Disney – Hot Stocks to Watch Right Now

Table of Content

Walt Disney, listed on NYSE as $DIS, targets its newest growths after coming back over 140 per cent from its March 2020 lows due to Covid-19.

It has been an avid drive on Wall Street since Feb 2020 because the stock market dropped into a bearish position among the Covid-19 fall. Hot stocks to watch – Disney shares fell since the Dow Jones shut its theme parks and abandoned Line Sailings of Disney Cruise.

Hot stocks to watch – action for Disney

Disney’s quarterly or periodical outcomes depicted some of those adverse impacts. Yet, soon it is moving ahead since Covid-19 cases came to a halt and state-run to offer vaccines. Indeed, travel-associated shares have returned recently despite constraints.

Although Disneyland in Shanghai and Walt Disney World are being kept open, Disneyland in Hong Kong and Paris are presently closed. Theme parks of Disneyland resort hotels in California have remained closed since mid-March.

On 28th Sept., Disney stated that it is cutting twenty-eight thousand jobs in theme parks. It stated in a report that Covid-19 risk increased in California by the State’s aversion to lifting limitations that will let Disneyland open again.

In October 2020., Disney declared a big reorganization, which increased stocks by 3 percent the next day.

In November 2020., Disney+ created Nielsen’s Top ten list of streaming captions for the initial time since the 2nd period of its hit group The Mandalorian hit off on 30th October.

Also, after the termination of Feb. 11, the media announced quarterly revenues and sales that hit targets of Wall Street. Industry lookers now hope theme parks will open this spring season or summer season again.

Technically, the Disney stock looks to sustain its bounce on the inside trendline, and a sustained move to the upside could see the stock price looking to plot new highs.

Does that signify stocks of Disney are in a buy position now? So, read the post to find out more.

Netflix & Coca Cola Share Price After Q2 Earnings

What is happening with Disney stocks?

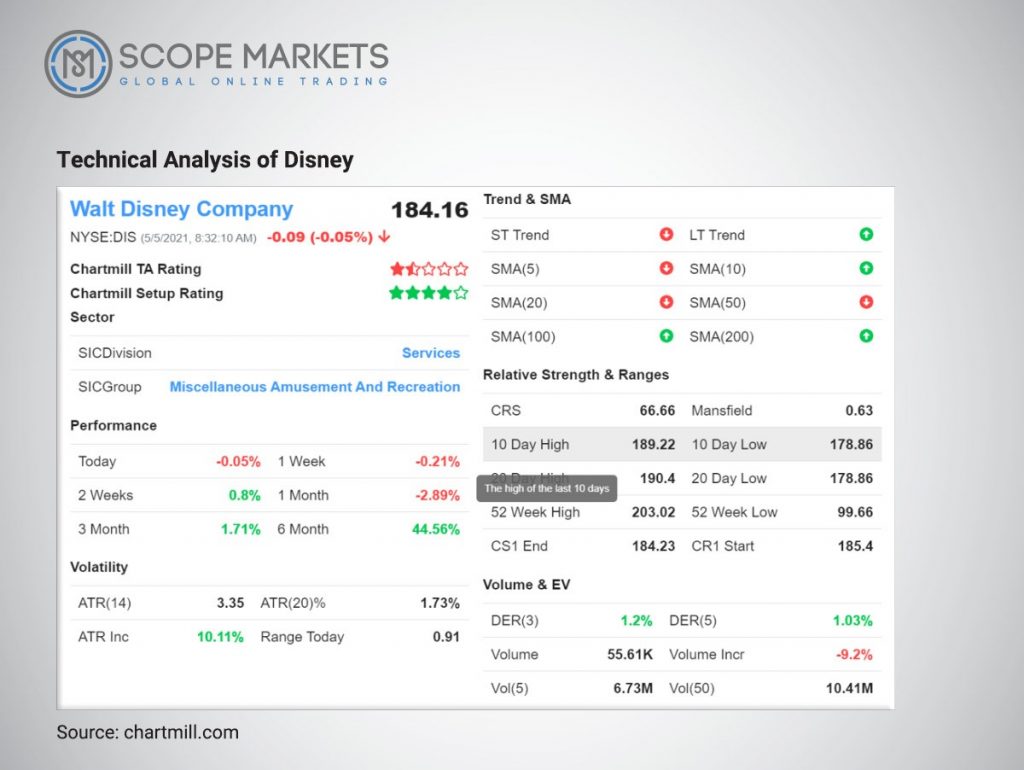

Technical analysis of Disney

Hot stocks to watch – Disney shocked analysts’ earnings hope by a broad margin in Quarter one of Fiscal Year 2021. The organization’s adjusted Earnings Per Share was assertive, hitting estimates of an improved loss for each share. Income and Disney+ recommendations also gone beyond analyst estimates. But, both earnings and fixed Earning Per Share were falling much linked to the year before quarter since the organization still confronts challenges associated with the Covid-19.

Once more, the Parks, Adventures, and Goods section of Disney was the portion of the company’s sales most critically affected by the Covid-19 and associated capacity to restrict the spread of Covid-19. Disney’s theme parks were both closed or running at decreased capacity while sail ships and supervised tours were getting delayed all through the quarter.

What to Consider in Disney Stocks?

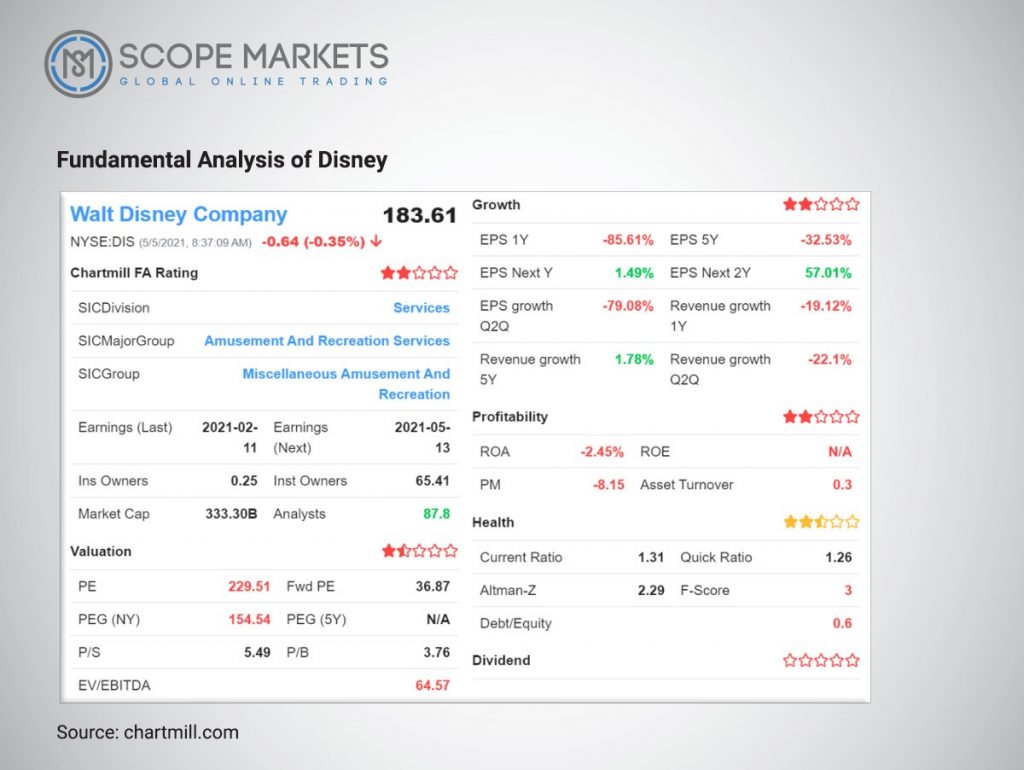

Fundamental analysis of Disney

DIS, one of the prevailing international recreation brands, has been compelled to integrate huge layoffs and end a few operations during the Covid-19 crisis. Disney (DIS) chose this year to end Blue Sky Studios, called for the Rio and Ice Age film licenses. The shift tracks layoffs of 10s of 1000s workers the previous year because Disney tentatively closed theme parks, delayed cruise tours, and dropped theatrical compositions.

Shareholders would be looking to consider if Disney’s price cuts can come into extra losses among plunging income when it announced profits on Feb. 11, in 2021, for the first quarter of the Fiscal Year for 2021. The fiscal year of Disney winded up on Oct. 3, 2020. Shareholders are anticipated to get disheartened. Forecasters are hoping Disney can summarize a 2nd sequential quarter of fixed losses for each share and a 3rd direct quarter of dropping income.

Shareholders would also be getting aware of the number of subscriptions Disney records for its Disney+ streaming service of videos. The service was initially started in 2019 and has increased fast despite confronting big, rooted opponents. Forecasts hope for overall subscriptions for Disney+ to grow three times to a similar period of 3-months a year before.

Hot Stocks to Watch- Disney Stocks have exceeded the wider market in the previous year. Yet, the share only started driving the market in the previous Dec. after delaying for most of the time, pulled down by the unfavourable effects of the Covid-19. The current certainty has driven Disney’s stocks to a complete return of 32.0% in the previous twelve months, more than the index of S&P 500’s complete gain of 16.7%.

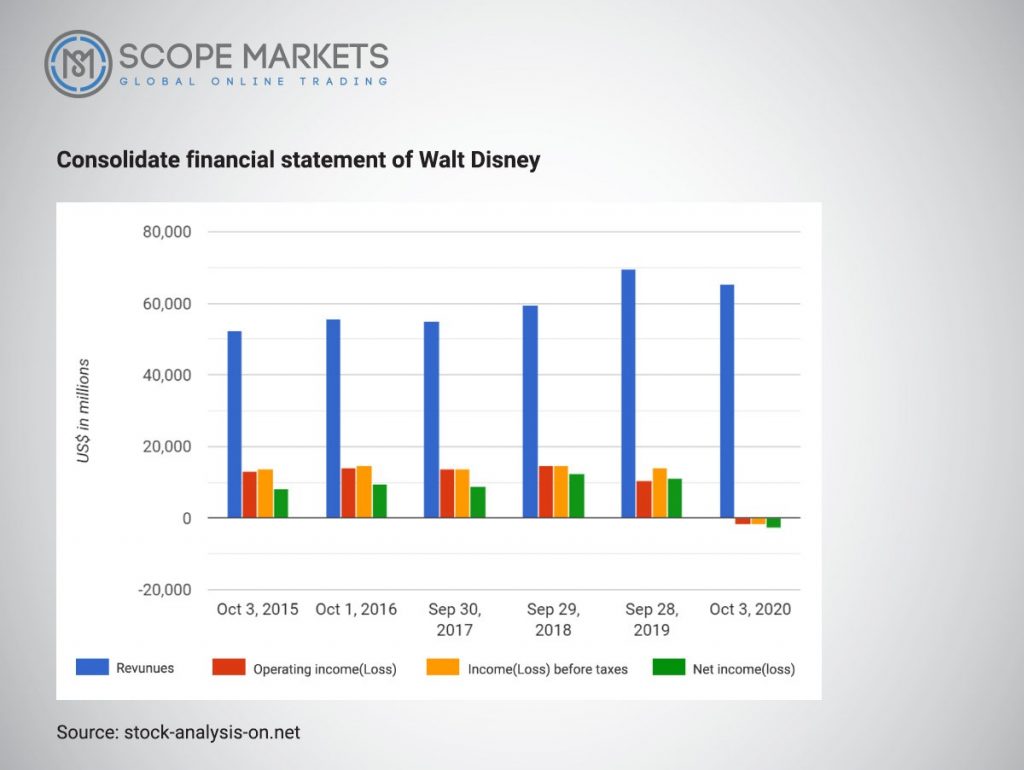

Disney’s shares grew after a periodical forfeiture loss of $0.20/ share in Quarter 4 of the Fiscal Year 2020, which was then declared on Nov. 12. It was the initial decline in slightly sixteen quarters, but it was far smaller than forecasters hoped. Income dropped by 22.9%, creating the 2nd continuous quarter of drops. Disney stated that its outcomes were negatively affected by Covid-19, most essentially because of sharply decreased capacity at its Experiences, parks, and Products section.

Its stocks grew after declaring financial results for the third quarter of the Fiscal Year for 20despitee despite earnings dropping by 41.9%. Disney published actual adjusted EPS (earnings per share), but it dropped by 94.0% when evaluated to the year-before quarter, the biggest fall in almost fifteen quarters. It also announced the 7th sequential quarter of declining adjusted Earnings Per Share as investments in its latest streaming fun business primarily pressed profits.

Stock forecasters anticipate further losses and huge income falls in the first quarter of the Fiscal Year for 2021. It will consider the 2nd sequential quarter of fixed losses. Income is generally hoped to drop by 23.9% evaluated to a similar 3-month time a year before, dropping for the 3rd sequential quartDespitee of this shaky performance, forecasters predict that Disney would post yearly earnings growth of 5.9 per cent for all during Fiscal Year 2021.

They also hope yearly adjusted Earnings Per Share to be certain, although 38.7% weaker than in Fiscal Year 2020.

Key metrics to consider for Disney

As described above, shareholders would also concentrate much on Disney’s recreation streaming market, which sees growth as millions of customers internationally grow their views of movies and TV shows all through Covid-19. For the organization, that increase is generally marked by the whole number of Disney+ users.

The video streaming solution provides programming from Pixar, Disney, Marvel, NGC, and Star Wars with 1000s of episodes and 100s movies from the organization’s library of film and TV programming. Disney+ was initially introduced in Nov. 2019 as a significant part of the organization’s online transmutation and swivel towards providing more content straight to users. The growth of the streaming business is the best place as Disney parks and adventure business tries to survive amid Covid-19.

Since its introduction in delayed 2019, Disney+ has grown fast, whereas struggling next to big streaming competitors like Netflix’s (NFLX) Prime Video and Amazon (AMZN), in addition to Apple Incorporarion’ss (AAPL) Apple TV+, one more novel entrant. Disney+ ended its 1st quarter of execution, Quarter 1 of Fiscal Year 2020, with 26.5 mn cumulative subscribers. By the finish of Fiscal Year 2020, that estimate had somewhat three-folded to 73.7 mn. Stock analysts are foretelling the complete number of Disney+ of Quarter one for Fiscal Year 2021 to grow by 236.7% evaluated to the year-before quarter.

Disney+ carries on to increase

Following the finish of Feb. 11, Disney announced EPS of 32 cents on earnings of $16.25 bn. Forecasters hoped for a loss of 45-cent on $15.8 bn in sales.

Parks’ earnings position 53% to $3.59 bn. But direct-to-customer earnings, which involve Disney+ and diverse streaming solutions, plunged 73% to $3.50 bn.

Disney+ users or subscribers increased by 9% to 94.9 mn as of Jan. 2, increasing from 86.8 mn on 2 Dec. and 258 per cent from a year before. In March, regular charges would grow by $1 to $7.99 in the United States and by two Euros to 8.99 Euros in a month in Europe, which would likely increase earnings. Users of ESPN+ have increased by 83 per cent during the year to 12.1 mn. As well as Hulu is growing by 30 per cent to 39.4 mn.

Fundamentals and revenue for Disney stock

An 11 EPS Ranking shows a 5-year income growth movement of -16%, which involves a flat outcome in the fiscal year 2017, a 19% drop in the fiscal year 2019, and a 65 per cent fall for the fiscal year 2020. Forecasters now hope for an EPS to drop by 8 per cent in the present fiscal year concluding in Sept., backed by a 159 per cent growth in 2021.

Are Disney stocks in a buy position now?

After separation from a low base and growing to a record high in Nov. 2019, Disney shares dropped over 40% all through the Covid-19 market drop. It got a base on March 18 but has risen close to its peak.

On Feb. 8, Disney started the DJIA with a 4.9% rise to the latest high. Stocks made a $183.50 buying point of a 5-week low base in an amount of 38% more than usual, but the move around the $183 level failed, and the price continued to dip.

After a recent sell-off in tech stocks amid inflation concerns, the Disney shares were amongst the companies that saw their price drop. The share has made a rejection on the 1-year trendline at $167 and could be looking for a rebound after reaching a record high but failed to sustain its move up.

Conclusion – hot stocks to watch – Disney

As the hot stocks to watch- Disney is up, the organization has had $5.4 bn in a loss in the previous 2 quarters, which has driven shareholders to sell. The market is in a verified uptrend, which signifies shareholders can buy and affix shares at peculiar entries. Yet, sales began to fall in the 3rd quarter of 2020. Also, 2021’s 3rd quarter is now compelled to confer YoY growth.

References: https://www.forbes.com/sites/rosaescandon/2020/12/18/disney-stocks-soar-even-after-billions-in-losses/?sh=4d5be922b7ee

https://www.investors.com/research/disney-stock-buy-now/

https://www.investopedia.com/disney-q1-2021-earnings-5105267

Disclaimer: This material is a marketing communication and shall not in any case be construed as an investment advice, investment recommendation or presentation of an investment strategy. The marketing communication is prepared without taking into consideration the individual investors personal circumstances, investment experience or current financial situation. Any information contained therein in regardsto past performance or future forecasts does not constitute a reliable indicator of future performance, as circumstances may change over time. Scope Markets shall not accept any responsibility for any losses of investors due to the use and the content of the abovementioned information. Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.