Stocks vs Gold vs REITs – 3 Historical Performances

Table of Content

When investors choose trade portfolios, they are usually lured to look for the newest and most prominent investment possibilities. But continuing investors must be conscious that allowing small-term trends to affect their investment strategy may be disruptive. Long-term or continuing investors should also perform a comparison between main investment instruments like Stocks vs Gold vs REITs – Historical Performance. Thus, they can select the best investment type. In this article, we discuss stocks vs gold vs REITs, and here are our findings.

Any investor seeking to predict the market by uniformly trading to and fro of what is hot is struggling next to the amazingly combined knowledge of millions of sellers and buyers all over the world. With the profit of retrospect, it is simple to know the luck one could have accumulated by taking the proper call on a particular niche, or personal safety over a particular period.

We are going to discuss 3 investment tactics that several individuals have shown an interest in which are Stocks vs Gold vs REITs- Historical performance.

Comparison of historical performance: stocks vs gold vs REITs

Before starting comparison of Stocks vs Gold vs REITs- Historical performance, let us understand the basics of each kind of investment:

A stock also called shares and assets is a kind of security that shows possession in a company and shows a request on part of the business’s assets and income. There are two key kinds of stocks: favored and common. Common stock generally names the holder to vote at stockholders’ gatherings and to earn profits. Favored shareholders have an increasing demand for earnings over common shareholders.

REITs or Real Estate Investment Trusts Investment

REITs (Real Estate Investment Trusts) let individual investors buy stocks in investment real estate portfolios that gain revenue from a variety of businesses, including condo associations, data centers, healthcare facilities, hotels, infrastructure, office buildings, retail centers, timberland, storehouses, and self-storage.

A Non-Traded Real estate investment trusts are a type of real estate investment procedure that is usually created to decrease or eliminate tax while offering profits on real estate. A non-traded REIT doesn’t exchange on a bonds exchange and due to this, it is slightly illiquid for a large period. Front-end fees may be as much as 15%, a lot more potent than a traded REIT as its weak secondary market.

Gold – investing in a precious metal

From all the valuable metals, gold is the most common investment. Shareholders usually buy gold as a method of changing risk, but do you wish to own gold when the worth is at its highest point? The gold market is all set to volatility and speculation only like any extra market.

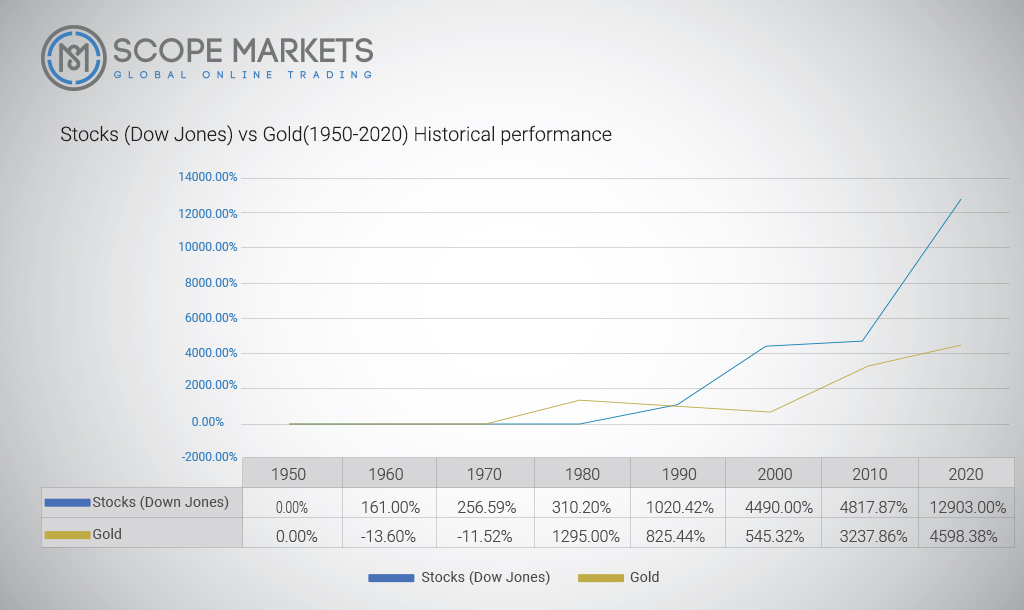

Comparison of gold vs. stocks investment

When assessing the performance of the gold like a long-term investment, it truly relies on the period getting analyzed. Suppose, throughout thirty-year, stocks have outpaced gold and bonds, but aside from a time of 15-year, gold has surpassed bonds in addition to stocks.

From the period 1990 to 2020, the cost of gold improved by 360%. Above the same period, the DJIA (Dow Jones Industrial Average) increased by 991 percent.

If we go through rather above the 15 years from 2005-2020, the cost of gold has risen by 330 percent, approx. the similar period as the thirty years. Across the identical period, the Dow Jones grew by only 153 percent.

Thus, in the long term, stocks appear to exceed gold by approx. 3-to-1, but in smaller periods, gold can outperform. Positively, if we stretch way again back to the 1920s via today, gold gets left away by stocks.

Backtracking to bonds, the standard annual rate of return on investment-category corporate bonds or securities reaching back to the 1920s till the year 2020 is approx. 5 percent. That shows more than the previous thirty years, corporate bonds have yielded approx. 330% – somewhat below that of gold. In a time-period of 15-year, the bonds’ rate of return has been falling in comparison to gold and stocks.

Why holding time matters in stock investing?

Some individuals hold stocks for several decades—and various people lose cash in the market in a smaller period. The main thing is offering stocks time to go, signifying anticipating any smaller-term market volatility.

Suppose, the S&P 500 index, is far less stable across any 12-month time, signifying you go through a huge risk of losing cash. Say, stocks tend to drop much only before and all through financial reversals. Adjust the market poorly and your impairments could be unpleasant.

Increase the holding time to 5 years, though, and you are more prone to generate cash. From 1945 to 1995, only some 5-year periods would have come out in a significant loss in the S&P 500 index. A ten-year holding time done even very well, with yields averaging approx. 13%—with 0 negative returns. Thus, the more the holding time, the more probable you are to generate cash.

Stocks vs Gold vs REITs investment in current years

Despite the .com bubble and the Global Monetary Crisis, stocks have made powerful gains in the previous 2 decades too. But from the period 1999 to 2018, the S&P 500 index was then exceeded by REITs, gold, as well as oil. REITs earned 9.9% a year through that period, gold 7.7 percent, and oil 7 percent. The S&P 500 index has grown by 5.6 percent a year.

What about stocks vs housing investment?

Various individuals think of a home as an outstanding long-term investment and there is a good cause for that. Home costs have grown firmly beyond time, specifically in current decades, so throughout the housing bubble. But more than the long-term, the return is less important. Amid 1890 and 2012, the home prices in the U.S. increased prices by 150% in a real sense, signifying after considering inflation. That is only a part of the growth in the DJIA.

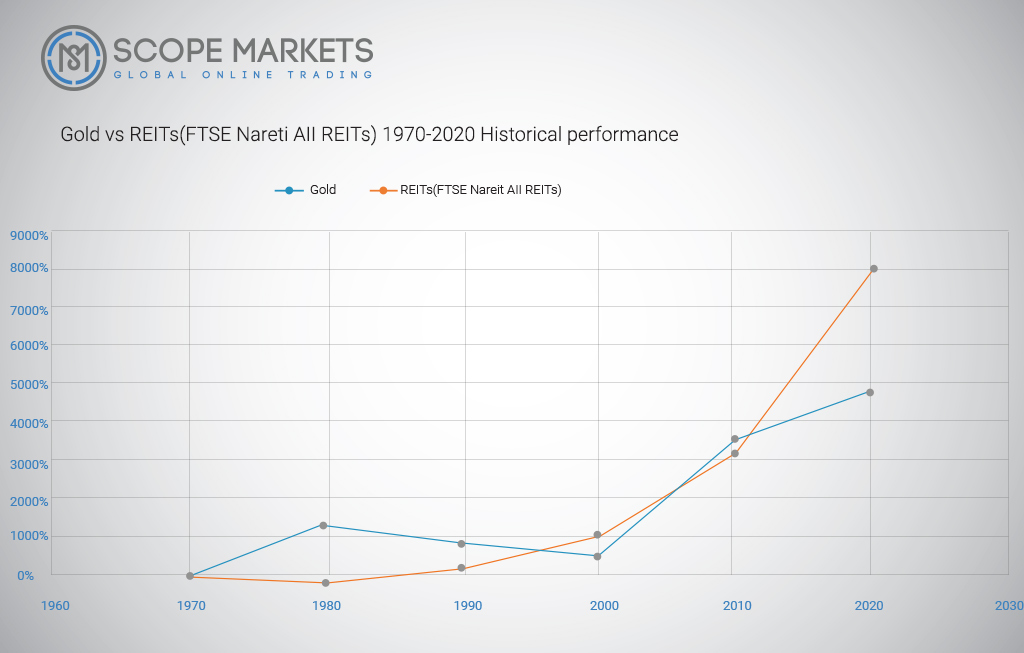

Gold vs REITs – which is better?

A key feature of assessing even if gold and real estate produce good hedges is to attempt and find out their profits over long timeframes. Real estate, as held by the FTSE Nareit REIT Equity index, has performed very well in the previous forty years and also has been somewhat compatible.

So, what’s there about gold?

We could not get the increased gold returns, thus we had to start with the overall returns for the complete forty-year period.

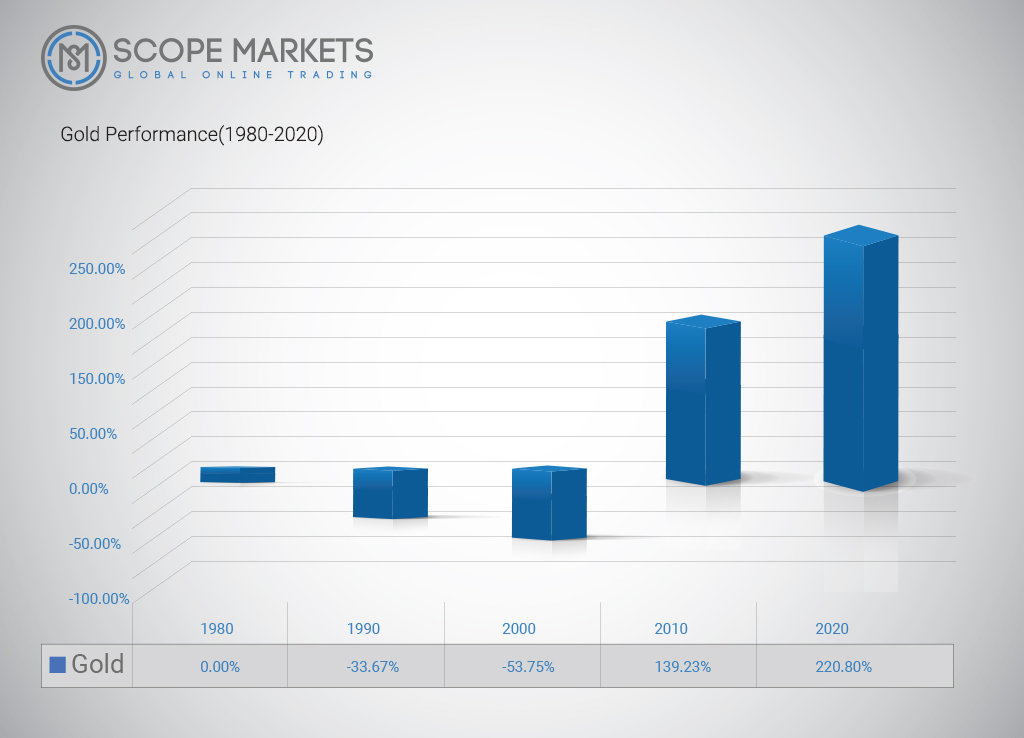

Gold produced 220.80% in that period. In different words, $1,000 would have grown to $3,208 – which adds to an increased yearly growth percentage of 2.96 percent a year. At initial look, gold was thrown by REITs. Gold had only grown off a big bull market in 1980 and employing that start time reduces our profits and doesn’t overlay an actual picture.

But, whether we begin at the 1970 mark of $35 per ounce, gold’s gains over fifty (not forty) years grow to fifty-six-fold. A $1,000 spent on gold in 1970 will come out to $56,000.

Also, from that start position, gold was helpless to hit REITs, despite an extra highly inflationary period. Whereas not checked by the FTSE REIT index, real estate in the US did somewhat well in that 1970 to 1980 inflationary period and this will have broadened its performance notch with gold yet more.

As both of these assets have different merits, equity REITs are inexpensive today when compared to what they were in a long period. Equity REITs generate revenue and thus lets them furnish a bigger plan than what gold may likely offer.

Significantly gold also seems very costly vs. mid-priced houses.

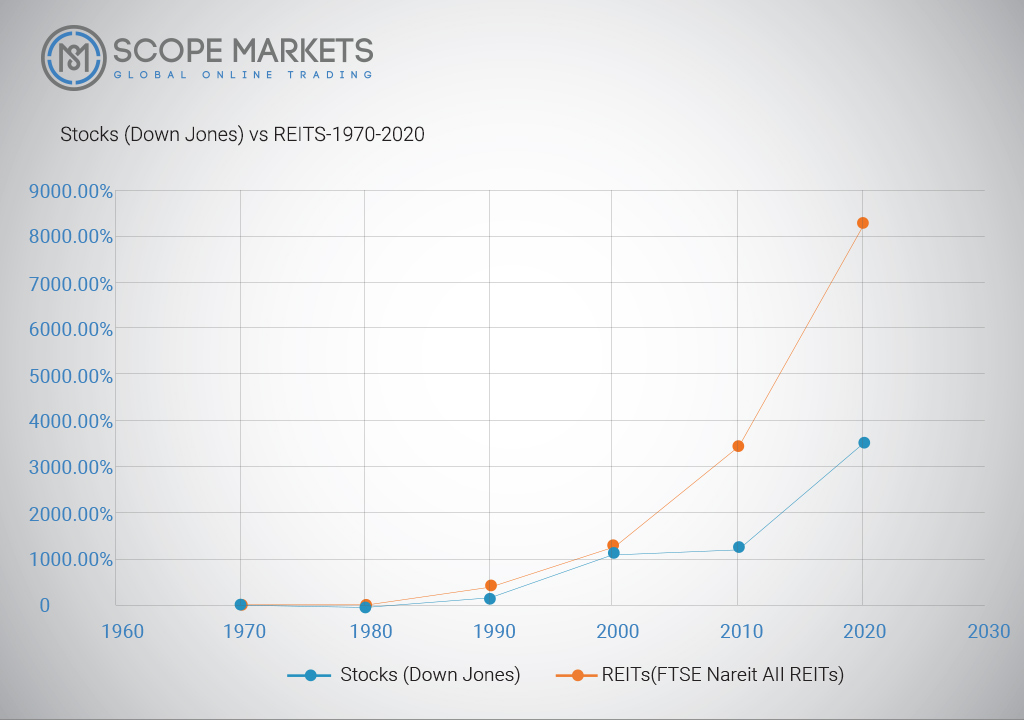

How have REITs investments compared with stocks?

It is tough to get secure historical information on complete returns from personal investment assets. There are very different variables, and there is no good way to check overall returns attained by specific real estate shareholders.

Yet, one best method to see the potential of investing in real estate is to check how REITs have done in the long period.

By remembering that, here is an estimate of the complete returns of the Vanguard Real Estate mutual fund and S&P 500 index, the best standard index of investment REITs:

Stocks in real estate tend to get associated with interest rate variations in a short time. Growing interest rates are not good for Real Estate Investment Trusts, and the Federal Reserve increased interest rates 8 times in the previous years.

Conclusion – Stocks vs Gold vs REITs – historical performance

Since with any kind of investment, such as Stocks vs Gold vs REITs – Historical Performance- it is essential to think of the investment timeframe, also, to understand market analysis to assess the perception of how markets are generally anticipated to do. Gold is not a reliable investment asset, since, with bonds and stocks, its price varies based on many factors in the international economy. With all portfolios of investment, change is necessary, and gold investment can help in diversifying a trading portfolio, generally in market fall, when the gold price is on a solid rally.

The REIT segment head in the previous period was Extra Space Storage. It was the leading stock in the REIT section from the period 2010 to 2019 with a complete return of 1,179 percent, which was 3 times the normal return of its commonly-traded storage REIT companions. Also, its performance eliminated the index of S&P 500’s 256 percent whole return all through that timeframe, indenting the finest whole return in the S&P 500 stock index.

Gold’s average return for (1990-2020) 30 years was 5.41%. Also, returns have been more than 20% a part of the time. All this recommends that when international investment markets shift into an improvement area, prices of the gold react emphatically.

Going by variations in returns across diverse timeframes, returns of the gold may vary in a way that is like equity, although the amount of volatility is more moderate. But, this volatility levels out after some time, also same to equity.

https://seekingalpha.com/article/4371798-gold-vs-reits-can-be-only-one-winner

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

https://www.reit.com/data-research/reit-indexes/annual-index-values-returns

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.