Walt Disney, Alibaba and Roblox earnings preview

Will Walt Disney streaming concerns continue to depress stock price?

Walt Disney report earnings on Wednesday 9 August. Their shares have been hit hard over the course of the past quarter, with Q2 2023 earnings coming in below estimates. However, perhaps the most troublesome issue for investors has been the weakness evident in their crucial streaming services, with markets keeping a close eye out for any further contraction the Disney plus subscriber numbers.

Total subscriber numbers fell by roughly four million, from 163.17 million to 157.8 million. The problem is that this appears to signal the end of a period of expansion for a part of the business that many had hoped would provide substantial revenue upside for years to come. While their parks business performed well last quarter, there is a risk that we see that boost as a temporary which will prove short-lived in nature. With the stock having halved in value over the past two-years, investors will hope that CEO Bob Iger can provide a plan to turn the tide.

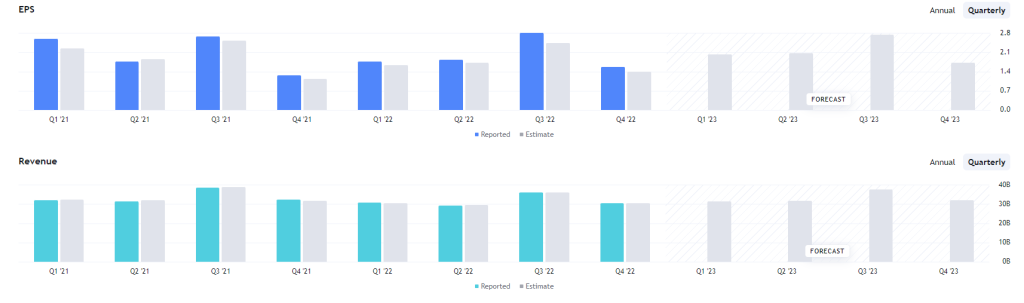

Expected earnings per share (EPS): $0.99 per share. Comparatives: $0.93 (Q2 2023) and $1.09 (Q3 2022)

Expected revenues: $22.49bn. Comparatives: $21.82bn (Q1 2023) and $21.50bn (Q3 2022)

Alibaba provide key insight into the Chinese economy

Alibaba report their Q1 2023 earnings on Thursday 10 August, with markets keeping a close eye out for this e-commerce giant as a proxy for consumer health in the Chinese economy. There have been significant concerns for those hoping for a consumer-led economic resurgence in China, following a drawn-out zero-Covid policy that served to dampen demand and economic output. However, that growth story has been underwhelming, with the PBoC and Chinese government stepping in over recent months in a bid to help improve conditions. Part of that appears to be a willingness to become more accommodative to businesses after a period that drew concerns over the potential stringent oversight from Xi Jinping’s government.

Due to the post-Covid reopening, Alibaba stand in a good position to benefit from relatively favourable year-on-year comparatives. After-all, the business the economy has been recovering, albeit slower than some had hoped. Keep an eye out for any potential AI boost from their cloud business, while logistics and international retail provide other growth areas of note.

Expected earnings per share (EPS): $2.01 per share. Comparatives: $1.56 (Q4 2023) and $1.75 (Q1 2022)

Expected revenues: $30.93bn. Comparatives: $30.31bn (Q4 2023) and $30.67bn (Q1 2022)

Questions remain for lossmaking Roblox

Online video game creator Roblox report their latest earnings before the bell on Wednesday 9 August. The company has struggled to see the success of their games translate into profits, with losses continuing to rack up each quarter. Talk of a deal between Meta and Roblox highlight the importance of the company in the Metaverse, with investors hoping that increased adoption of the new technology will ultimately translate into a surge in revenues.

The company allows people to both create their own games and play games created by others. While profits may be elusive, surging interaction numbers do highlight the continued growth in popularity of their products. Unfortunately, the lack of profits has resulted in a stock that has been largely rangebound for the past 18-months. Will we finally see an update that can change the tide, or will traders just see this stock as a good rangebound market to jump in and out of?

Expected earnings per share (EPS): -$0.44 per share. Comparatives: -$0.44 (Q1 2023) and -$0.30 (Q2 2022)

Expected revenues: $785.4mn. Comparatives: $773.82mn (Q1 2023) and $591.21mn (Q2 2022)

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.