US CPI Preview: Will higher inflation dent sentiment?

Table of Content

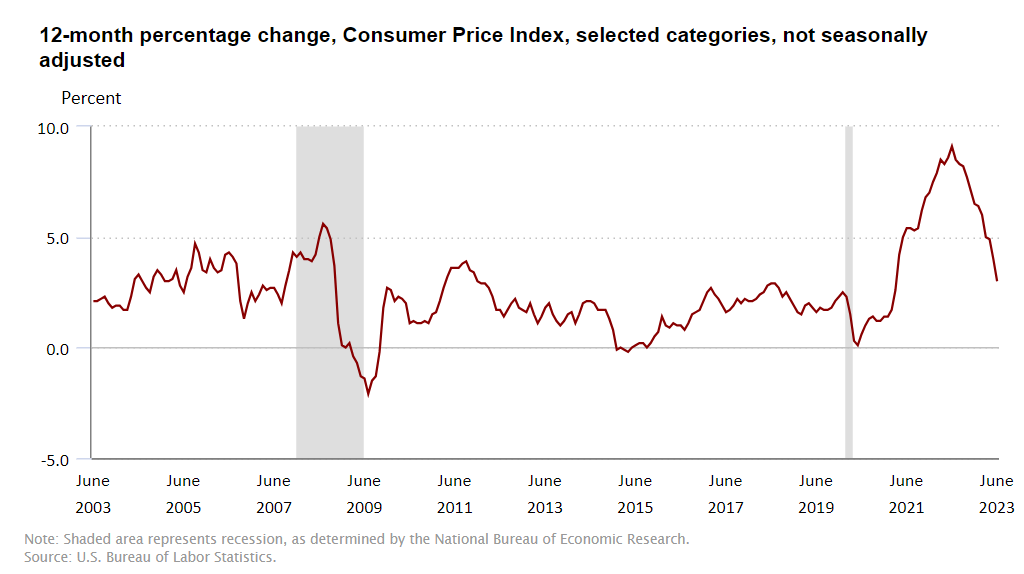

Thursday sees markets gear up for the main event of the week, with US inflation data due to be released at 1.30pm UK time. Inflation remains the key determinant of market sentiment given the impact is has upon monetary policy. Recent moves to slow the pace of tightening come in response to a disinflation drive that has brought headline CPI down to 3%. That has been some journey given the June 2022 peak of 9.1%. Nonetheless, the core inflation rate of 4.8% does serve to highlight the ongoing battle for the FOMC, with price pressures still well above target when stripping out the more volatile elements.

Disinflation likely comes to an end

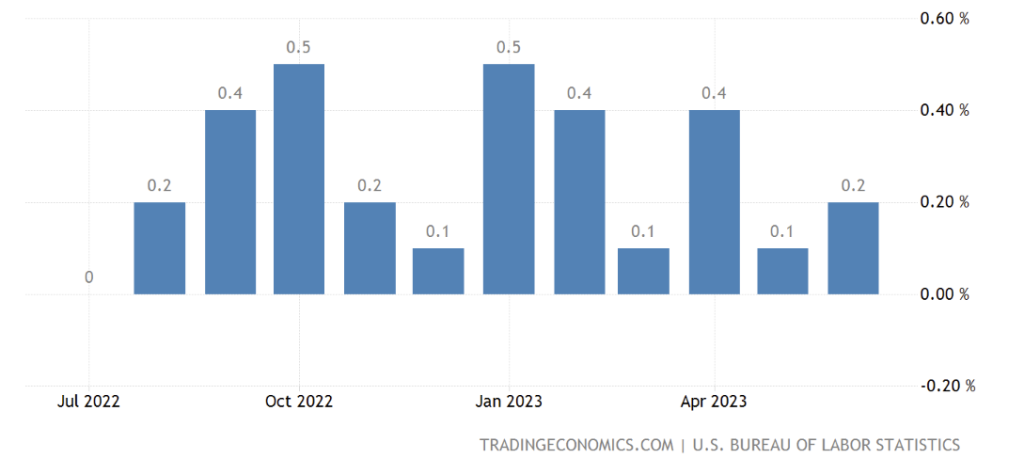

This week represents a significant step for markets, with the consistent trend of declining inflation likely to come to an end. Base effects bring a high likeliness of an uptick in headline CPI, with the July 2022 monthly reading of 0% being shifted out in favour of this new figure. With that in mind, any reading above 0% for this month would drive the year-on-year number higher. That fact is a known entity, but there are still questions over the market’s reaction to a move higher for inflation. Headlines around rising inflation could spark a risk-off move that lifts the dollar. Nonetheless, the degree of upside seen would be crucial as market estimates have a wide spectrum between 3.1% and 3.3% (according to TradingEconomics). A rise to 3.3% could serve as a warning that the battle against inflation is far from over. However, traders should look at the monthly figure as a method of reducing the impact of base effects. The expected figure of 0.2% results in an annualised CPI of 2.4%. Not so bad!

US month-on-month CPI

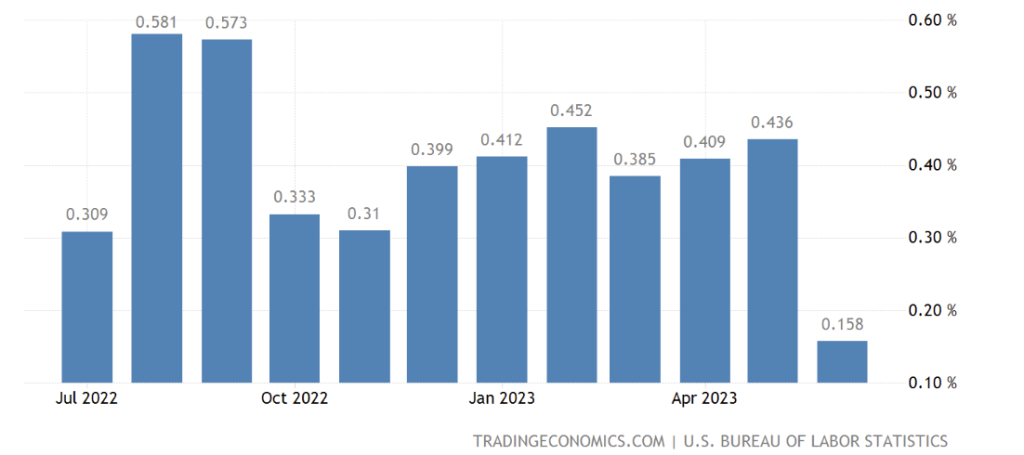

Core inflation remains key

While headline inflation grabs the headlines, core price pressures are just as important. Much of the volatile elements included in the main figure are largely influenced by outside factors, such as food and energy. Considering the Federal Reserve prioritises core PCE as a key metric, the core CPI reading will clearly hold significant value. With the 0.3% figure from July 2022 being replaced, anything below that will bring the year-on-year number down. However, a look at the breakdown of monthly core CPI over the past 12-months does highlight that we are only likely to start seeing the annual figure come off in a meaningful manner from next month (when we replace the August 0.6% figure).

US month-on-month core CPI

As such, this month looks likely to see headline inflation turn upwards, with minimal downside (of any) for the annual core CPI reading. Will markets take that in their stride or react with a risk-off tone?

Dollar index technical analysis

The dollar has been climbing higher over the past fortnight, with traders piling back into the currency as equity markets start to soften. However, part of that strength has come as European inflation rates heads lower, with the gap narrowing. The dollar index is heavily influenced by the euro in particular, with EURUSD forming 57% of the index. As such, the fact that eurozone and UK inflation has been moving lower brings potential upside for the dollar. The prospect of an uptick in US inflation does similarly raise the possibility that interest rate differentials and risk-off sentiment boost the dollar further. A look at this chart highlights a downtrend that remains in play for now. With that in mind, traders should consider that an upside move for the dollar could see price break out of this pattern of lower highs and lows. With Fibonacci and trendline resistance coming into play, there are significant hurdles up ahead. Ultimately, we would need to see price break through the 103.572 resistance level to signal the end of this trend. Until then, there is a risk of another move lower which would be more likely in the event that inflation comes in below expectations.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.