US jobs report preview: Fed watch closely amid signs of economic weakness

As the whole talk on Powell’s comments at the Jackson Hole Symposium fades, the market now looks ahead to the upcoming Jobs report which is one of the Key economic indicators the Fed will rely on for its next monetary policy decision in September.

The Federal Reserve Chairman, Jerome Powell maintained a hawkish tone at Jackson Hole, stressing that it would be premature to start implementing rate cuts despite receding inflation in recent months as figures are still above the central bank’s 2% target. The Fed Chair noted that inflation could remain high as the economy continues to experience growth amid strong consumer spending. At its last policy meeting, the central bank insisted it would rely on data to guide it on its future policy path. The recent decline in US PMI surveys do provide some concerns for the US economy. Will this jobs report bring a market-moving update for the Fed to mull over this Friday?

How has the Labour market fared

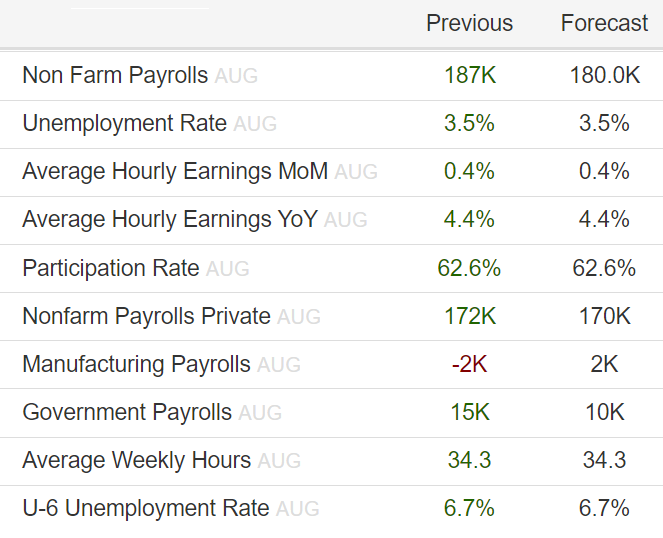

Recently, the labour market has started to show signs of cooling with employment numbers dropping for two months in a row. The latest figure of 187k came in well below the 205K anticipated by markets. While this is already aligning with the Fed’s agenda, wage growth, and unemployment are yet to feel the impact of the Fed’s tightening with both remaining resilient for now. At the moment, the Federal Reserve will be expecting to see these indicators yield to its monetary policy campaign, or else they stick to the initial plan (holding rates higher for longer) which will come at the expense of the economy.

This week has seen a number of signals emerge that could allude to a weakening of the economy and employment outlook. The concerns over US economic health emerged last week, with the declines evident in both manufacturing and services PMI readings. However, we have seen traders adjust their expectations around future interest rates thanks to recent figures that could cause concern at the Fed. Firstly, the JOLTS job opening figure came in sharply lower, falling to the lowest level since March 2021. Consumer confidence similarly took a nosedive, falling by 10 points more than expected. Finally, the ADP payrolls figure fell to a five-month low of 177k, missing expectations of 195k. Could these figures allude to potential weakness on Friday?

Aside from the payrolls and unemployment data, traders will be keeping a close eye out for any changes to the average hourly earnings figure. With wages acting as a key input driving US inflation, there is a concern that the current 4.4% rate will lift CPI. From an economic perspective, the fact that wages outstrip inflation does help improve spending power and the quality of living after a decline in real wages. Nonetheless, the Fed remains focused on driving down inflation, highlighting the importance of seeing the hourly earnings figure drop lower.

Dollar and gold technical analysis

The dollar has been on the rise over the course of August, benefitting from a risk-off sentiment that benefitted this haven currency. With the jobs report impending, that dollar strength could persist in the event that we see further data that might signal the need for higher rates or a longer period of tight policy. As such, a move higher for wages, or a strong payrolls figure could result in a stronger dollar as risk sentiment sours on the prospect of higher interest rates. Conversely, a weakening economic outlook would increase calls for the Fed to stop raising rates, benefitting equities to the detriment of the dollar.

Gold has generally taken on a role as the anti-dollar, with the precious metal typically moving in the opposite direction of the greenback. After exiting the descending channel, the price rose about +1.69% before hitting a roadblock around $1925. Much like the dollar, gold will be heavily influenced by the jobs report, with USD weakness needed to drive another upside break from here.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.