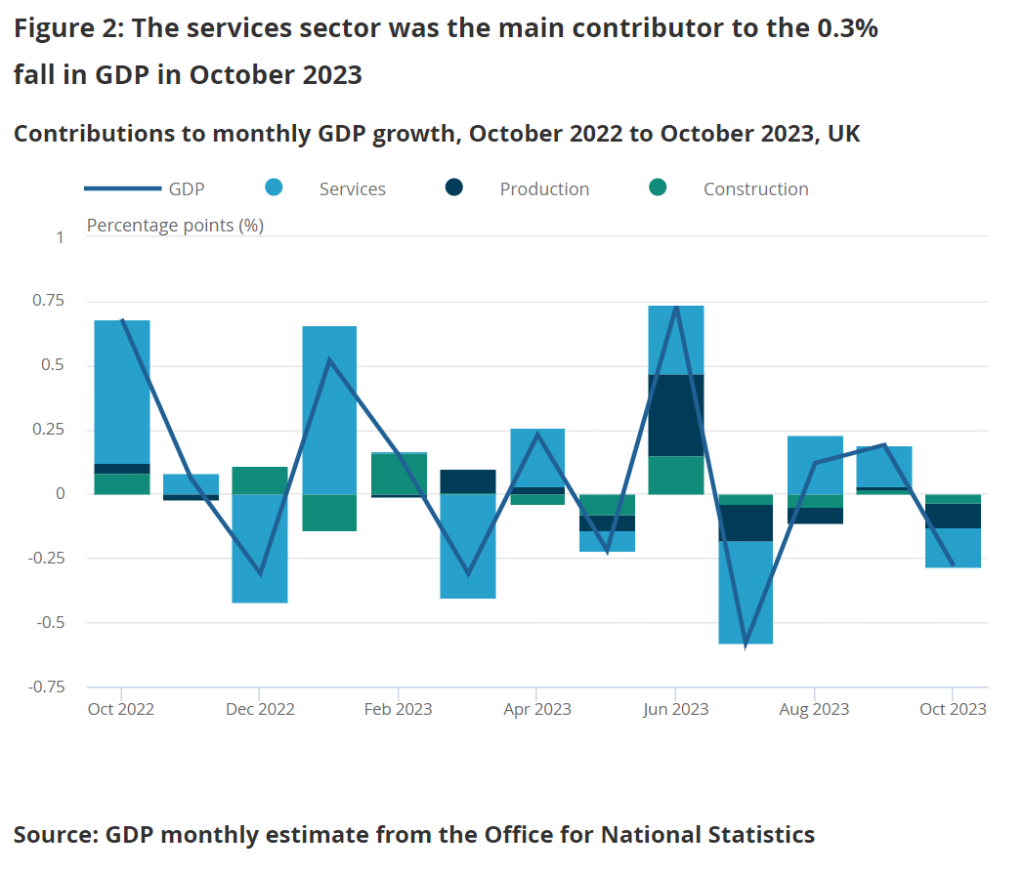

European markets look to be continuing their hot streak if early price action as anything to go by, with the likes of the DAX and CAC showing the potential for another record highs after yesterday’s consolidation. The UK economic outlook remains in the limelight today, with Tuesday’s jobs report being followed up by today’s dour data dump headed up by a worrying -0.3% GDP figure for October. That surprise contraction represented the worst growth in three-months, with UK 10-year yields heading lower as markets tentatively bring forward expectations over the timing and size of the BoE rate cuts next year. With services, manufacturing, and construction all contracting in October, markets will be keenly watching out for signs of whether this is another temporary blip in a notoriously volatile series, or the start of something more troublesome.

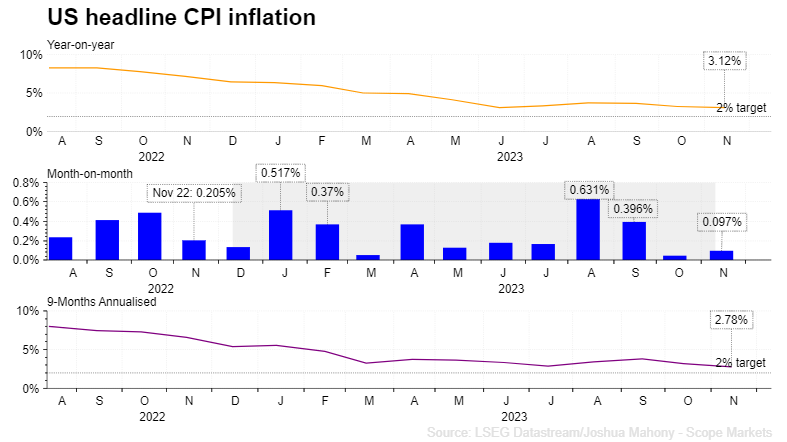

Janet Yellen took a remarkably optimistic tone yesterday, with markets hoping that her view that inflation is meaningfully moving back down towards inflation is replicated by a similarly dovish tone from Powell today. The inflation report may have only signalled a mere 0.1% decline in headline CPI, but the Fed will be aware that the heavy lifting will likely occur when the January (0.5%) and February (0.4%) figures drop out. Nonetheless, with markets currently pricing 5-6 rate cuts next year, there certainly appears to be more room for a hawkish shift in expectations rather than a shift in favour of more easing.

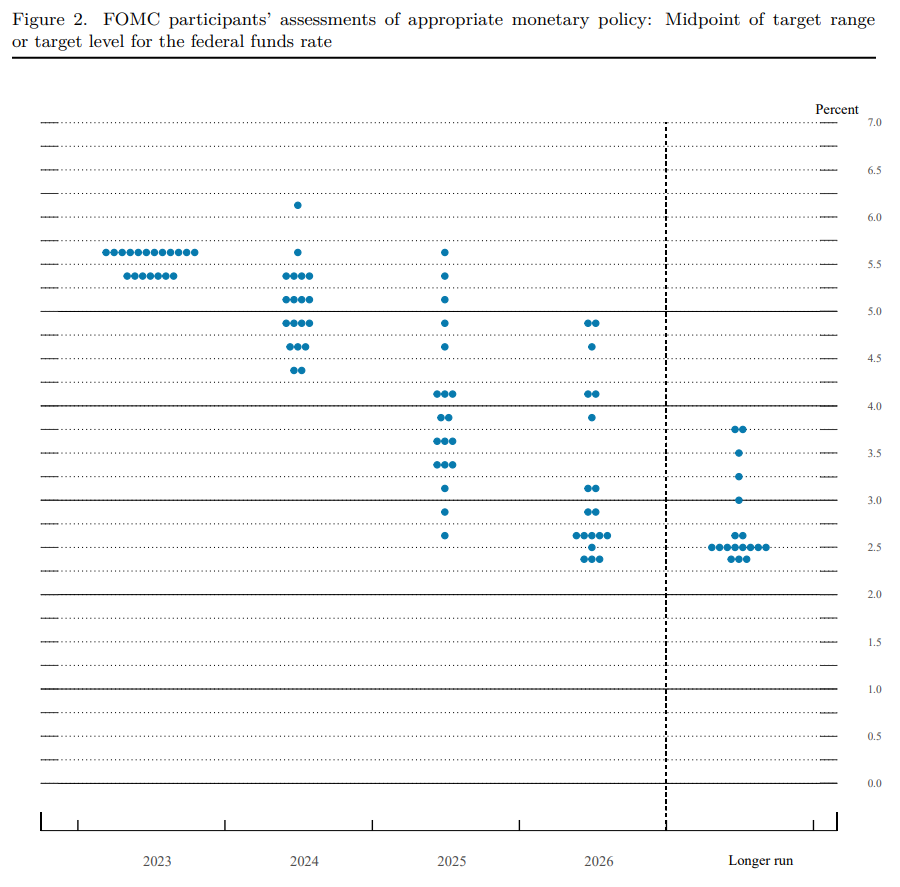

The release of the updated Dot Plot and economic forecasts provide the basis for substantial market volatility, with the September outlook for 2024 easing a far cry from what markets currently expect. The question here is whether the Fed will shift to accommodate the market view or take on a more cautious approach to the detriment of market sentiment. With the US economy remaining remarkably resilient, and inflation likely to remain above target throughout half of next year, the chance of a hawkish shift in expectations does bring a potential hurdle for the currently upbeat markets overcome.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.