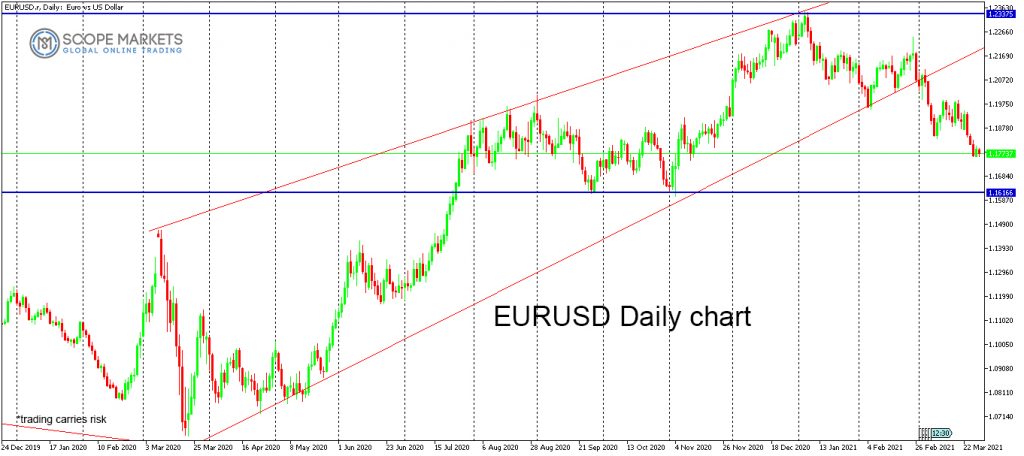

EURUSD Continues Bearish Momentum Amid Rising Covid-19 Cases

EURUSD currency pair has been on a bearish trend since breaking a year-long trendline at the beginning of the month. On January 6th, 2021, the Euro hit a two-year high of 1.23494 before starting a bearish momentum that has lasted three months.

Key points

- EURUSD breaks year-long trendline on bearish momentum

- Massive bureaucracy blamed for Eurozone’s slow vaccine rollout

- Lockdowns and rising Covid-19 cases dampen EU recovery’s outlook

EURUSD opened the week at 1.17888 and kept trading on a slightly bearish trend within a range of 30 pips. The volatility remained low despite the Ever Given ship breaking free of the Suez Canal, which raised volatility in oil markets.

EURUSD technical outlook

Several factors have contributed to the selloff. This includes the strong dollar and the slow vaccine rollout in the Eurozone. The temporary suspension of AstraZeneca’s vaccine weighed on the Euro. Since the Eurozone had placed huge bets on AstraZeneca’s vaccine, the supply shortage is forcing the Eurozone to deploy measures to ban Covid-19 vaccine exports for six weeks.

The slow vaccine rollout can also be attributed to massive bureaucracy in Eurozone countries that has slowed vaccine approval, purchase, and administration. The Eurozone has managed to vaccinate a meagre 14.9% of the population compared to the US with 40.8% and the UK with 48.5%.

The EU has also been plagued by overly aggressive lockdowns that have dampened the chances of a fast economic recovery. With 8.3% of the population unemployed, these lockdowns are expected to bring longer-term effects to the economy, thereby hurting the recovery process. Despite the lockdowns, the number of Covid-19 new cases has been rising since January’s bottom.

The European Central Bank (ECB) has rolled out a massive stimulus program that has expanded the Eurozone’s budget to 63% of the gross domestic product (GDP). This has mounted inflationary pressure on the Euro combined with the effect of negative interest rates.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.