US Q2 earnings season round-up

With the second quarter earnings season largely complete, we are faced with an opportune moment to look back at how things shaped up and what that tells us about US corporates and the economy as a whole. The ability to gauge market expectations going forward will be key in determining how things shape up for the third quarter. Utilising data from Factset, let’s gauge where the areas of strength and weakness are in US equities going forward.

The winners and losers

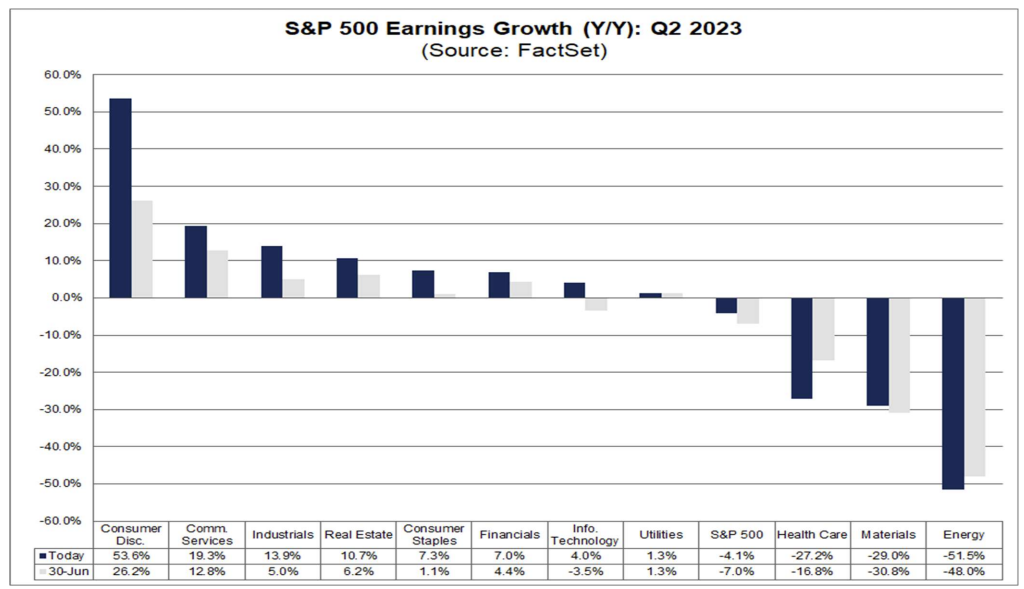

Much has been made of the ability of companies to massage market expectations in a bid to outperform estimates, helping to maintain a strong share price. This time around we have seen plenty of companies see their stock underwhelm despite beating expectations. Crucially, a year-on-year picture highlights the trajectory aside from often manipulated forecasts. From an earnings perspective, we have seen energy slump as expected, with materials following on as a result of disinflationary pressures in the commodity market in Q2. Meanwhile, healthcare is the one notable underperformer, with EPS falling sharply. On the positive side of the spectrum, consumer discretionary is the big winner, thanks to a remarkably resilient US consumer.

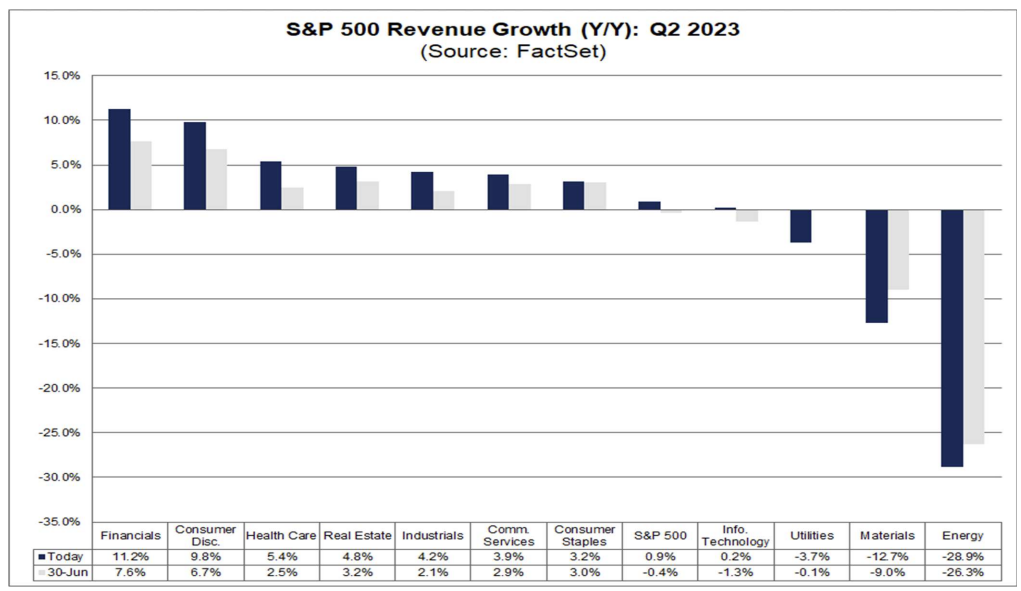

In terms of revenue, outperformance from financials and consumer discretionary dominate. That disparity between strong revenue and less impressive EPS for financials does highlight questions about margins and profitability. Energy and materials are once again the significant weak spots for the quarter, with utilities surprisingly seeing a 3.7% decline in yearly revenues.

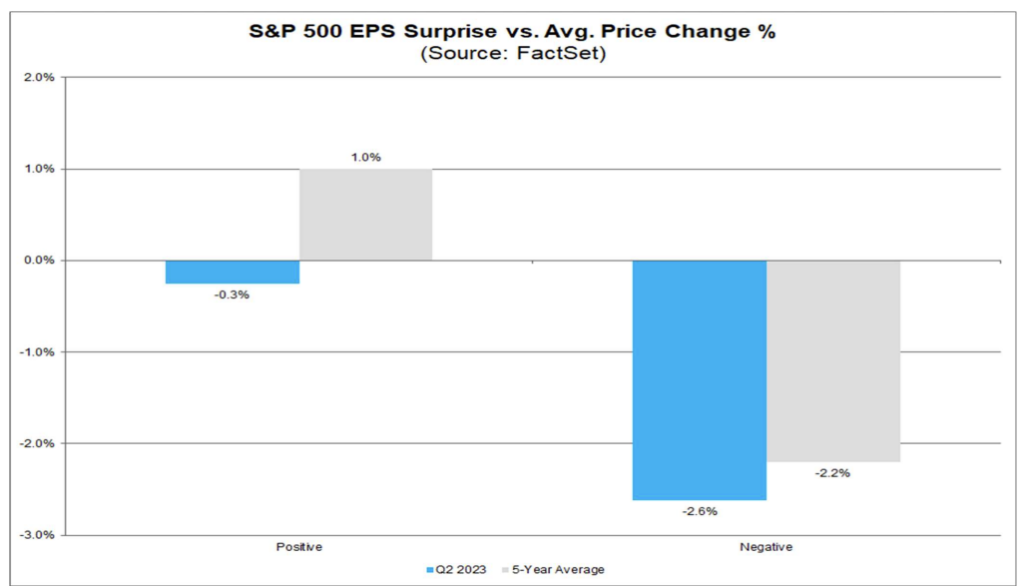

Unfortunately, this earnings season has seen many companies underperform aside from their performance vs expectations. The ability to beat estimates would ordinarily result in benefits for shareholders. That has not necessarily been the case this time around, with the average response being largely negative. This could be a reflection of a weaker outlook, or a perception that estimates had set a relatively low bar.

US remains the place to be

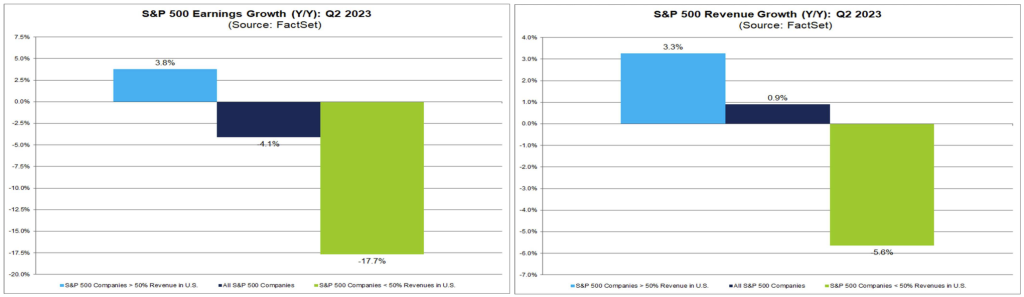

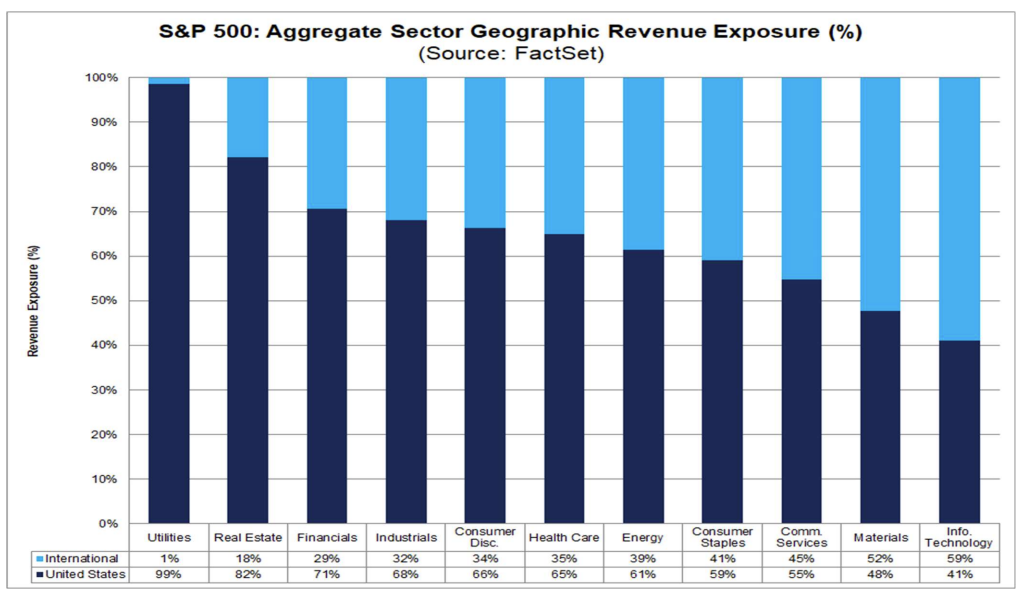

Looking into the outperformers from this earnings season, there is a notable disparity between US-focused companies and those earning abroad. The resilience of the US consumer has been notable throughout this year, and that has helped retain demand throughout a period of elevated inflation.

A look into which sectors are more heavily geared towards the US highlights the fact that only information technology and materials see the majority of their earnings coming from outside of the US.

Outlook

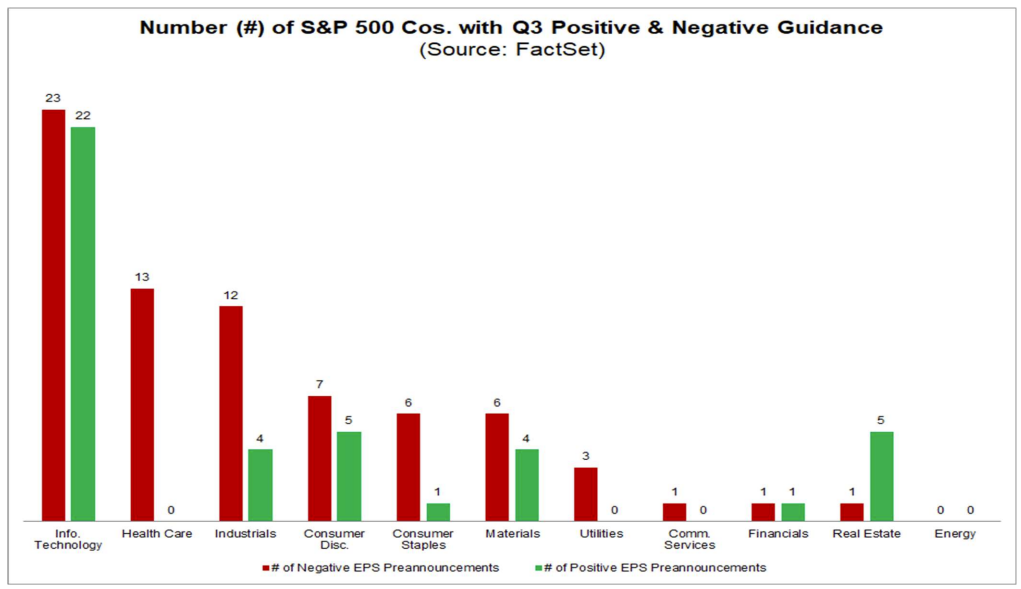

Part of the reason why many companies have seen price action defy their earnings and revenue performance has come down to the forward-looking outlook provided by the companies in question. Why do concerns over potential performance in the coming months to shift the focus away from backward-looking data in favour of future earnings the chart below provides a sector-specific breakdown around where we have seen an optimistic or pessimistic tone taken by the CEO. Notably, we have seen a remarkably balanced affair in the tech sector, while companies across healthcare industrials and consumer staples appear to be overwhelmingly weighted towards a more pessimistic earnings outlook for the third quarter. Real estate stands as the one area of potential outperformance in Q3, with five companies providing positive guidance compared with just one negative view.

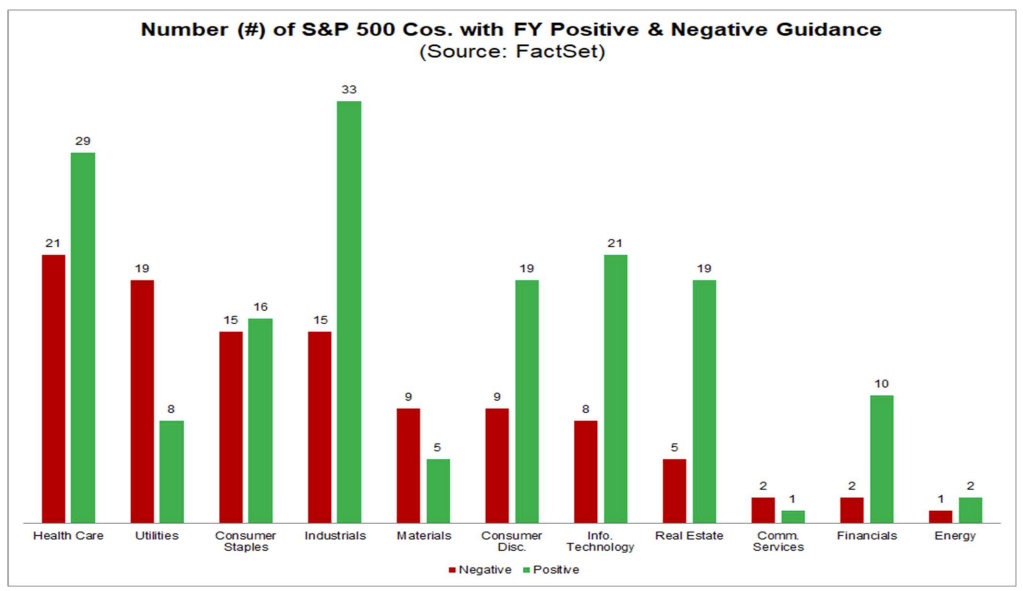

The full-year outlook is very different, with a number of companies clearly expecting to overcome a difficult Q3 to bring a strong year-end earnings picture. Real estate does continue to look strong, but there is also a more constructive view from a number of other significant sectors such as industrials, financials, and tech.

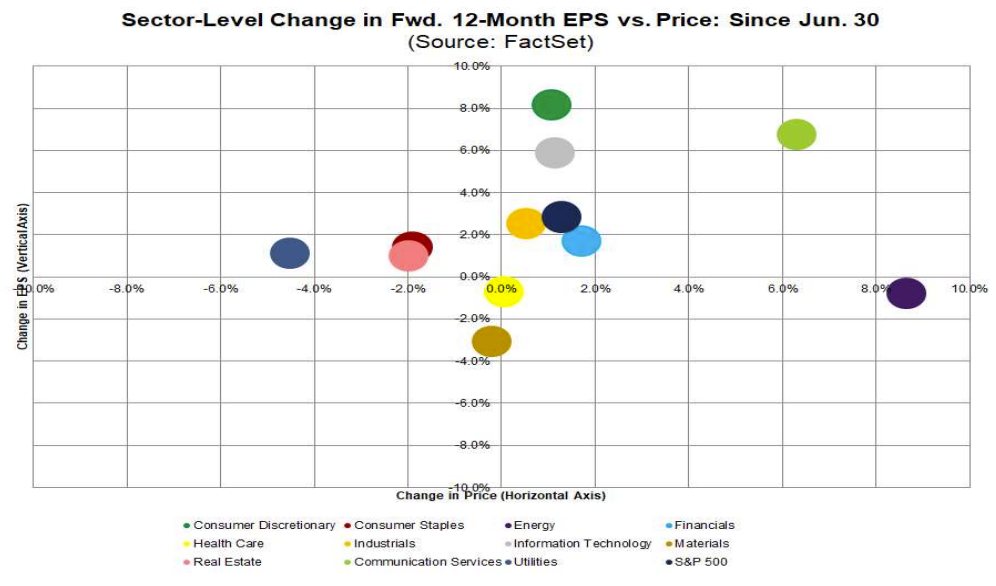

If we are to look at the 12-month earnings per share outlook compared with prices since the end of June, there are some interesting conclusions to take. From a performance standpoint, energy has done well despite no material improvement in the EPS outlook. However, the standout sector has to be consumer discretionary, which has seen a sharp improvement in the EPS outlook, with little share price appreciation as a result.

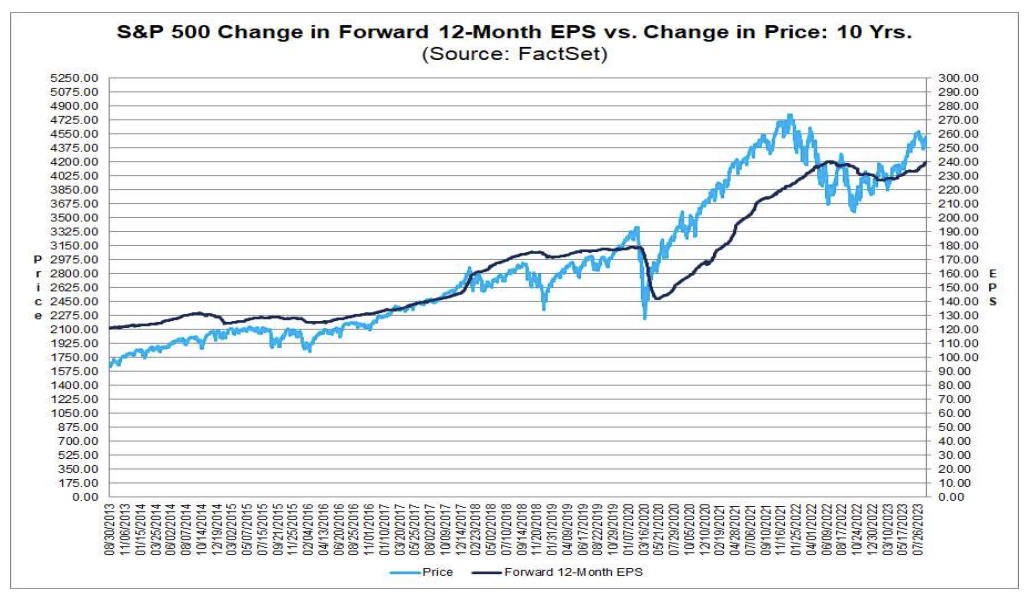

Taking that 12-month earnings outlook, we can see that the positive outlook does provide justification for the gains we have been seeing in US markets. The S&P 500 strength is built on the expectations of improved corporate earnings data alongside the likely push towards a more accommodative monetary policy once inflation heads lower. This should provide further confidence for those looking for additional gains in the US equity space.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.