Legendary Forex Traders – Who is George Soros & What He Represents for the 21st Century?

Table of Content

George Soros is a customary hedge fund supervisor who is generally considered one of the compelling investors ever. He led the Quantum Fund, a fund that gained a common yearly return of 30 per cent from the year 1970 to 2000. He continues as the director of Soros Fund Management.

The Hungarian-based Soros is also recognized for his huge humanitarian movements. He has bestowed billions of dollars for different causes via Open Community Foundations. He’s a longtime supporter of reformist causes, making him a target of traditional conspiracy theories.

The Legendary Forex traders – George Soros gave over $30 billion for charitable causes. Enough of that cash given to subsidize education and health plans, human equities, and the progress of democracy. In current years, he has provided a huge sum to the Political Party in the United States.

All about legendary Forex traders – George Soros

George Soros, who is of Jewish origin, born in Budapest in 1930, left for England in 1947. He has a doctorate degree from the London School of Economics previous to starting a career in banking. He established his hedge fund, then named Double Eagle, in 1969.

George Soros – The man who made the Bank of England insolvent

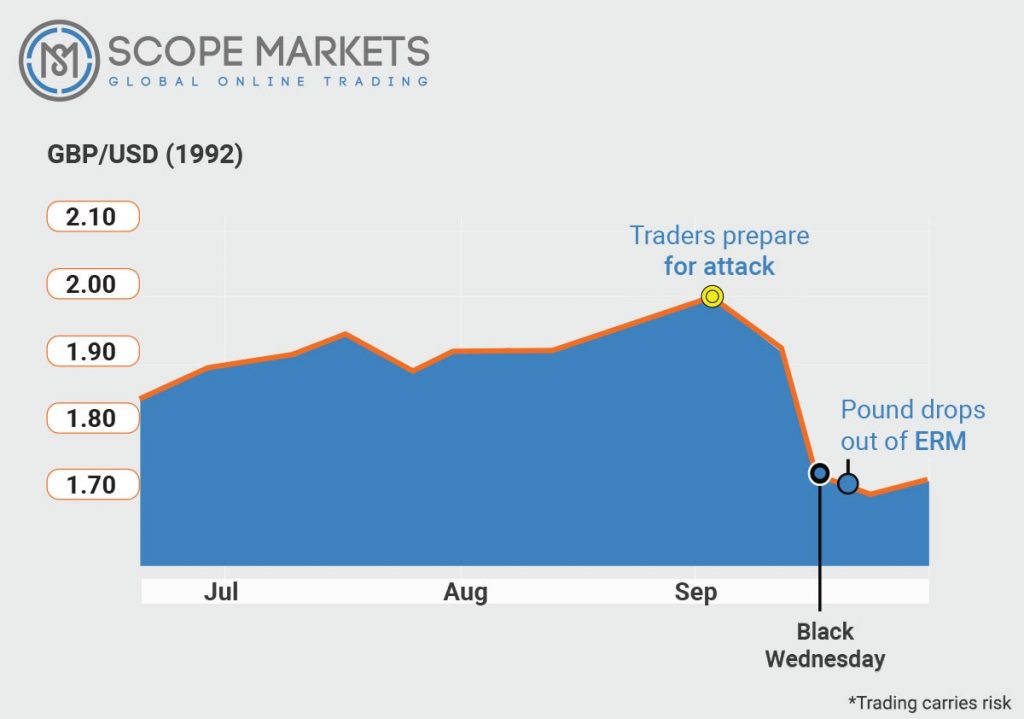

Legendary forex traders – George Soros (you can read some of his famous quotes) is well-known for a sole profit of $1 billion on 16 September 1992, which he created by small-selling of the British pound (GBP). At that time, England was a member of the Exchange Rate Mechanism of Europe, a set-exchange-rate contract amongst many European nations. Some other nations were urging England to depreciate its currency or withdraw the system. After holding the reduction for some time, England drifted its currency, and the worth of the British pound fell.

Employing leverage, George Soros could take a $10 billion low position on the British pound, making him $1 billion. The trade is then recognized as one of the most prominent of all time. Also, George Soros was then claimed to be the man who made the BoE insolvent.

George Soros’ investment approach

Legendary forex traders – George Soros is generally considered unique amongst very successful investors in realizing that ability plays a big role in his financial decisions. Even so, he has a huge knowledge of financial trends on a provincial and international level. As well as he can use this knowledge to make use of the market impasse with big, highly-leveraged lots.

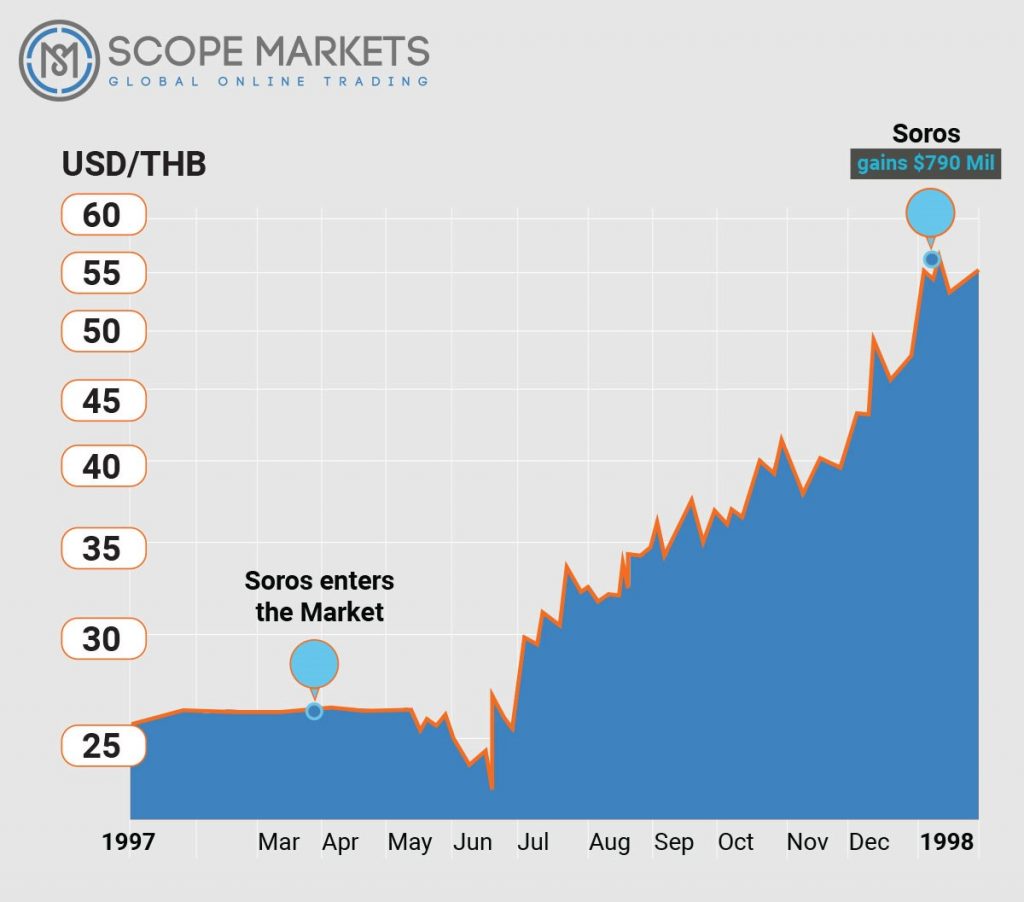

He has both the funds and the risk threshold to take out these bets higher than many hedge fund supervisors. Indeed, he has cowed many state governments on the currency problems with his determination and thick pockets. Throughout the Asian economic disaster, known as the 1997 Asian financial crisis, George Soros continued to receive more nicknames. He turned out as the man who made the Bank of Thailand insolvent.

Despite Soros’s extensive knowledge of international markets and the best data sources, the verdict to close out a stake is reportedly added a gut request than a reply to a market sign. One prevalent theory is that he has internalized very much of the exchange and its functioning. He very well understands when the time has reached to close out for an interest running before he may deliberate the verdict.

Even if that is right or not, whatever George Soros is performing has earned him luck that some investors in the world with the exclusion of Warren Buffett may go with.

George Soros and his trading knowledge

George Soros is often known as a short-term stockholder. He generates huge, highly-leveraged stakes on the way of the economic markets. His leading hedge fund is usually recognized for its international macro tactics. A knowledge generally focused all over making huge, one-way stakes on the changes of exchange rates, commodity costs, shares, securities, derivatives, and different assets based on macroeconomic interpretation.

George Soros and his Hong Kong battle

George Soros attempted to break the Hong Kong Dollar’s peg to the US currency, but he failed to break it throughout the Asian financial crisis of 1998. Whereas Bill Ackman’s bet on a dominant strengthening in the year 2011 also became fruitless.

That archive shows big as the latest growth of hedge funds targets at the Hong Kong dollar once more, attracted by anti-government rallies that have moved the monetary centre for twelve continuous weeks.

At last, George Soros failed to break Hong Kong’s Dollar because he underestimated the fact that the HK Financial Authority had individuals who were previous investment bankers who knew how to keep up the HK dollar value.

George Soros and territorial break-ups of Brexit

Recently, George Soros has been raising his voice about the uncertain fate of the EU in the vigil of Britain’s 2016 referendum to withdraw the union and the ongoing emigrant disaster that has made many Middle Eastern migrants to Europe.

He advised of empirical challenges facing Europe. He has fixed a plan to save Europe from a continuing crisis by stopping 3 big problems: the migrant emergency, regional break-ups such as Brexit, and the severity crisis that has troubled nations such as Spain and Italy.

Particularly, he has recommended that the EU issue regular bonds, a process of investment that Britain employed to fund the Napoleonic Conflicts.

George Soros in opposition to the British pound

The (GBP) British pound trailed the German point reaching up to the 1990s, although the 2 countries were very diverse economically. Germany was a powerful nation, regardless of lingering problems from reunification. But the United Kingdom wished to keep the worth of the British pound over 2.7 marks.

Efforts to follow this standard split Britain with increased interest rates and inflation. But, it needed a set rate of 2.7 marks to a British pound as a form of getting into the ERM or European Exchange Rate Mechanism.

Various critics, George Soros main between them, questioned how much time settled exchange rates can withstand market units, and they started taking up small positions next to the pound. He raised much to stake more on a decline in the British pound. The United Kingdom increased its interest rates to 2 digits to bring investors. The authority was then expected to ease the selling force by producing more buying force.

Staking interest charges cash, though, the British administration recognized that it will lose billions to try to boost the pound. It departed of the ERM, and the worth of the British pound plunged next to the mark. George Soros earned approx. $1 billion off this single trade. On the British administration’s part, the decline of the pound helped in an actual way. Since it overcame the huge interest and relation out of the market, thus, making it a perfect background for trades.

The United Kingdom lost cash due to Soros, and he compelled the country to take the bitter medicine of eliminating from the ERM. But various individuals also recognize these shortcomings to the business as essential steps that assisted the U.K. to come out stronger. If there had not been a decline in the British pound, the U.K.’s financial issues might have moved on as lawmakers kept working to pinch the ERM.

George Soros and different controversies

One of the legendary forex traders – George Soros’s biggest trading stakes was also one that earned him huge fame. When the United Kingdom was experiencing a currency disaster in 1992, George Soros risked that the nation had no choice but to leave the ERM or European Exchange Rate Mechanism.

He shorted the British pound via $10 billion. Also, when what he hoped seemed to be true, the British pound fell, making him $1 billion in a sole trade.

Throughout the Asian Financial Crisis(1997), he also led a strong position next to the Malaysian ringgit, considering the currency to be fragile.

But George Soros’ stake next to the currency did not fall with Malaysia’s PM Mahathir bin Mohamad who blamed George Soros for wishing to diminish the nation to the limit that he was then listed as, Unacceptable Person. (They resolved their disputes afterwards).

What George Soros has gained through his strong stakes, he has used on actions he thinks are near to him.

Conclusion – legendary Forex traders – George Soros

Legendary forex traders – George Soros earned his first luck by using an antagonist position. He speculated that the Pound currency will bargain when it was plus and looked great, and most individuals were high. He was capable of doing this by being an intelligent disciple of the exchanges and charts. We are prompt to back that George Soros observed the withdrawal signal like the last hay for him to short. Both the way, he was an antagonist at heart, and thus we think such a powerful link with his strategy.

When you understand reading and trading from the price charts’ actual price charts, you definitely start considering more as an antagonist and less as a herd member. You hold to get worried as the chart begins to give more insights to you.

Anxiety comes from the need for information, from not knowing that we are fearful of it. You definitely cannot be great at something if you are afraid of it. You can remove your trading anxiety by getting more information and understanding how to trade price activity. If there’s a thing we may say to review George Soros’s trading achievement, is that he produced his trading skills so well that he had no doubt of practising any trade. Also, we can view the pay-off of such a capability in his great billion-dollar success shorting the Great Britain Pound.

References: https://www.investopedia.com/articles/forex/08/greatest-currency-trades.asp

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.