The Week ahead 02 – 06 August 2021/busy week for the Aussie?

Table of Content

KEY POINTS

- The markets will be relatively busy in the week ahead

- The US jobs report and the central banks are in focus

- on the earnings front, Uber will draw attention.

- Technical outlook

WEEK AHEAD

Developed market central banks are unlikely to take a tougher stance in the week ahead. The US labor market is still plagued by insufficient labor supply, and the Bank of England expects clearer signs of growth.

Monday

The markets will be relatively busy with the market set to focus on the Germany retail sales data and the US manufacturing ISM, the news will aim to set the tone for the market to start the week.

Germany is set to release its retail sales data on Monday and could set the tone for the Euro currency. The economy has been showing a rebound in Eurozone and this could be because of the reopening of the economy. Market projects that the figures will show a recovery in Germany.

We will also see that the ISM manufacturing index should report strong demand, but will once again highlight the pressure from the supply side of the economy that limits production growth. Extended delivery times from suppliers, large order backlogs, and low customer inventories indicate that supply chain problems are plagued by the American economy. As prices continue to rise, the company can pass on prices to customers in this environment. This is a key factor that leads us to believe that inflationary pressures will be more persistent than many at the Fed, so we expect the first rate hike to be achieved by the end of 2022.

Tuesday

The U.S markets will be busy for the Aussie as the RBA takes the center focus and other markets will be quiet due to lack of economic events.

The focus will be on the August meeting of the Reserve Bank of Australia (Tuesday). We believe that after the adjustments were announced in early July, policymakers in Sydney (a city that is about to go through the lock-up period of August) will not make any changes to the current political stance. The jump in inflation to 3.8% in the second quarter should be considered temporary, and the central bank may wait for further signs in the labor market before responding to policy. The recent spread of Delta variants is causing further restrictions in Australia, which may be another reason why the Bank of Australia should sound more positive or optimistic again at this meeting. It should be noted that, unlike the United States and Europe, only 14% of Australians are fully vaccinated. We believe that the Reserve Bank of Australia will not be able to boost the Australian dollar next week. If iron ore prices continue to decline, the Aussie may still lag behind in the procyclical space and face significant downside risks.

The focus will be on the release of New Zealand’s employment data for the second quarter. This is expected to be a potentially key event for the New Zealand market, as strong data may increase the possibility of the Reserve Bank of New Zealand raising interest rates in August. The market currently holds a 65% probability. The consensus has predicted that the unemployment rate will drop to 4.4%, which may be enough to convince the market that the Bank of New Zealand will appreciate in August. Unless the readings are very pessimistic, we still believe that the first-rate hike will not be later than October. If, as we expected, the US dollar stabilizes, labor data may determine the trend of the New Zealand dollar next week. But considering that August’s gains are not fully priced and the New Zealand dollar looks cheap compared to its interest rate attractiveness, we tend to be bullish on the New Zealand dollar in the coming week.

Wednesday

The markets will be much busy, it’s a blockbuster Wednesday from Jobs report, retail sales data, and US ISM services. Traders can expect a very volatile day.

The Aussie is having a busy week ahead and on Wednesday we gonna see the release of retail sales data. We expect Australia’s seasonally adjusted retail sales in June to fall 1.8% month-on-month, following a 0.4% increase in May, reflecting the impact of the closures in Victoria and New South Wales on consumer spending.

The Euro-market will be busy as the Eurozone reports retail sales data and after Germany data showed an increase and the lift-up of retail sales data in the U.K due to the Euro tournament and the reopening of the economy. The market projects that Euro retail sales data will show an increase of 8.2% in June. A better than expected reading will continue to strengthen the Euro and the sterling pound.

The US ADP employment figures will draw attention in the markets just two days before the anticipated US non-farm payrolls. The markets projection is that the ADP is set to increase to 700K from 692K. If the better exceeds expectation it will provide a clear picture of the success in reopening the economy and the Dollar could move higher.

The markest will then follow the US ISM services which remained strong in the previous report.

Thursday

Markets will be busy especially for the sterling pound as traders brace themselves for the Bank of England monetary policy and Australia will release the trade balance data.

The Aussie will hoop into the Trade balance data which is set to show an increase of 10450M in June from 9681M in may. A higher-than-expected reading could send the Aussie for further gains.

The focus will be on the Bank of England meeting. We do not expect any new guidance on the trajectory of interest rates, and we expect the repetition of the previous language that requires “significant progress” before the stimulus measures are canceled. Only 12 members can vote for the early termination of quantitative easing. Given that this should not come as a surprise to the market and the guidance should be considered neutral, the impact on GB

we expect the Bank of England to take a cautiously optimistic tone next week, although it is crucial that we are unlikely to get any new indications on the possible opportunity. of future interest rate hikes. We are also unlikely to see the early end of the central bank’s quantitative easing program; This is the recent initiative of Michael Sanders, the Bank of England’s newly appointed hawk.

Although the central bank may raise its inflation forecast for this year, short-term growth prospects are clouded by the increasing popularity of Covid19. At the same time, the market has digested the appropriate adjustments in the next one or two years, which shows that the central bank hardly needs to set a more specific timetable for raising interest rates.

The RBA governor will finish up the day for the busy Aussie with a speech and could well set the tone for the Aussie movement.

Friday

The market will be busy on the day as the markets anticipate the most awaited US jobs data, the RBA monetary policy will be key, and the Canada unemployment rate.

The markets will again begin with the RBA monetary statement and the RBA would have set up the monetary tone on Tuesday. However, the Bank of Australia is expected to change its previous decision to reduce the pace of bond-buying starting in September, when it meets this week. Some economists even expect the weekly rate of purchases to rise from the current $ 5 billion per week. The market has postponed the expected timing of the Bank of Australia’s first rate hike from late 2022 to 2023.

The key focus in the market will be the US jobs report and could set the tapering tone for the Fed in the September Jackson Hole meeting. We expect that the July employment report registered employment growth of around 900,000, which is largely in line with the consensus and should support the view that the labor market is on track for a steady recovery.

Technical outlook;

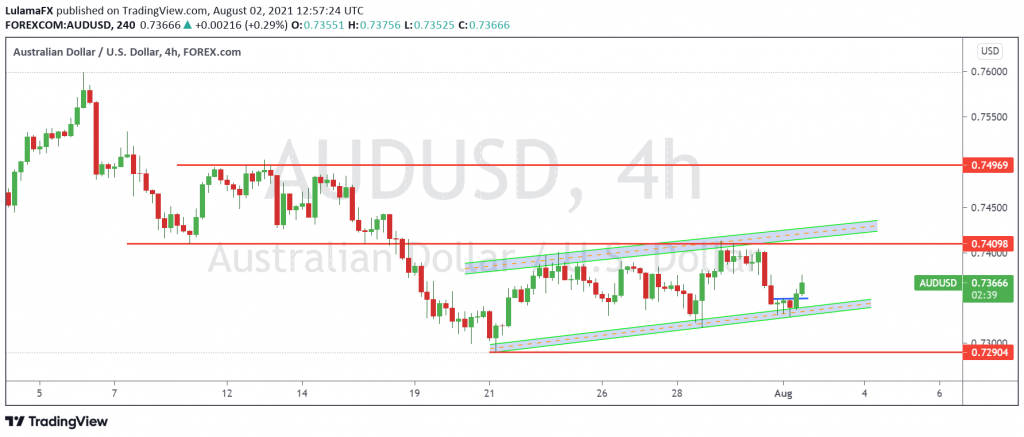

The Aussie started the week off on a good note and should the upside move continue ahead of key economic data in the week ahead, we could see the market pull up the best performance since the beginning of July.

Technically, the price rejects a move below the support trendline, and should the market gains continue we could see the price move towards the resistance at 0.74098 and a move further could see the price looking to go as higher as 0.74969.

Lulama Msungwa – Financial Market Analyst

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.