US CPI preview: Will markets celebrate return to disinflation?

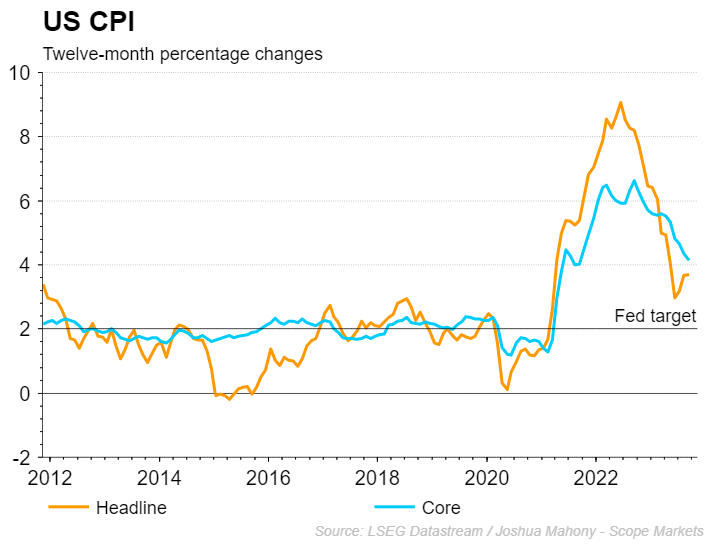

Global markets will be keeping a close eye out for US CPI inflation data due on Tuesday, with the recent turn in sentiment around a December hike serving to provide a key backdrop against which to view this crucial economic data release. With the post three months having seen headline CPI rise or remain flat, this week looks likely to bring a return to the disinflation theme. With that in mind, equity bulls will hope to see pricing around a December or January rate hike subside further.

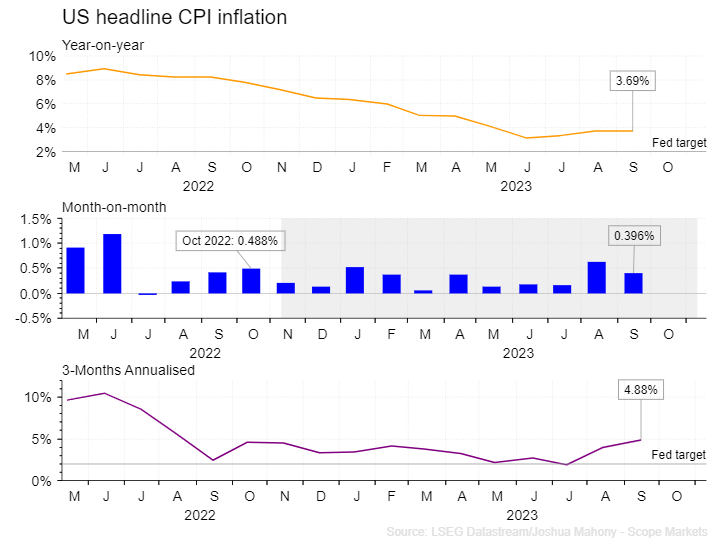

Headline inflation currently stands at 3.7%, following period of upside in the wake of the June 3% low. From a month-on-month perspective, we see the 0.5% reading from October 2022 drop out. With markets expecting a relatively low monthly figure for October, there is a hope that we will see the annual reading drift lower once again. However, it’s worth being cautious given the strength seen over the past two months, with August and September alone providing a worrying 1% increase to the annual reading. With energy prices falling there is a hope that this figure will come down markedly in the months ahead.

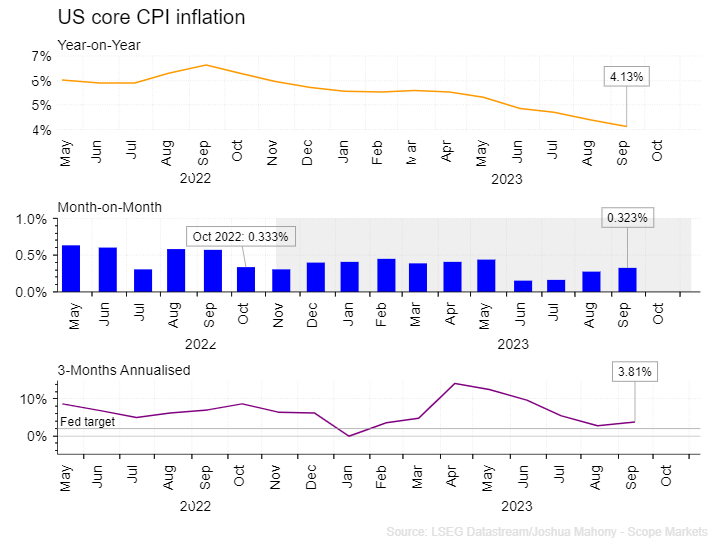

The core inflation rate has been making steady headway downwards over the course of this year, although we are likely to see that decline slow over October and November. The past two months have come in around 0.3%, but base effects favoured additional downside as we saw the 0.6% figures from both August and September 2022 drop out. Things are set to become a little more difficult from here on in, with the October and November 2022 figures standing around 0.3%. With much of the past year having seen monthly figures around 0.4%, the trajectory over the past two months would suggest a slow and steady decline in year-on-year inflation over the course of the next eight months. However, the forthcoming announcement could see things stabilise somewhat.

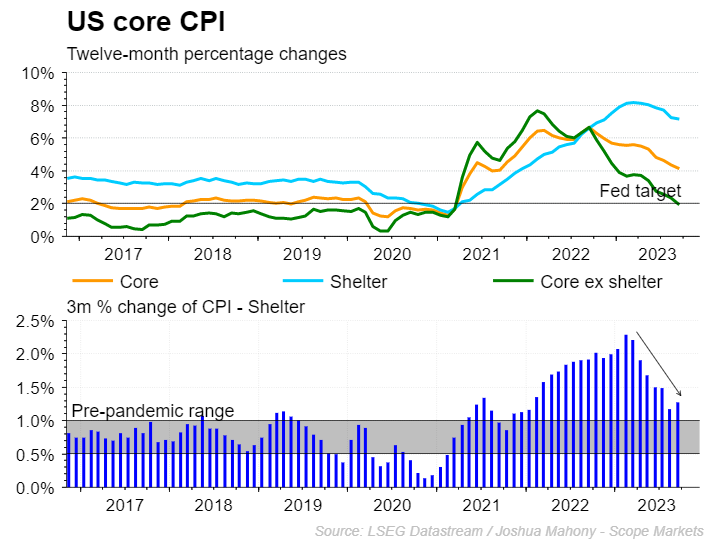

It is worthwhile noting the impact shelter costs have had upon inflation and in particular core CPI. According to the last report from the BLS, they stated that the 7.2% increase in shelter prices over the past 12-months accounts for a whopping 70% of the 4.1% core figure. However, it is worthwhile noting that the shelter component is highly lagging. Nonetheless, if we look at the past three-months (lower section), there has been a marked shift back towards the shaded zone which highlights the pre-pandemic levels. As such, we are seeing normalisation of this key element of inflation event if it will take him to see the year-on-year shelter metric return to normal.

In summary, this forthcoming meeting should see headline inflation post a welcome decline, while core CPI either flat lines or ticks gradually lower. Given the fact that we have seen a distinct lack of deflation in the headline figure over recent months, any notable move lower should help bolster the narrative around another rate pause in December. That stands to benefit risk assets such as equity markets and come to the detriment of the US dollar. However, it is worthwhile noting that the next two releases beyond Tuesday’s announcement will likely see headline inflation flatline or increase once again, raising questions over the drawn-out nature of this pathway back down to the key 2% target. Markets are pricing in an initial rate cut in Q2, but traders should be aware that any upside in inflation in the two months following Tuesday’s announcement may not necessarily impact those plans despite the potential initial risk-off move we could see next month.

Energy prices will remain critical going forward, with the recent decline in WTI and gas helping to alleviate fears that have emerged off the back of the past two monthly CPI figures (0.6% and 0.4%).

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.