Crude-oil and Natural gas-can we predict their Price?

Table of Content

Key points;

- Natural gas price moves toward $4.00, finding support at the trendline

- The weather forecast could have an impact on the price movement

- Crudeoil momentum fade slightly after a 10% jump in the last three days

- Investors paying close attention to the Jackson Hole meeting for tapering updates from the Fed

- Technical outlook

What we can expect from the price of Natural Gas?

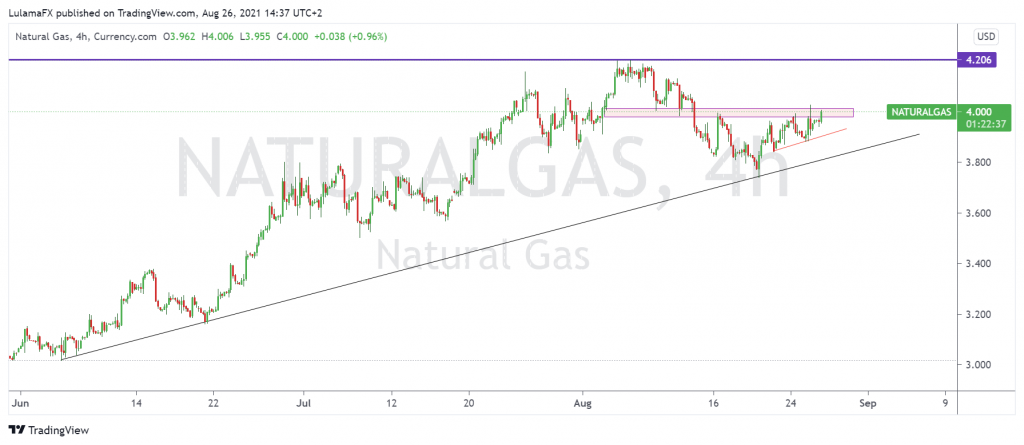

The natural gas price has been on an upside movement after retreating at the support trendline and has been trying o break the resistance level of $4.00 as the price look to make a V-Shaped recovery in the 4-Hours timeframe, the upcoming weather conditions as forecasted can change the price movement.

As the U.S expect warmer temperatures, summers in most parts of the United States are hotter than expected, natural gas futures have surged recently. Temperatures in parts of Texas and the Southwest continue to exceed 100 degrees, highlighting the increased demand for natural gas products. The National Oceanic and Atmospheric Administration of the United States also issued its forecast, predicting that the temperature will remain above normal in the next two weeks.

There are still risks in the natural gas market, especially in the form of major storms. A possible tropical storm in the Gulf of Mexico poses a threat to natural gas production. Power and consumer lines along the southern coast of the United States may also be affected. The development of severe weather throughout the Gulf region, coupled with the forecast of colder September, highlights the potential downside risks of natural gas prices. Although the total supply remains stable, the demand for natural gas products is still very strong.

What we can expect from the price of Crude-oil?

The Crude-oil price paused its three-days rally on Tuesday ahead of the Jackson Hole meeting after jumping as much as 10%, reacting to the headlines that FDA has granted approval to the covid-19 produced by Pfizer, easing concerns about the virus and the prolonged lockdown has clouded the outlook for global energy demand, driving oil prices down from their July high.

At the same time, investors are paying attention to the Jackson Hole seminar for clues on the Fed’s downsizing schedule. Fed Chairman Jerome Powell will speak at the Fed’s annual economic seminar on Friday. Global investors will pay close attention to whether the central bank plans to reduce the size of asset purchases by $ 120 billion a month before the end of this year.

Technical outlook for the Natural gas

Natural Gas: The price has fallen in the last days after hitting $4.20, to test the June.2021 trendline as the demand for gas continues to strengthen. The price has recently been hovering around the resistance of $4.00 with an attempt for potential gains set up more gains. A sustained move above the resistance level could suggest a potential move back to $4.20.

Technical outlook for the crude-oil

Crude oil: The oil price has been on upside movement since November 2020 but has recently faced a challenge to the upside after topping $75 per barrel as the Delta variant strike U.S and China. The June sell-off is highlighted in the formation of a descending pattern and investors could be eyeing news from Jackson Hole to provide the market with a direction. The bulls will be eyeing a potential break above the resistance of $70 for more upside move.

LULAMA MSUNGWA

Research & Markets Analyst

Scope Markets

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.