Will US jobs report flash red after JOLT and ADP warning?

The US Bureau of Labour Statistics is set to release its latest jobs data on Friday 6 October, set against the backdrop of market declines and increased economic fear. The shift from a period of economic tightening to one of hesitancy from the central banks does serve to highlight the perception of impending risk from an economic standpoint. Despite the Federal Reserve having recently ruled out a recession, the postponed government shutdown does highlight a growing concern around debt as rising long-term yields drive the cost of borrowing higher. In particular, the US is faced with an almost certain future of paying over $1 trillion worth of interest per year. The US government and Joe Biden face a difficult future, with rising energy prices providing little grounds for optimism that interest rates could be cut anytime soon.

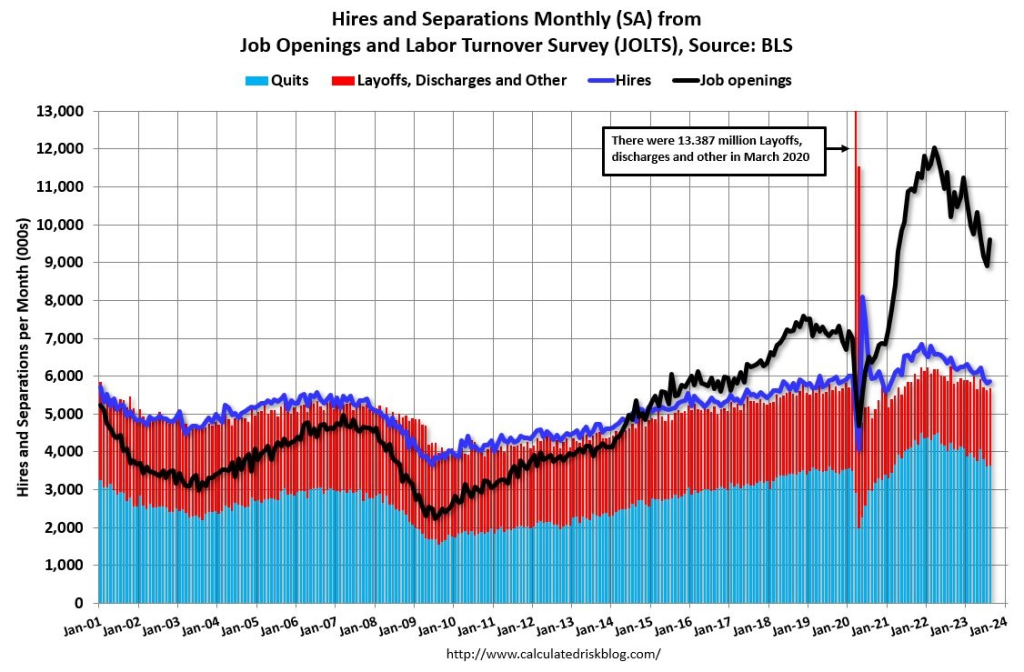

From an economic standpoint, the US has done relatively well thus far. The jobs market has been healthy as businesses continue to hire despite the new pricing and salary environment. This week sees a host of employment data points released prior to Friday’s big report. First of those was the JOLTS job openings figure, which sparked a risk-off move thanks to an unexpected jump in openings (reaching a three-month high of 9.61 million). Whether there should be some caution in drawing any substantial conclusion to this reading with the jokes job openings figure often volatile in nature. The trend remains downward, we are yet to see any tangible jump in layoffs or quits.

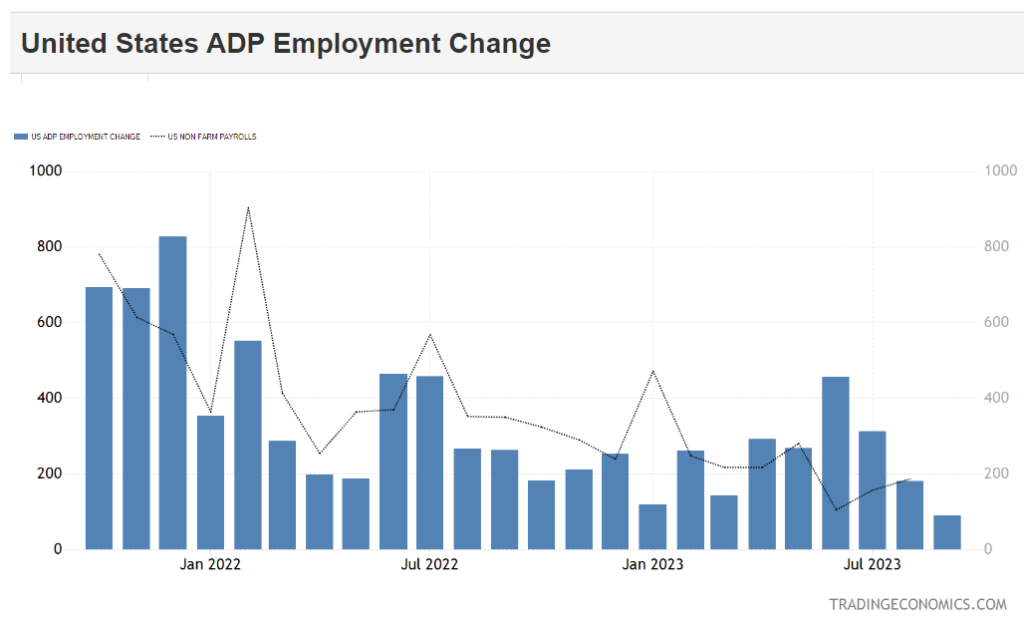

Wednesday brought a fresh ADP payrolls release, with this private reading slumping sharply lower to a third consecutive decline. The reading of 89k represents the lowest ADP figure since early 2022, coming in well below the 160k region expected by markets. The relationship between ADP and headline payrolls has been a bone of contention over the years, but the size of this downward move would indicate the potential for weakness around Friday’s headline NFP figure

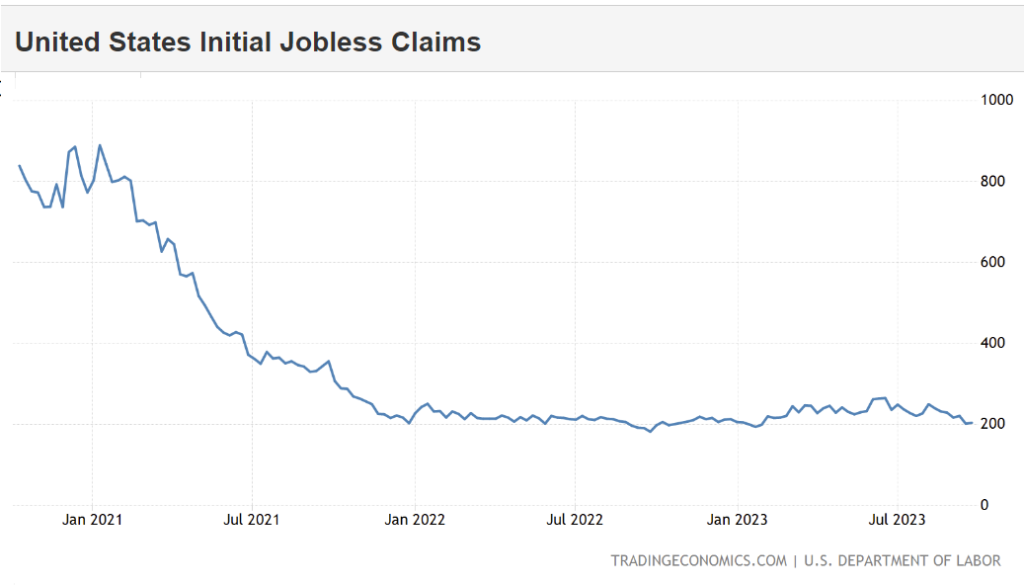

Looking at the US unemployment claims data, the trend has been consistently downward over recent months. September saw weekly claims fall to a five-month low, signalling underlying strength within the US employment market. According to this metric, we are not seeing a significant uptick in unemployment quite yet.

Looking ahead to Fridays job reports, the three readings to watch out for can be clustered into two categories; job market strength, and wages. While Tuesdays jump in the JOLTS job openings figure caused a risk-off move, the ADP decline saw a mixed response as expectations of a November hike fell. Pricing around a pause at that meeting are around 81%, compared with 72% prior to the release. The confusion over whether economic weakness should be seen as a positive (less chance of another hike) or negative (economic distress) will likely be a theme going forward. However, what is less contentious is the response to higher inflation data, with a jump in wages likely to drive a risk-off move.

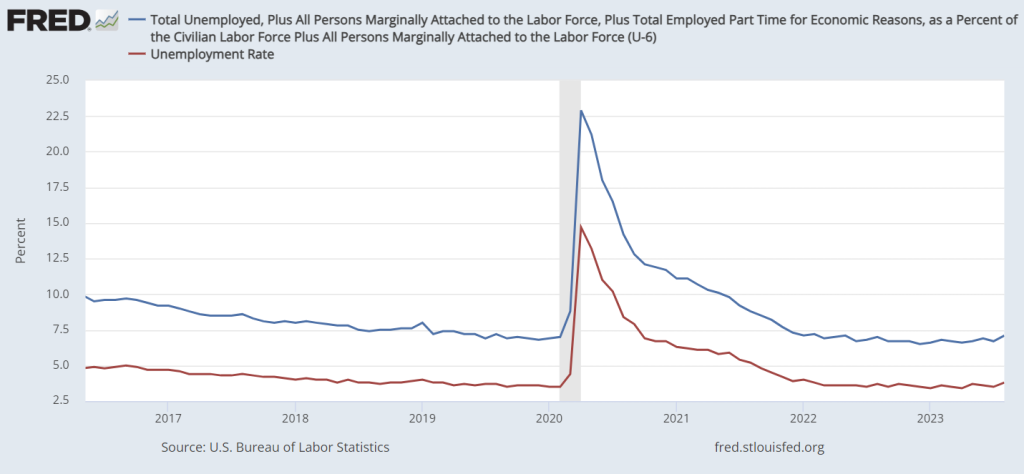

US payrolls have been heading lower of late, with any decline on Friday representing a fourth consecutive decline. Given the size of the ADP slump, a similarly sharp pullback in headline payrolls would likely take a November hike off the table. However, unemployment will also be key, as we are yet to see any particularly notable move higher of late. While unemployment pushed through the 3.7% barrier for the first time in 18 months, we are yet to see a particularly notable rise in job losses according to this metric. However, last month did see a jump in the wider U-6 unemployment metric which includes those that have given up on the search for a new job. This rise in the so-called ‘total unemployed’ rate could allude to underlying weakness that will soon show its hand to drive up the headline figure. Market expectations point towards a potential decline in US unemployment, although that could serve to set up a market move if unemployment instead heads higher once again.

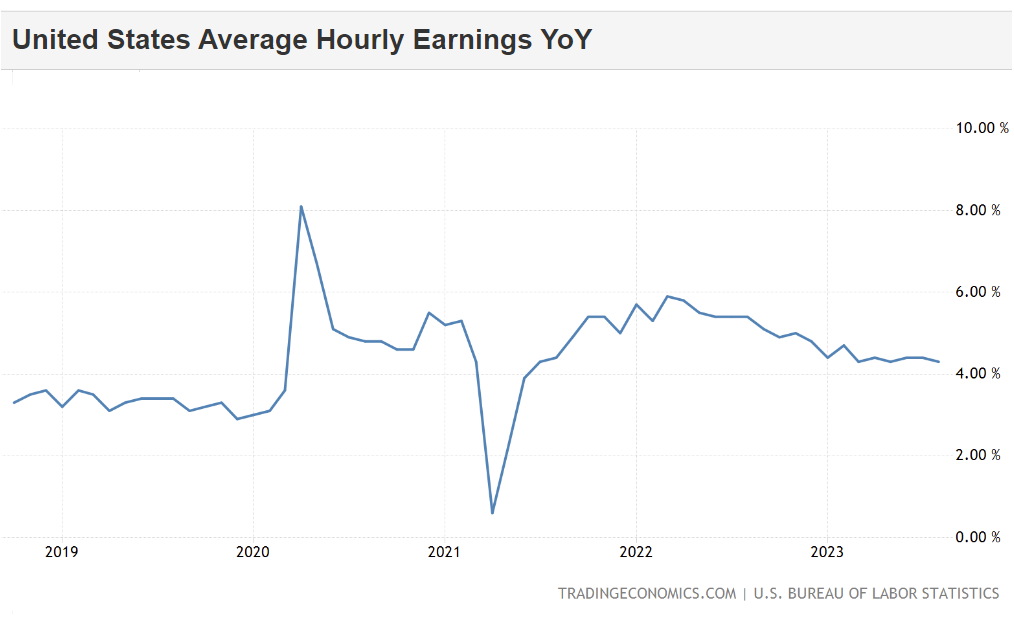

Aside from the payrolls and unemployment rate readings, there will be a significant focus on average hourly earnings as a proxy for inflation. Rising energy prices have seen markets on unstable ground, but a significant rise in wages can also drive underlying inflation pressures as it allows people to swallow ever-higher prices, while businesses push the increased cost onto the end consumer. Thus far we have yet to see an uptick, with market sentiment likely to improve in the event that wage growth deteriorates. Conversely, a significant uptick in average earnings could drive dollar strength and equity market weakness.

Nasdaq technical analysis

Tech stocks have been a focus of recent equity market weakness, with the Nasdaq having been hard hit as sentiment of higher-for-longer kicks in. Any signs of higher inflation on Friday could dent this index further, with a move through the 14565 double top neckline signalling a likely top here for the index. With price having already tentatively moved below that threshold, watch for a decline below the recent low of 14432 as a signal of impending downside. Weak unemployment or payrolls data could help lift the index momentarily given the impact on expectations of higher rates. However, markets are largely pricing in such a move anyway, and thus there is a good chance that such weakness could simply be taken straight as a reason to be concerned about the direction of the US economy. As such, it appears to be the case that things are more negatively geared at the moment. Interestingly, when it appears markets are geared up for a certain move, we can see a ‘sell the rumour, buy the fact’ event. As such, watch out for potential volatility on Friday, with concerns around a prolonged period of high rates, and the potential impact on the economy likely to rumble on for some time.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.