US jobs report preview: Will a weak NFP figure lessen December rate hike bets?

Table of Content

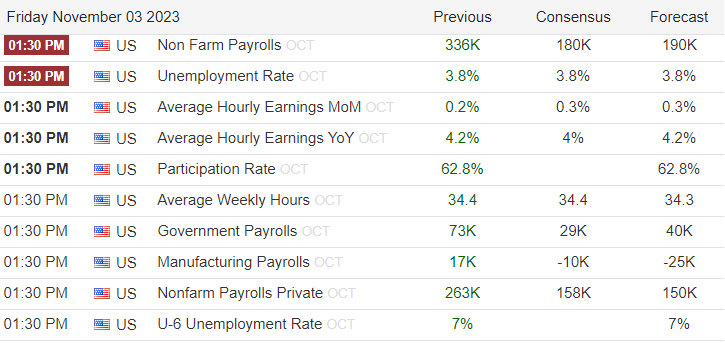

The US Bureau of labour statistics will release the latest jobs report on Friday 3 November, with traders gearing up for another potentially volatile end to the week. The report covers data for October, covering key elements such as the nonfarm payrolls, unemployment rate, and average hourly earnings.

The wider backdrop

The jobs report comes in the wake of the latest FOMC interest rate decision with markets by and large expecting to see a pause from the Fed. However, with the US economy continuing to show signs of strength, there is a feeling that the Fed may act in December should they deem the economy sufficiently strong, and the inflation outlook worrisome enough. Better-than-expected retail sales (0.7%), GDP (4.9%), and services PMI (50.9) figures point towards an economy that appears to be remarkably resilient in the face of a historic two-year period of tightening that took rates from 0.25% to 5.5%. With central banks around the world bringing an end to their tightening process in response to weakening economic outlooks and disinflation, the enviable strength of US economy does highlight the potential for further action in December. It is against this backdrop with which markets will likely judge the upcoming US jobs report.

Non-farm payrolls

The non-farm payrolls element of the report will typically be seen as the headline grabber, with this figure providing a key insight into hiring over the period. The trend over the course of 2023 has largely provided NFP figures between 217k and 281k. Last month blasted estimates out the water with a huge beat of 336k bringing the highest monthly jump in payrolls since January. Coming to the time when markets are looking for signs of economic distress, this figure provided yet another reminder that the US jobs market remains robust. There is speculation that this may be a result of people taking up second jobs in response to the rampant inflation evident over the course of the year. Nonetheless we are yet to see this figure provide any particular warning sign that the US economy is deteriorating to the point at which the Federal Reserve might need to take a less hawkish stance.

Market expectations point towards a likely slowdown, with the bumper September figure of 336k expected to be counteracted by a sub-200k figure this time around. Also keep a close eye out for any notable revision to the September figure. To an extent the strength of last month’s figure means that a weaker October reading can largely be overlook by the Fed if they do intend to hike again. However, another strong figure would undoubtedly point towards an impressively strong jobs market.

Unemployment rate

A sharp uptick in unemployment would be one potential warning sign for US Federal Reserve to keep an eye out for, although we are yet to see any particular warning sign quite yet. The latest reading of 3.8% keeps the unemployment rate relatively low for now, and markets expect another 3.8% figure for October.

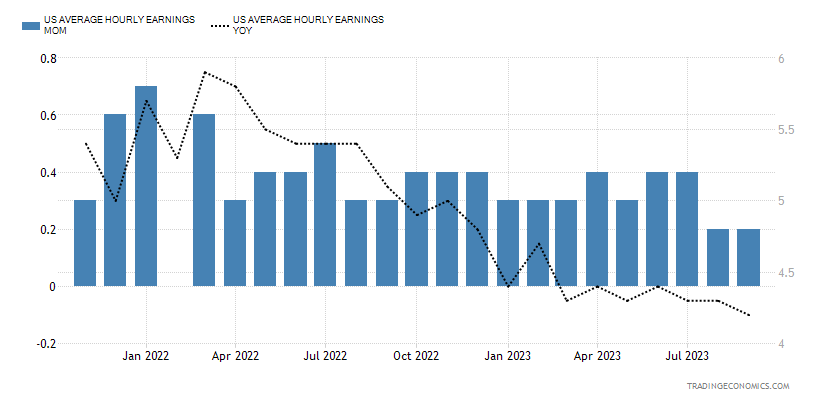

Average hourly earnings

The rise in inflation over the course of the past two years has served to ramp up interest in the average hourly earnings figure, which acts as a strong proxy for underlying inflation pressures. The past two readings have seen this wage figure moderate, posting month on month readings of 0.2%. That monthly figure annualizes to 2.4%. For now, the year-on-year average hourly earnings figure stands at 4.2%, which is the lowest reading this year. Notably the pre pandemic norm puts this figure roughly around 3%, which ensures that real earnings increase overtime on the premise that inflation is around the 2% target.

Any spike in the average hourly earnings figure could raise the possibility of a December hike, bringing a risk off move into play (USD strength). However, markets are expecting a figure between 4% and 4.2%, which would keep the trajectory on track for the Fed.

Alternate data

The US ADP non-farm employment change figure came in below expectations, although the reading of 113K does represent an improvement over the prior figure of 89K. The weakness of last month’s ADP figure stands in stark contrast to the headline payrolls number, highlighting the questionable link between the two.

We are yet to see any notable uptick in the unemployment claims metric for the US, with recent figures remaining between 200-210k. In the absence of any particular spike in unemployment claims, the US jobs market continues to look strong enough to justify another hike if the Fed deem it necessary.

Dollar technical analysis

The US dollar index has enjoyed a period of strength over recent months, although the risk off sentiment seen throughout global markets has provided less upside than many might expect. Instead, we have seen a gradual regaining of ground characterised by higher highs and higher lows as exhibited below. With markets stabilising somewhat, the US dollar has started to weaken as we head into the back end of the week. Nonetheless the pattern exhibited over the course of October highlights the high likeliness that any near-term downside is a possible opportunity for the dollar bulls. A break below the 105.725 support level would be required to negate this recent pattern. Should we see further downside, watch out for support around the mid to deep Fibonacci levels (106.335, 106.190, and 106.015).

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.