US CPI preview: Will the FOMC look beyond any short-term rise?

Table of Content

Wednesday sees the US Bureau of Labor Statistics release the latest consumer price index inflation gauge, with markets widely expecting to see headline CPI rise once again in August. Such a move would represent the first consecutive rise since mid-2022, with base effects playing a key role in ending the disinflationary path that held for over a year. For markets, the idea of a second peak for inflation brings the potential for another risk-off phase as traders seek to gauge whether this is short-lived or the beginning of a protracted period of rising inflation.

Where does the US stand?

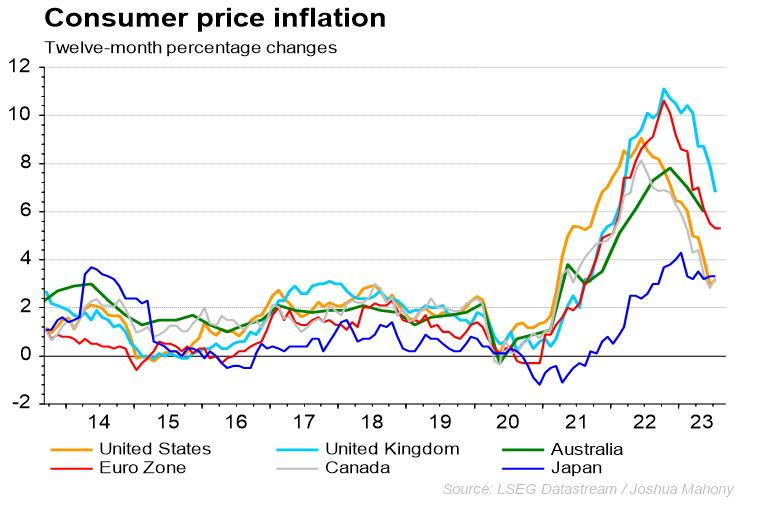

First of all, it is worthwhile noting that the US and Canada have been relatively successful at driving down inflation compared with their counterparts. The move back down into 3% back in June came as the eurozone struggled to break below 5%, and the UK CPI stood at a whopping 7.9%. That final stretch from 3% to 2% appears to be a troublesome one for the US, with a protracted period of elevated interest rates likely as a result. Nonetheless, with eurozone inflation struggling to break below 5% over recent months, it is clear that the US is better equipped to reach target than most.

What about core?

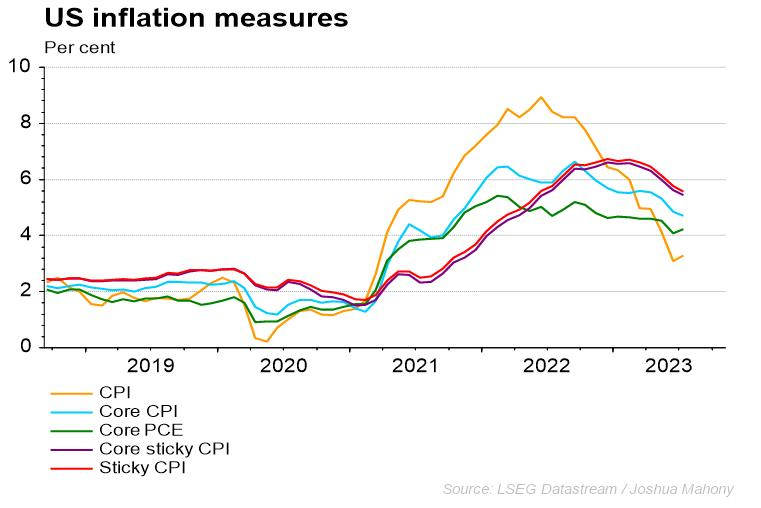

Core inflation has remained a major thorn in the side of central bankers, with the elevated nature of this focused metric highlighting that the impact of higher interest rates may be less important than many speculate. Monetary tightening from the Fed will likely have a greater impact on the core inflation elements rather than those volatile global factors such as energy and food. While we have continued to see core CPI head lower, it stands well above headline inflation. With markets predicting further core disinflation alongside a rise in headline CPI, there is a convergence underway between the two metrics.

The core PCE inflation gauge is widely speculated to be the favoured figure amongst Federal Reserve members. It is therefore notable that we have seen this metric tick higher last month, providing a warning sign for the Fed.

What do we expect?

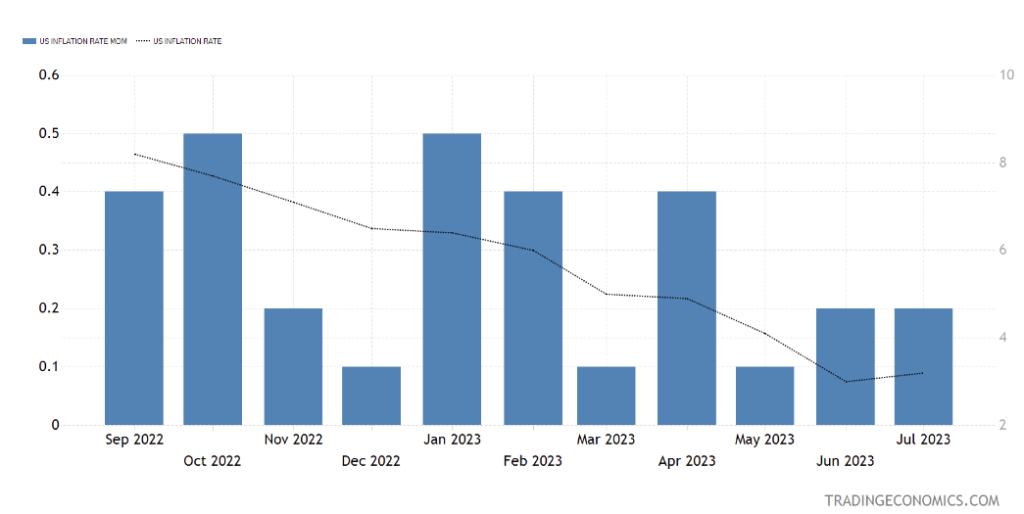

A rise for the headline CPI figure looks likely according to estimates, with base effects meaning that any monthly figure above 0.2% would push the annual reading higher. Forecasts signal a potentially worrying figure around 0.6%, which could bring the annual CPI reading up to 3.6%. This could be a reflection of the recent rise for energy prices, with WTI on the rise over recent months. Taking base effects out of the equation, we need to see inflation come in around 0.1-0.2% per month to bring the annual figure down to target. With that in mind, the speculated 0.6% figure this month could concern the Fed, raising the likeliness of another rate hike.

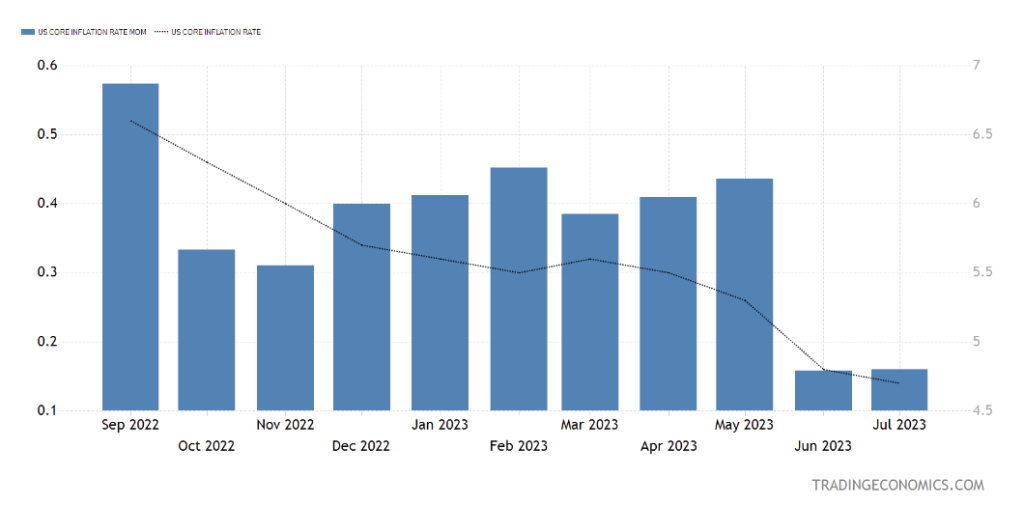

In terms of core inflation, the declines we have seen over recent months are gradual in nature. Markets expect to see another move lower, with the prediction of another 0.2% monthly rise providing an encouraging signal if it comes to fruition. This would represent the third consecutive 0.2% monthly reading, marking a substantial step-change from the trend prior to June. Should we consistently see US core CPI come in at 0.2% month-on-month, it wouldn’t take long to realise that we are on track for a dramatic decline in the annual figure once each figure from the prior year drops out. The chart below highlights how we are highly likely to see a significant decline in the annual core CPI figure this time around, as the 0.6% figure from September 2022 is replaced. The hope for bulls will be that any rise in headline inflation would be partially offset by a substantial decline for core CPI.

Inflation breakdown

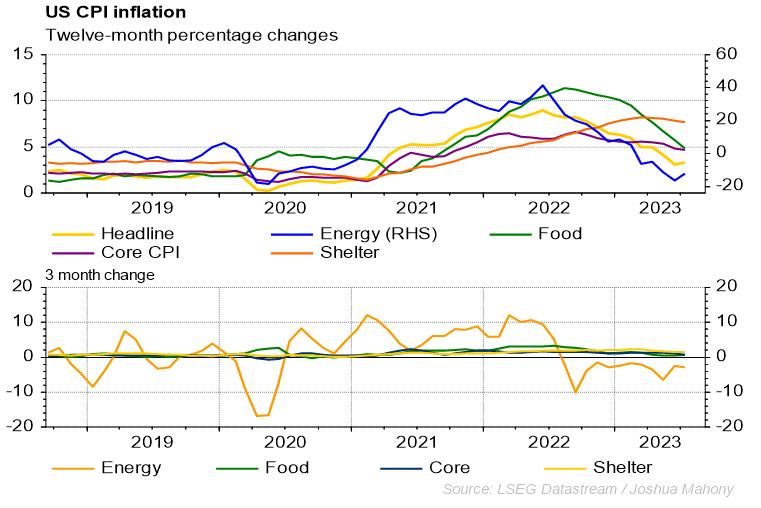

With an understanding of the wider picture, it is worthwhile taking a look at things on a more granular level. This helps us spot wider trends that will inform the way we view data away from these big events. The chart below highlights a number of elements worth mentioning. Firstly, we can see that the rebound in headline inflation has been driven primarily by energy, which is the only other element to rise last month. While we have grown accustomed to energy prices dragging the headline figure lower, that phase appears to be behind us.

We can also see that shelter remains a significant problem for the Federal Reserve to solve, with this accounting for 40% of the core CPI reading. The positive is that we have finally started to see this element roll over. The negative is just how elevated the shelter aspect of inflation remains. This highlights the need for the Fed to continue its assault on housing, with house prices and rents required to drive down inflation.

What about the dollar?

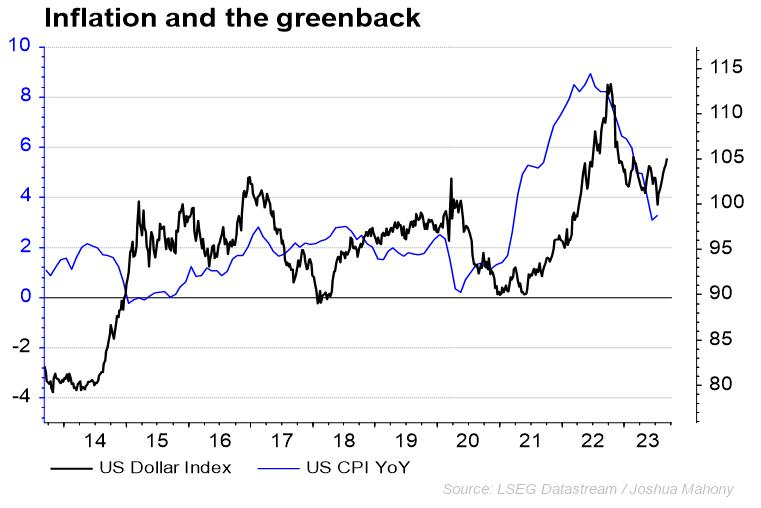

The dollar typically trades with a positive correlation to US inflation, with rising prices raising demand for haven assets on the expectation of a more protracted period of tight monetary policy. The chart below highlights this relationship well, with the dollar gaining ground in response to last months elevated CPI reading. With that in mind, an inflation report that sees a more elevated headline and core CPI than expected would likely lift the greenback. However, a lower-than-expected inflation survey would likely come at the detriment of the US dollar.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.