UK inflation preview: CPI looks set to tumble, easing concerns of additional tightening

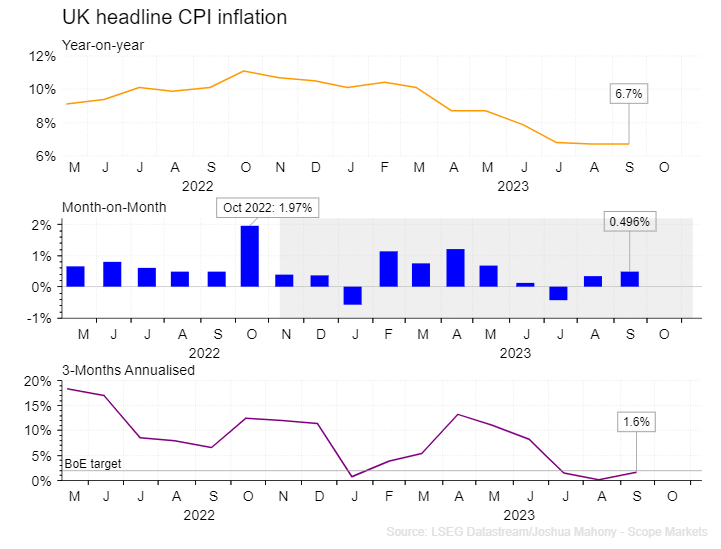

The pound comes into focus this week, with Wednesday’s inflation report being straddled by Tuesday’s jobs report and Friday’s retail sales number. Much like the US inflation gauge, the UK looks set for a particularly notable release as it seeks to break free from a period of stagflation. The current headline CPI figure of 6.7% remains stubbornly elevated, with the Bank of England likely to look at their US counterparts with a degree of envy. Nonetheless after three months, there are convincing signs that we are set for a sharp decline in the consumer prices figure.

From an annual perspective, the Bank of England will have waited patiently for October to come around, as last year’s 2% rise for October 2022 alone drops out of the calculation. That makes for a relatively easy task ahead in bringing down inflation this month, although it should be recognised that things become more difficult from October onwards. In particular, January will likely see a significant uptick in inflation as the minus 0.6% reading is replaced. Nonetheless this month sees base effects provide the basis for a shop decline for this headline CPI reading, easing concerns around additional tightening from the Bank of England.

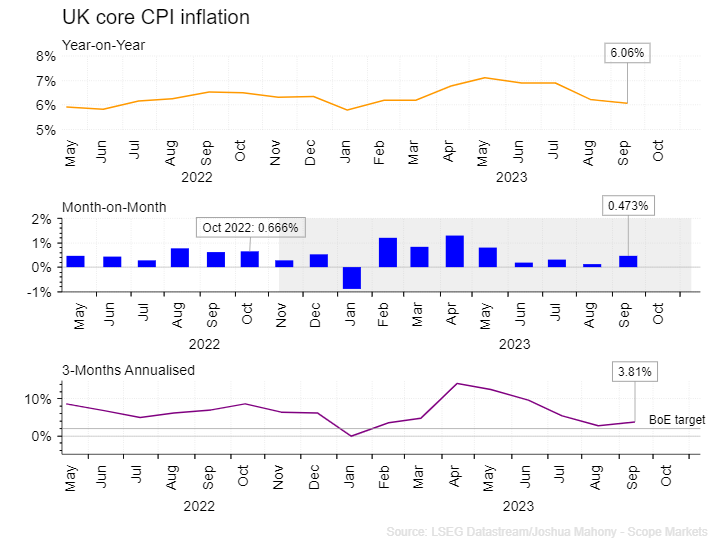

Markets will also be keeping a close eye out for the core CPI figure, which has been gradually declining over recent months. That frustratingly slow downward trajectory looks likely to continue for some time yet, with the chunky inflation readings only dropping out between February and May. Nonetheless, recent readings have provided the basis for a more positive outlook in the second half of 2024. This will undoubtedly play a role in the outlook for the Bank of England to start cutting interest rates.

A look at the outlook for Bank of England rates, markets are predicting a Q3 2024 cut which tallies up with what we have explained above. However, by paring the two off against eachother, we gain a better idea of when markets begin ton really gain greater confidence that such a rate cut will be likely. This coming week should provide encouragement, but that may lull for months to come. Only once we start seeing those big H1 2024 inflation figures chipped away will we start to gain confidence over the current plan to start cutting rates in the third quarter of next year.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.