US CPI preview: Will energy spoil disinflationary shift?

Table of Content

As the financial market braces itself for the forthcoming release of the Consumer Price Index (CPI) on Thursday, October 12 (1:30pm UK time), traders will need to make preparations for potential volatility that often comes around this key metric.

Dissecting the inflationary trends

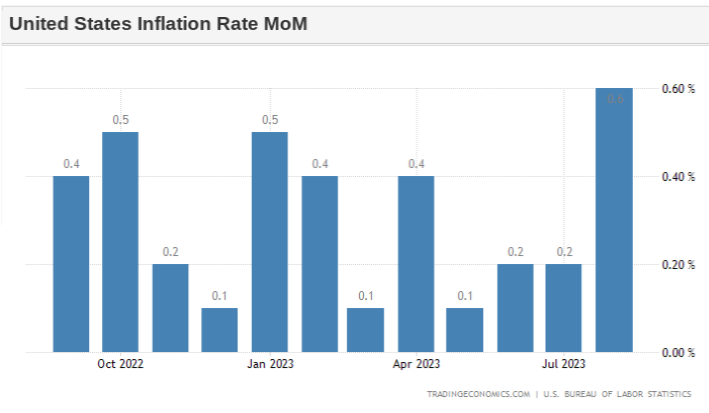

The US inflation picture has become increasingly complex of late, as traders struggle with the decision over whether to prioritise falling core CPI or rising headline prices. However, that trend may be set to end according to market estimates, with forecasts signalling a potential end to the two-month period of increased inflation. Whether we will see headline CPI trend down towards target in the near future remains to be seen, with the recent rise in energy prices lifting expectations of a second rise for headline inflation. The chart below highlights what is required to bring the headline figure down, with the removal of the September 2022 figure of 0.4% meaning that any monthly reading below that would see the annual CPI reading of 3.7% weaken.

Energy to play key role

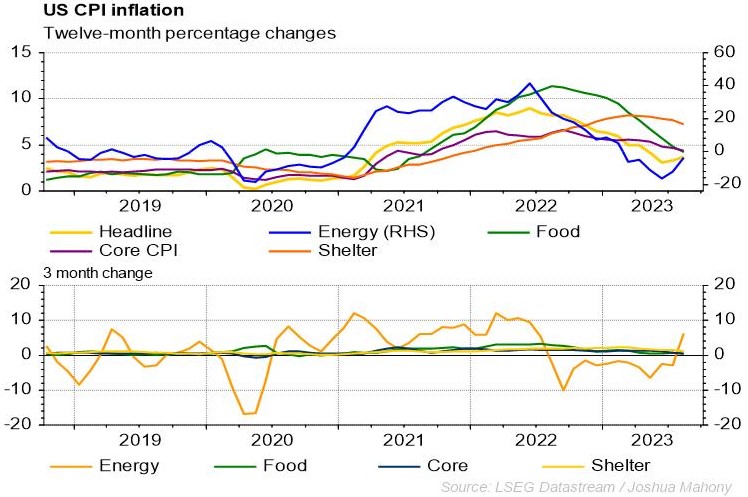

The chart above highlights a worrying shift for US prices, with the 0.6% monthly figure for August representing the highest reading since mid-2022. Unfortunately, this surge came as a result of higher energy prices, as OPEC actions to lower output finally pay dividends amid an environment of sturdy consumer demand. Unfortunately, September continued that upward trend, with WTI rising $7 over the course of the month. With that in mind, there is a risk that we see another oversized monthly reading, causing the headline figure to continue its recent upward trajectory. It is notable that we have seen plenty of crude volatility in October, with an initial $9 slump partially unwound after the events in Israel sparked a partial rebound. As we can see below, the energy component has ended its disinflationary phase, with the three-month energy element pushing up into positive territory last month. The upper pane highlights the fact that rising energy prices are similarly driving an increase in the annual energy component of CPI even as other elements head lower. This volatile segment clearly remains one of the biggest issues facing the Federal Reserve’s efforts to drive inflation back to target.

Core metric remains key

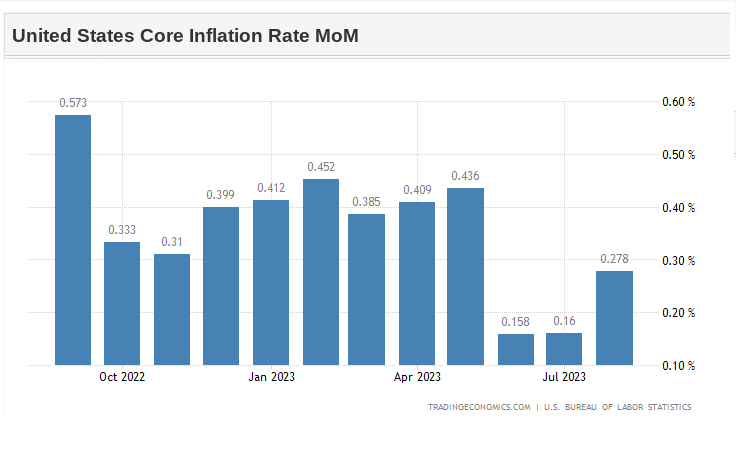

It is worth noting that the Federal Reserve has little ability to impact global commodity prices, thus justifying their historical focus on elements such as the core PCE inflation gauge over the headline figure. That being said, energy prices are obviously key for future expectations given how they impact businesses and costs throughout the economy aside. Nonetheless, the core CPI figure will be key as a signal of how the Fed interest rates are impacting consumption and underlying inflation. A look at the monthly core inflation rate highlights the lack of any comparable rebound last month unlike the headline figure of 0.6%. Notably, we can see that the September 2022 figure of 0.57% will drop out of the equation. Given the fact that we have not seen a similarly high monthly figure in the 11-months since, it looks likely that we will see the annual core reading decline when the new September 2023 figure replaces the 2022 number.

The Fed’s Stance

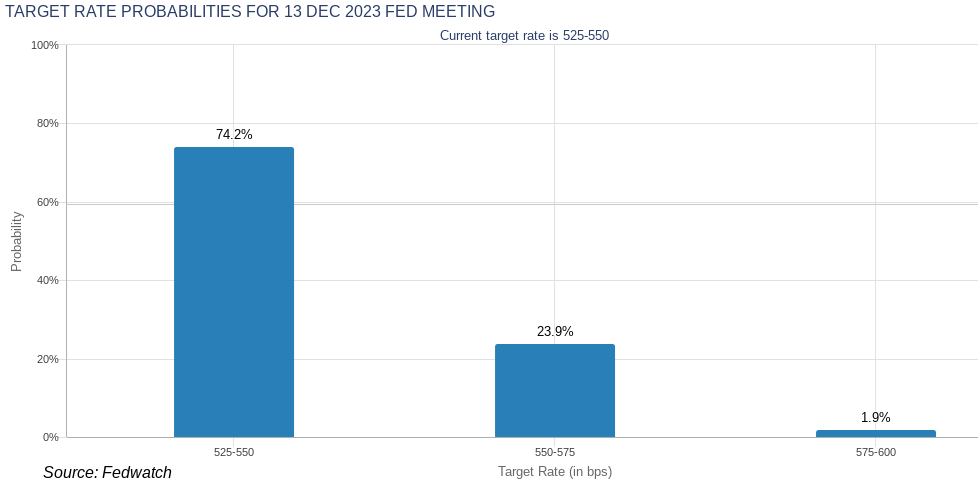

The Federal Reserve outlook for interest rates remain in the balance according to previous dot plot projections, with the outlook of another 25-basis point upside looking more likely as long as the US economy holds up and inflation is on the rise. It is worthwhile noting the recent comments from Fed members Logan and Jefferson who both indicated that the tightening effect of rising yields could mean that an additional hike is not necessary in the current climate. While the Fedwatch tool indicates market pricing a 72% chance that we will see rates remain still this year, that does leave a 28% chance of a hike that may rise or fall depending on the upcoming CPI release.

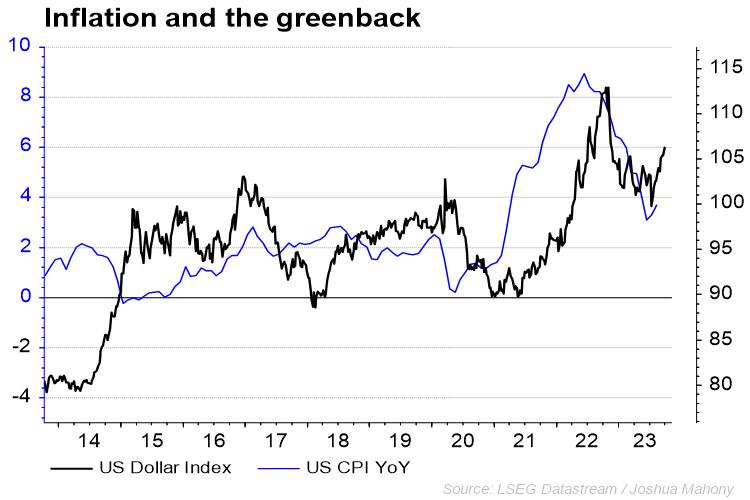

The US dollar outlook

While markets are expecting to see both headline and core CPI head lower, it will be key to see whether the rising price of crude over the course of the month will drive further upside for consumer prices. A decline across both metrics could help ease market concerns around another FOMC hike, lifting equities and weakening the dollar. However, with energy prices potentially lifting headline CPI, a third consecutive rise could instead raise pricing for a hike before year-end (November or December). Should that come to fruition, we would be looking at a potential risk-off play that benefits the dollar as markets become increasingly fearful of an energy driven second wave in inflation around the world.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.