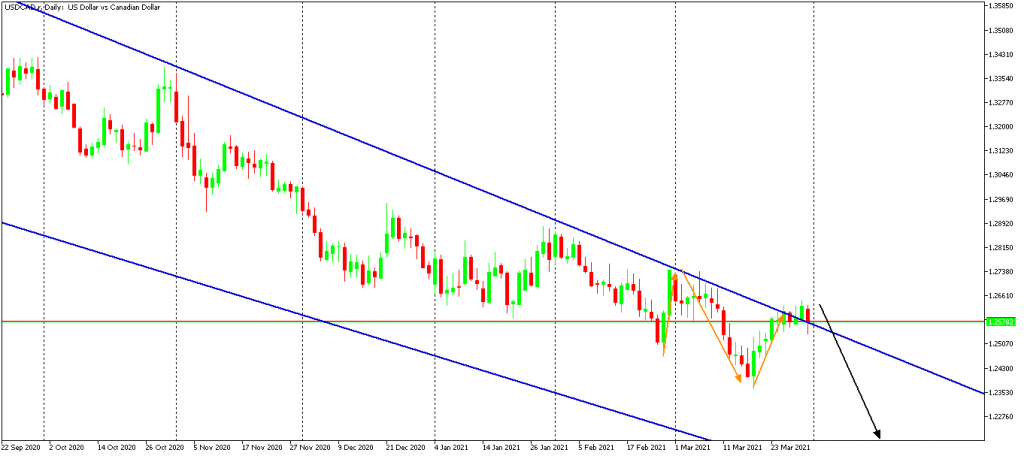

USDCAD Could Continue Bearish Run

USDCAD currency pair has been on a bearish trend since the beginning of the Covid-19 pandemic when it had rallied to a high of 1.46677 on 19th March 2020. This bearish trend has largely been contributed by recovering oil prices and a weak US dollar. The Canadian dollar will be traders’ focus in the coming weeks, with more market developments underway. Additionally, any oil-related news or oil prices volatility has the potential to shake the Canadian dollar in a short term.

Key points

- USDCAD has been on a strong bearish trend since March 2020 high

- Rapid global vaccine administration working to directly strengthen the Canadian dollar

- Bank of Canada is creating a fertile environment for a stronger Canadian dollar

On Thursday, the OPEC+ countries and the joint ministerial monitoring committee (JMMC) represented by Algeria, Kuwait, and Venezuela, and two non-OPEC countries – the Russian Federation and Oman are set to hold a virtual meeting discussing the future outlook of oil markets. Investors will be following the live proceedings to adjust their positions, especially in Canadian dollar pairs.

Being a commodity currency whose value is highly influenced by the oil price, the Canadian dollar is expected to experience heightened volatility during the event. The OPEC+ countries are expected to roll over the previous agreement to continue the output cuts in a bid to manipulate oil prices upwards.

Last week, the Ever Given ship was stuck in the Suez Canal, blocking more than 422 ships in the shortest route between Europe and Asia. The ship was later refloated on Tuesday. This affected the oil markets since it cut the oil distribution chain, thereby creating a temporary supply hitch. This drove global oil markets higher before crashing back down when the ship was refloated. The loonie is positively correlated with the price of oil and experienced a similar movement.

The US is expected to release its non-farm payroll data this Friday. The data is expected to report 652,000 new jobs created in March compared to 379,000 jobs created in February. If the data is at that level or above expectation, the US dollar is expected to strengthen against the Canadian dollar leading to a breakout above the current one-year-long upper trendline. However, if the data misses expectations, the USDCAD currency pair is expected to resume its long-term bearish trend and bounce off its upper trendline towards the February low of 1.2365.

The rapid vaccine administration in the US, Canada, and the rest of the world is set to drive higher oil demand which is expected to boost oil prices. Investors are expecting the global economy to reopen in the near future, thereby boosting oil demand and, as a result, boosting the value of the Canadian dollar.

On 10th March 2021, the Bank of Canada (BOC) retained rates at 0.25%, citing that the economy is still weak and could contract in the first quarter of 2021. However, the BOC mentioned that the current strength in the housing market could drive the GDP higher. The bank reiterated that it will not drive interest rates lower, but it expects inflation rates to rise back to a 2% level by 2023. When inflation goes back to 2%, the bank may consider a rate hike.

USDCAD technical outlook

Canada is already experiencing huge fiscal deficits and rising federal debt. This may induce the BOC to keep rates low to aid in servicing debt while expanding their existing asset purchase program (QE) for faster post-Covid-19 economic recovery.

There exists a high likelihood that the Canadian dollar will continue its bearish momentum against the US dollar. The USDCAD daily chart above shows a bearish trend. Positions along the upper trendline on the daily chart could be rewarding as oil markets rebound from the recent slump.

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.