What is hedging in Forex in 2021?

Table of Content

What is hedging in Forex?

A forex hedge is a kind of trade performed to safeguard a current or expected position from an undesired movement in exchange rates.

Hedging in forex is generally employed by a wide variety of market partners, involving shareholders, traders, and organizations. By employing a forex hedge very well, a person who is long-trading a forex currency pair or assuming to stay in the prospect through trade can be then safeguarded from downside uncertainty. In its place, a trader or stockholder who is performing short-trade a forex pair can secure next to upward uncertainty via a forex hedge.

It is necessary to keep in mind that a forex hedge is not a money-generating tactic. Hedging in forex is generally intended to safeguard from different losses, not to gain profit. Furthermore, many hedges are often meant to take out a part of the revelation risk apart from all of it, since there are prices to hedging that can exceed the advantages after a particular point.

Thus, if a Japanese organization is hoping to sell devices in USD, say, it can safeguard a part of the trade by removing a currency option that would benefit if the JPY grows in value next to the USD. If the trade occurs not protected and the dollar’s value increases or remains steady next to the yen, then the organization is only out the option’s price. If the dollar’s value decreases, the gain from the option currency can counteract a few of the losses recognized when recovering the stocks gained from the trade.

How to use a forex hedge?

The main procedures of hedging in currency trading are forex currency options, spot agreements, as well as futures. Spot agreements are the common trades developed by retail or dispensed forex traders. As spot agreements have a small-term delivery period, they’re not the most successful currency hedging means. Indeed, daily spot agreements are generally where a hedge is essential.

Forex currency options are one of the very common processes of currency hedging. Since with options on different kinds of securities, forex currency options offer a buyer the power, but not the commitment, to sell or buy the pair of currency at a specific market rate at any time in the prospect. Daily options tactics can be then used like long rides, long stifles, and bear or bull spreads, to restrict the loss possibility of a provided trade.

Example of hedging in forex

Say, if an investment group of the US was getting listed to repeated some gains made in Europe it could hedge a few of the conventional profits via an option. As the listed transaction will be to sell Euro currency and buy USD, the investment group will own a put option to exchange euro. Through purchasing the put option the organization will be considering the worst rate for its future activity, which will be the strike cost. Since in the example of the Japanese organization, if the currency is over the strike cost at ending then the firm will not execute the option and easily do the activity in an open market. The hedge price is the price of the put option.

Example 1

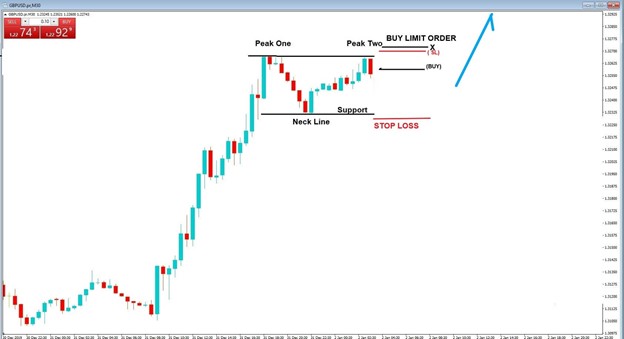

This shows us the formation of the double top pattern, the first peak, and the second peak has been formed with the below support being the neckline, once the price move past the neckline and the double top is confirmed.

Example 2

The situation in the double bottom scenario is quite the opposite. We have a pear shape that bottoms out and then reverses towards the neckline, which is a resistance zone where price action forms a second floor at or near the same exchange rate as the previous floor, and then reverses again at the cleavage as a zone of resistance. The area where the price trend breaks, and then this line acts as a support area, and then we see the continuation of the reversal of the price trend, confirming the double bottom pattern.

Example 3

The following is how we configure the foreign accounts for hedging. First, we must wait for the price movement to move slightly away from our second peak, and go short at this time, with the stop loss a few points above the highest peak of the movement. If the price movement continues below our neckline, the double top pattern will be confirmed and we can go lower. If the price movement reverses from the support line, this will confirm a consolidation zone. In this case, we can set a protective stop loss to prevent our entry, at least we will not lose money in this trade.

Example 4

The established hedging strategy is that we place a buy limit order on the first area of the stop loss of the first trade. The stop loss is a bit bigger. The following images should show the support or cleavage above. In this case, we expect the price trend to continue to maintain the initial uptrend. For this transaction, we must have a minimum goal equal to the number of points lost in the first transaction to control our gains and losses. However, naturally, we want the transaction to continue as long as possible.

Example 5

In the double bottom hedging strategy, we only need to reverse the double top trading settings. In this case, once the price trend reverses from our second bottom line, we will take action. The stop loss adjustment is a few points below the lowest point of the two funds. If the price movement subsequently reverses from the neckline to form the third layer, we can end the transaction with a meager profit. But once the neckline is predicted and the price trend continues to rise, the double bottom confirmation pattern will be confirmed.

The hedging strategy includes a sell limit order below the stop loss of the first trade. The stop loss for the hedging strategy should be a few images below the neckline.

This hedging strategy must be kept within the time frame of 15 minutes, above which we will find the most points. This should not be considered a reselling strategy.

Not all direct forex brokers let hedging in their interfaces. Make sure to investigate the broker you employ before starting the trade.

Why you should do hedging?

The key cause that you wish to make use of hedging for your trades is to restrict the risk. Hedging may be a larger share of your trading strategy if performed properly. It must be only used by expert traders who know about the market changes and timing. Working with hedging with no enough trading knowledge can decrease your account balance to 0 in no course of time.

Simple or direct hedging in forex

A few brokers let you keep trades that are direct or straight hedges. A direct hedge takes place when you get permission to keep a trade that purchases a single currency pair like USD/GBP currency pair. At a similar time, you may also keep a trade to market the similar pair.

Whereas the whole profit of your 2 trades is 0 and you hold both trades open, you may generate more cash with no acquiring extra risk if you measure the market quite accurately.

The safety of a hedge

A simple hedge in forex safeguards you as it lets you trade in the opposite way of your primary trade with no closing of your primary trade. One may claim that it is more sensible to end the primary trade at a failure and after that position the latest trade in a more suitable spot. This instance is one of the kinds of verdicts you will create as a tradesman.

You can close your primary trade and then enter again the market at the best price afterward. The benefit of employing the hedge is that you may keep your initial trade in the market and generate cash with a 2nd trade that generates a profit since the market shifts next to your initial trade position.

How to undo a hedge?

If you speculate that the market is going in the opposite direction and go again in your first trade’s support, you may ever keep a stop-loss on the hedging position, or simply finish it.

There are several methods available for forex hedge trades, and they may get somewhat complicated. Various brokers don’t let traders consider straight-hedged trade positions in a similar account, thus different approaches are essential.

Working process of forex hedge and hold strategy

Hedging in forex is all related to decreasing your risk, to safeguard next to unpopular price changes. The easiest method to decrease the risk is to decrease or close trade positions. But, there can be moments where you only wish to tentatively decrease your appearance. Based on the conditions, a hedge may be very useful than easily closing out. Let us consider an example – suppose that you have several forex positions forward the Brexit poll.

Your trade points are:

Short 1 order EUR/GBP pair

Short 2 orders of USD/CHF pair

Long 1 order of GBP/CHF pair

On the whole, you feel happy with these long-term trade positions, but you get bothered about the possibility of volatility in the British Pound entering the Brexit poll. Apart from freeing yourself from your 2 positions with the British Pound, you prefer rather a hedge. You can perform this by taking an additional trade position and trading the British Pound/US Dollar pair. This reduces your proclamation to the GBP or British Pound since you are trading British pounds and purchasing USD, whereas your existing trade positions involve long British Pound and short US dollars.

You can sell 2 GBP/USD lots to hedge your revelation to sterling, which would also involve an additional impact of removing your exposure to the USD. Rather, you may hedge some smaller sum in comparison to this, based on your approach to risk.

The chart provided above depicts only how the GBP/USD exchange pair shifted in the vigil of the Brexit poll in the year 2016. The short trade position considered in GBP/USD pair like a hedge will have kept you from a huge loss. See that you can also exchange a diverse exchange pair: the key feature is shorting sterling as it is sterling volatility you were looking to ignore.

GBP/USD currency pair is generally used as an instance here as it negates easily next to your current extended dollar position. See that there is a reasonable added effect on your revelation to the USD. One less straight method of hedging an exchange exposure is to keep a trade with an associated currency pair.

Doing forex hedging with a robot

Hedging in forex with automatic trading robots may be beneficial to some traders for simple causes. Once fixed, they perform a lot of the activities for you.

Hedging robots are generally made all over the thought of hedging, which is then based on creating various extra trade positions and selling or buying at a similar time mixed with trend review. This is all completed to safeguard yourself next to unexpected market changes. The hedging robots perform only that, with the target of keeping your floating sum definite.

Is hedging in forex legitimate?

A trading forex hedge is not legal in the United States. To be fair, not each kind of hedging is generally banned in the US. But the purpose of the law is on buying or selling a similar currency pair at similar or diverse strike costs.

But, hedging in forex is not prohibited by many brokers all over the world involving various in Europe, Australia, and Asia.

Conclusion- Hedging in forex

Hedging in forex is the best method of overcoming risk, but it occurs at a cost. There are transactional charges included, but hedging may also sink your profit. A hedge generally decreases your exposure. This decreases your deficits if the market changes adversely. But if the market changes in your support, then you gain more limited than you would have gained without the hedge.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.